GTM Research just published its most current and detailed report on thin-film solar technologies and markets. The author, MJ Shiao, conducted a webinar this week (archived here), which gave an introduction to the topic and the report.

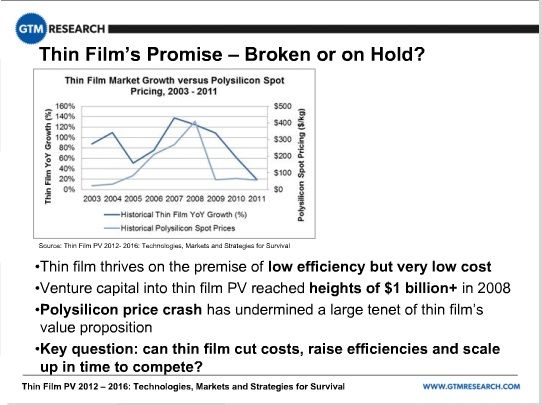

Those following the news are well aware that recent events in the thin-film solar market are less than positive.

First Solar is closing its German factory and idling four of its industry cost-leading production lines in Malaysia. The company's stock price is currently trading at $18.31 per share -- that's below it's $20.00 2006 IPO strike price. (On a somewhat unrelated note, Mike Ahern, the current interim CEO of First Solar, is crowned King of the Inside Sellers here.)

As Shiao said, if First Solar is struggling, other thin film firms are in deep trouble, as well.

Abound Solar has curtailed manufacturing in order to retool for an improved product. Odersun and Uni-Solar are bankrupt. Nanosolar, MiaSolé, SoloPower, Solexant, AQT -- who knows if these firms can survive the next few years?

Here are some of the slides from that report, along with some commentary.

Thin-film solar's premise is that it offers lower efficiency than crystalline silicon but at a much lower cost.

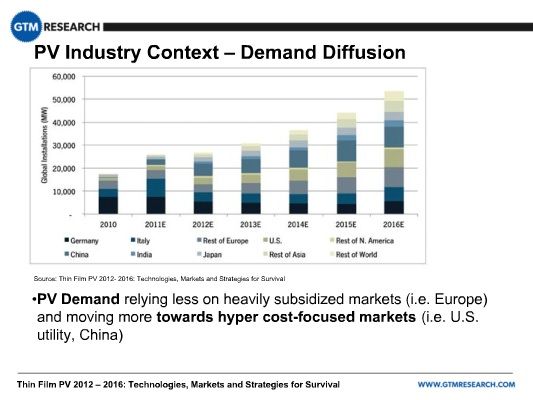

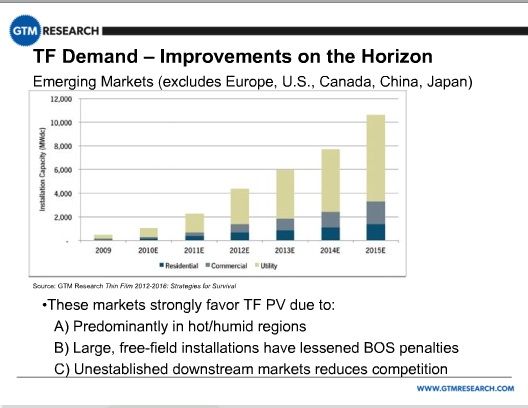

The industry's focus is moving away from markets with heavy subsidies such as Germany and Italy to emerging markets like China, the U.S., and South America.

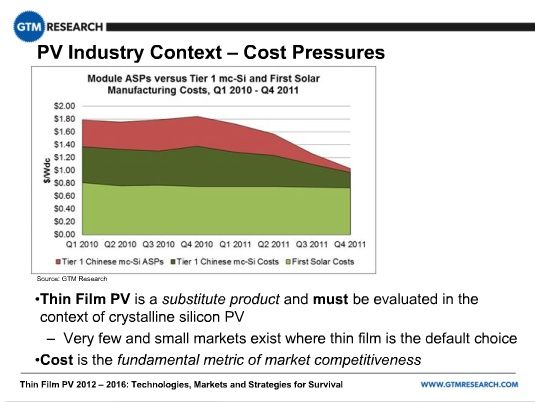

Thin-film photovoltaic panels are a "substitute product" and must be viewed in that context. Cost will be the fundamental metric to see if thin film can survive in this environment -- especially when bankable c-Si solar panels are priced below $1.00 per watt.

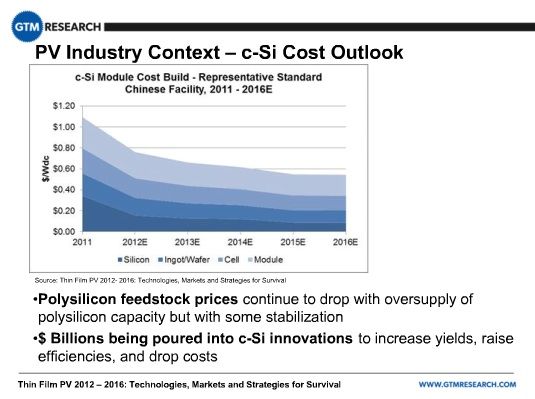

There is still the potential for price reduction and innovation in c-Si.

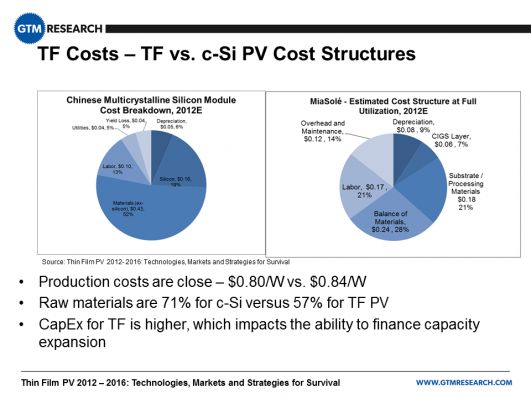

A fundamental value proposition for thin film remains: thin film is less reliant on raw material costs than other technologies. Seventy-one percent of the c-Si module cost is from raw materials and silicon is 20 percent of the cost of the module. But for CIGS or CdTe, the material for the active layer is less than 10 percent of the cost, according to the GTM Research model.

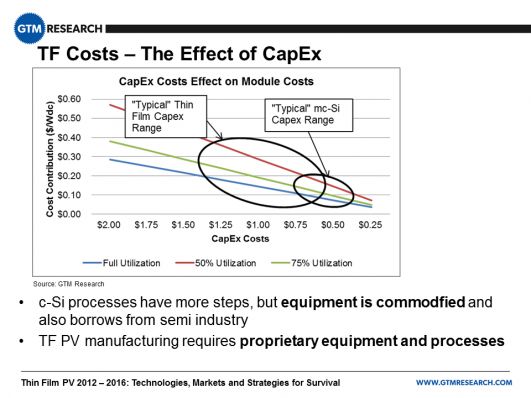

Shiao also claims that the initial capex for thin film is higher (CIGS solar CEOs might dispute this claim), and therefore there is a much bigger penalty associated with under-utilizing a thin film facility.

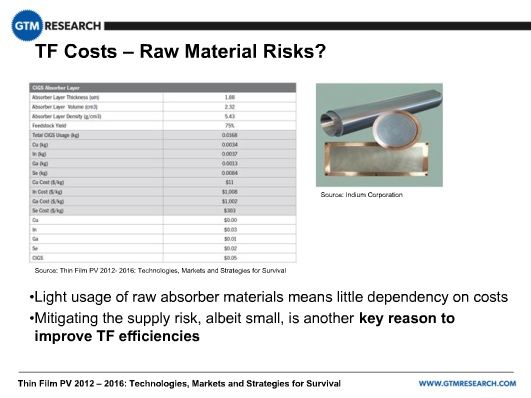

Thin-film PV module cost is not subject to the same raw material risk as c-Si. Even if indium prices doubled, CIGS module prices would only increase by 3 cents per watt.

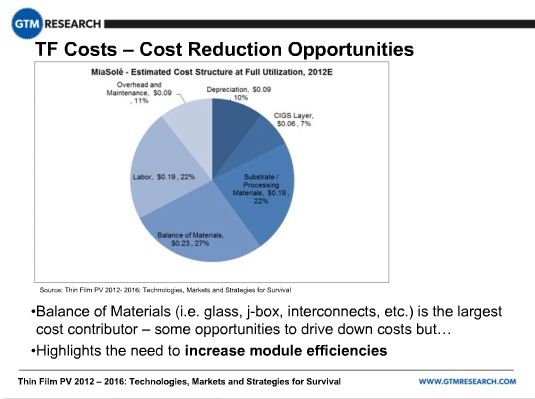

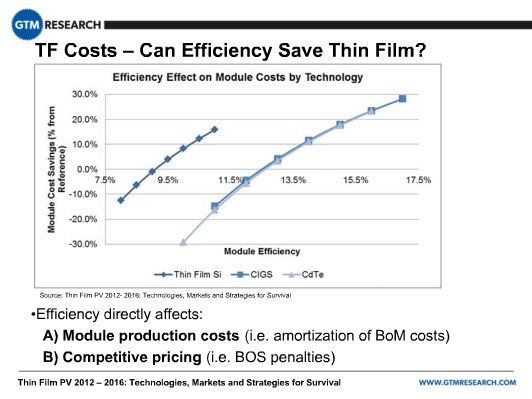

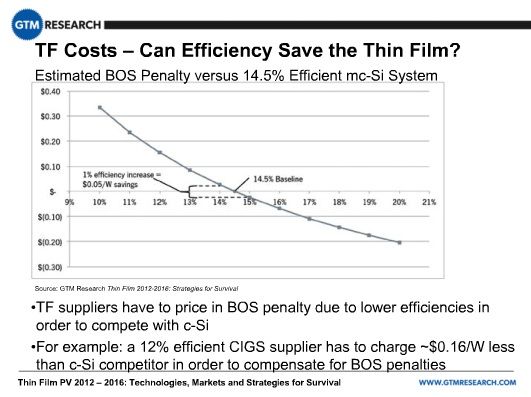

The opportunity for cost reduction lies in balance of materials, emphasizing the need to drive efficiency improvements.

Higher efficiencies will reduce area-related costs and eliminate the balance of system penalty. According to this model, CdTe must sell for $0.12 to $0.16 per watt less just to compensate for the BoS penalty.

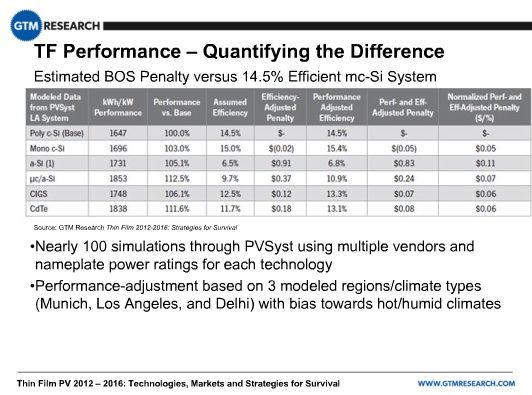

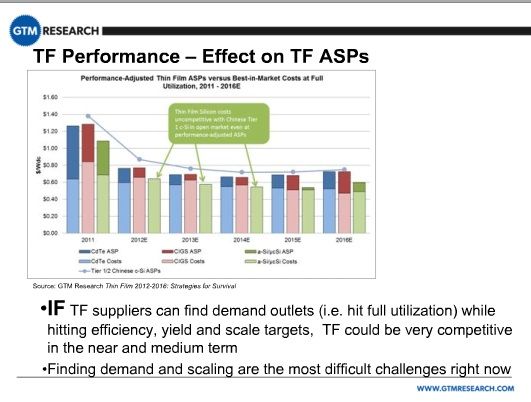

Thin film performs better in low light and high temperature regions. GTM Research adjusts efficiency for that thin-film adder and finds that a 12.5-percent-efficient thin-film panel yields equivalent power to a 13.3 percent c-Si module.

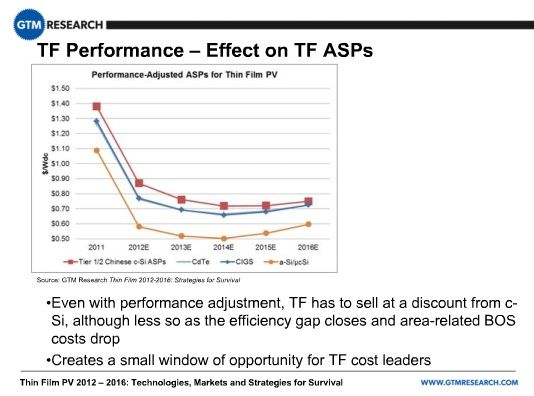

There is a small window of opportunity for thin-film solar.

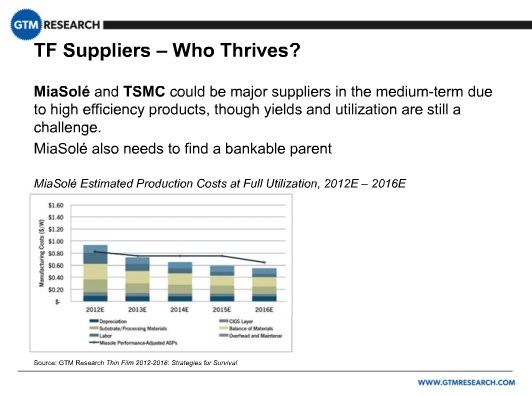

Note that these costs are at full utilization, and that's the challenge for thin film factories: finding customers to fill those factories (see Solar Frontier's 900-megawatt factory).

Emerging markets might favor thin film because of higher temperatures and the frontier nature of these markets.

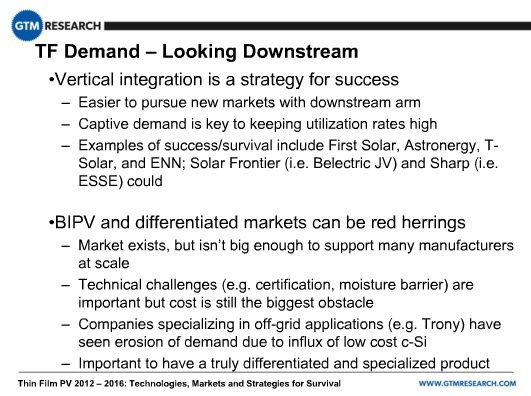

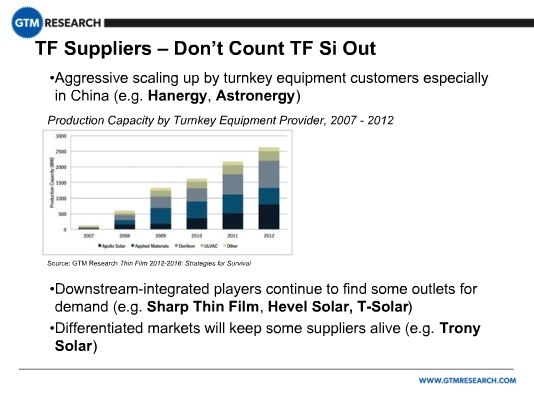

Vertical downstream integration is a key strategy for thin film players. Shiao cites smaller module maker T-Solar developing a 44-megawatt project in Peru. Shiao also notes that some thin film players are focusing on off-grid, BIPV, and consumer applications, but is skeptical of this market direction because of the small size of the market and the fact that c-Si can participate in these markets as well.

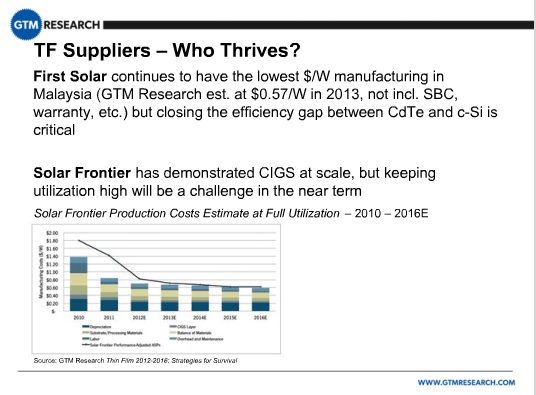

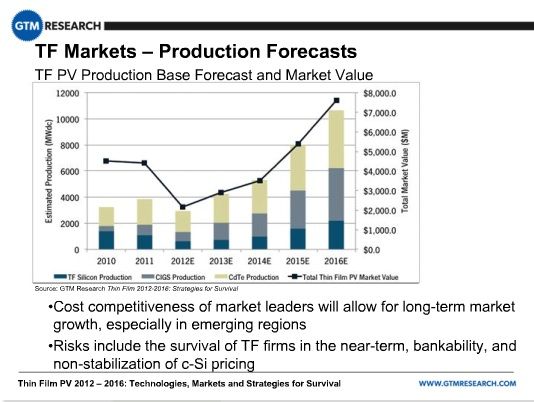

In summary, thin film is at a crossroads. There is a set of mixed signals: First Solar still has the lowest manufacturing cost of any solar panel firm in the world. GTM Research estimates that costs at First Solar's Malaysian factory could be $0.57 per watt. More importantly, the firm has shown that it has some headroom on efficiency improvements and can close the efficiency gap with c-Si. But the thin film factories of First Solar, Solar Frontier and MiaSolé need to be fully utilized.

The next few years are going to be trying times for thin film, which may never dominate as once expected. Still, GTM Research expects share to "creep up and claim about 18 percent of PV production by 2016."

Shiao notes that MiaSolé remains a contender but needs a bankable parent. Also, if c-Si prices fall more sharply, it could kill off these early thin film players.

Shiao says not to count out thin-film silicon, citing Trony as a leader in off-grid applications.

More on GTM Research's epic thin film market analysis here.