Silver Spring Networks (SSNI), the Silicon Valley smart grid networking startup that went public last month on the strength of its U.S. smart meter deployments, has now staked a claim in the U.K.’s plan to network every smart meter in the country by the end of the decade.

That’s according to Businessweek, which reported Thursday that Silver Spring and partner Vodafone are competing in bids to build countrywide-area wireless networks to support the country’s smart meter plans. Those call for about 53 million smart electric and gas meters to be installed by 2019, along with a system that can manage them from a nationwide perspective -- a tricky matter, given the country’s competitive energy market.

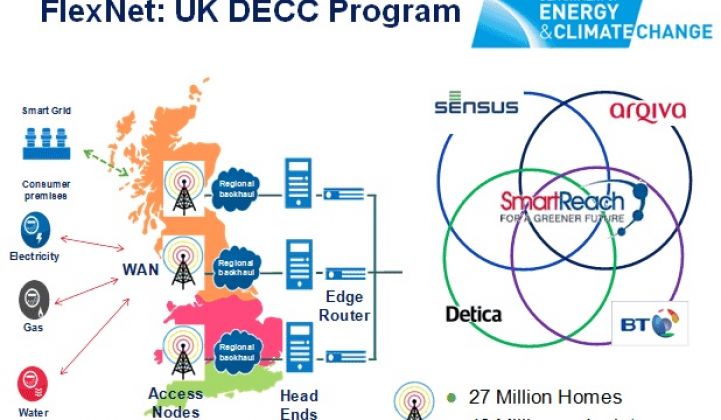

Other contenders for the nationwide networking project, which includes about $7.5 billion in contracts, include the SmartReach group, a collaboration of BT, BAE, Arqiva and U.S. smart metering company Sensus, as well as Telefonica and Airwave Solutions. Contenders like SmartReach are in the final stages of submitting bids to the U.K.’s Department of Energy and Climate Change (DECC), which expects to announce a winner in July, the report stated.

Silver Spring declined to comment Thursday, but it's no surprise that the Redwood City, Calif.-based company has aspirations for the U.K. In fact, it has been working on projects there since 2011 with Cable & Wireless, which Vodafone bought in 2012. The two are working on the Isle of Wight’s EcoIsland Partnership, as well as a smart grid networking project in Cambridgeshire. Silver Spring also added natural gas meters to its portfolio in January, and while it didn't specifically cite the U.K. as a reason, the nation's metering plans do require electric and gas meters to run on the same network.

Silver Spring has also made clear that it wants the U.K. to adopt a nationwide smart metering architecture that includes its wireless mesh technology, along with cellular and other communications. “We recommend that the U.K. consider an IPv6-based approach, which allows for a scalable, future-proofed deployment that includes existing transports such as radio mesh and emerging transports such as LTE and TV White Spaces,” is how James Pace, Silver Spring’s senior director of business development, put it in this December op-ed (PDF).

Still, these pronouncements, along with missives like its U.K. employee newsletter (PDF), have come with little or no information about just what Silver Spring is building in the market to date. Now that it has finally gone public, we can expect to see more details emerge on its international aspirations, which range from Europe and Brazil to New Zealand and Singapore.

It should be noted that Vodafone’s smart metering partnerships in the U.K. aren’t limited to Silver Spring. Redwood City, Calif.-based Trilliant, a neighbor and competitor with Silver Spring, is also working with British Gas on its own U.K. rollout, with about 500,000 meters deployed so far and millions more to come in the next few years under the utility’s commercial-scale deployment plans. Vodafone is also working with partners like Itron in Germany and other European markets.

Likewise, the U.K.’s utilities are using smart meters from a range of providers like Elster and Landis+Gyr. Unlike most other nationwide smart meter mandates, however, the U.K. is starting with a free-market approach. That is, instead of rolling out smart meters to all customers across broad regions, the U.K. is asking the energy retailers that compete for customers in its deregulated market, such as British Gas, E.ON, Scottish & Southern Energy, EDF Energy, GDF Suez and nearly 70 others, to entice customers to switch over to in-home smart meters, one at a time.

That’s a very different IT challenge than that faced by Silver Spring and other AMI vendors in utility-wide deployments like those they’ve done in the United States, or that they are contemplating in big European markets like France and Spain. For example, because the U.K. allows customers to switch their retail electric and gas providers from one month to the next, smart meters have to be able to switch from one competitor's network to the other.

All of these smart meters, meanwhile, will communicate to network hubs or collectors that connect up to the backhaul networks now being bid upon. The U.K. has broken up its WAN plans into three geographical areas, northern Great Britain and Scotland, central Great Britain and Wales, and southern Great Britain, but it has also stated that it wants bidders to support every function required of the network within a particular region, rather than supply only part of a solution to all three.

At the same time, all of these meters have to eventually connect to a master meter data integration platform or IT framework. That’s another big project in planning in the U.K., one being targeted by the likes of IBM, Logica, and Siemens and Atos.