Sempra Energy, which owns San Diego Gas & Electric, leads U.S. investor-owned electric utilities in renewable energy as a percentage of total sales, according to a new report from Ceres.

Utilities are investing in renewable energy to comply with mandated standards. More and more, however, the investment is a way to diversify generation portfolios as renewable energy prices have dropped, and utilities are using renewable investment as a way to meet the needs of some of their largest clients.

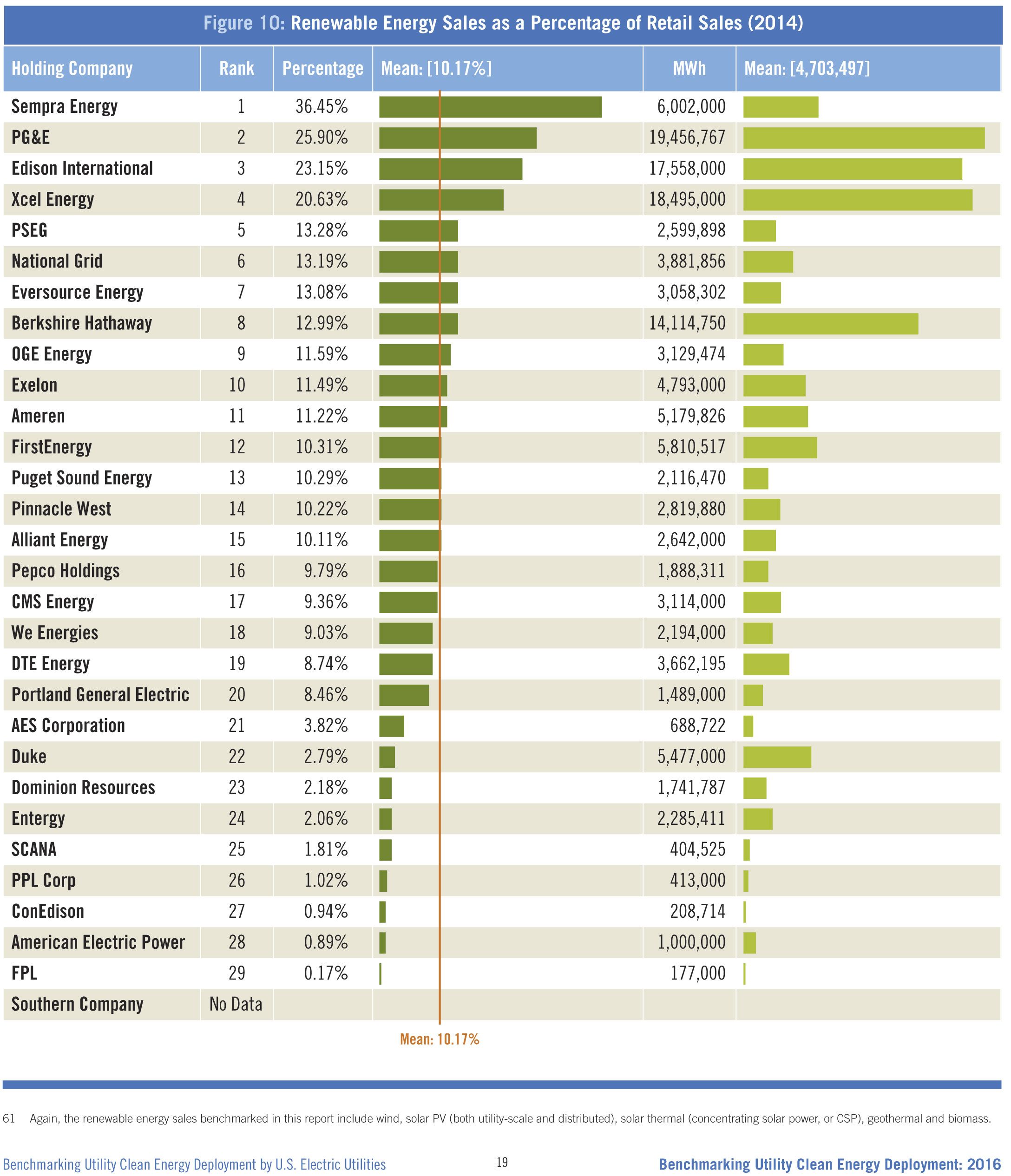

Ceres looked at the 30 largest investor-owned utility holding companies, which have a total of 87 electric subsidiaries that accounted for nearly 60 percent of total electric sales in the U.S. in 2014.

Unsurprisingly, the California utilities led the pack. More than one-third of Sempra Energy’s 2014 retail electric sales came from renewable energy, while Pacific Gas & Electric came in second at 25 percent, and Edison International, which owns Southern California Edison, was at 23 percent.

However, renewables energy sales in terms of megawatt-hours put PG&E in front, with nearly 20 million megawatt-hours of clean energy in 2014, followed by Xcel Energy and Edison International. Each of the three utilities had more than double Sempra Energy's total renewable megawatt-hours.

At the other end of the spectrum, American Electric Power, Con Edison and Florida Power & Light were at the bottom of the list, with less than 1 percent of retail sales coming from renewables in 2014.

But even many laggards are scaling up quickly. FPL’s director of smart gird and innovation said at Greentech Media’s Grid Edge World Forum in San Jose last week that the utility is tripling its investment in utility-scale solar.

It’s not just wind and solar that are seeing an increase of investment dollars. Eversource, which serves part of New Hampshire, Connecticut and Massachusetts, leads the U.S. in energy-efficiency sales as a percentage of total sales, but utilities across the country are following suit.

Exelon had the largest total number of megawatt-hours of energy efficiency. The Consortium for Energy Efficiency found utility efficiency programs, including demand response, jumped to $6.7 billion in 2014, up from $4.9 billion in 2010.

Even though energy efficiency has long been known as one of the cheapest ways meet electric demand, for market leader Eversource, energy efficiency still only accounts for less than 2 percent of electric sales.

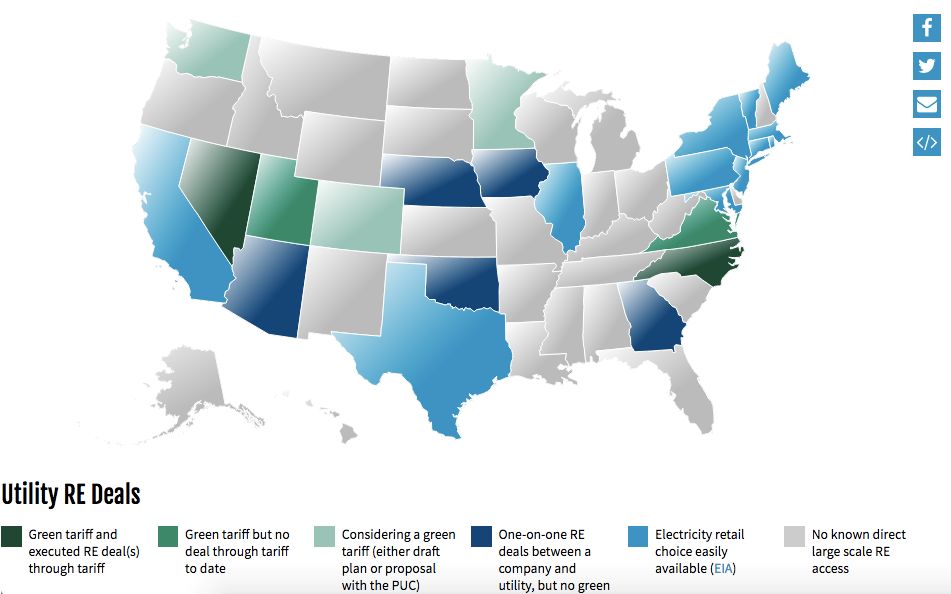

For both efficiency and utility-scale renewables, state-level portfolio standards have driven much of the investment so far. But that is changing. As prices have come down and corporate clients have become more sophisticated, they’re looking for additional help from utilities to invest in renewables and take on increasingly complex energy-efficiency projects.

“Demand from these companies has so far led to the development of innovative purchasing mechanisms (e.g., 'green tariffs') in a handful of states, and more extensive changes may soon follow,” Ceres wrote in the report. It went on to note that Rocky Mountain Institute reported a 300 percent increase in corporate energy deals from 2014 to 2015. World Resources Institute recently mapped where corporations can buy affordable renewable power from their local utility.

Of course, pinpointing the drivers for renewable energy investment can be difficult, as market drivers and regulations change quickly. But just getting the raw installation numbers needed to perform this type of analysis is still extremely challenging, says Ceres.

Ceres made a number of recommendations to make tracking utility renewable investment more transparent, including more detailed renewable energy reporting to the U.S. Energy Information Administration. The paper recommends better accounting not only for utility-scale investment in wind and solar, but also for grid infrastructure upgrades.