Solar startup Scifiniti, in an exclusive interview, just revealed its technology as well as a $10 million round B for its kerfless solar silicon and materials technology. Funding comes from Alloy Ventures, Firelake Capital Management, I2BF Global Ventures and Peninsula Ventures. Total investment raised to date is approximately $20 million. (This week also saw investment in solar startups Sol Voltaics and Solexel.)

The 22-employee startup's expertise lies in substrate creation, silicon deposition and recrystallization with potential applications in batteries, optoelectronics and ceramics. But the first application is solar.

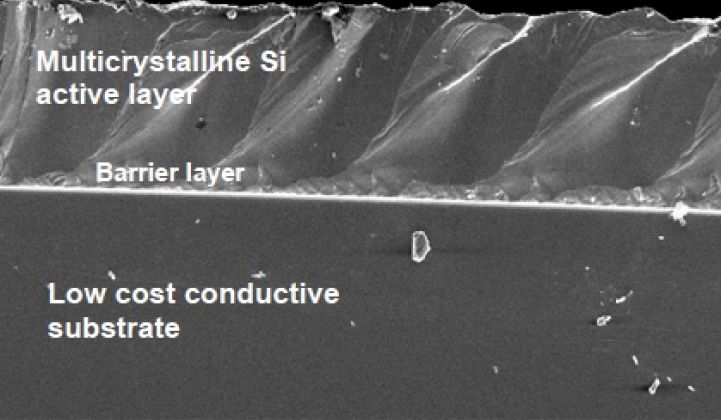

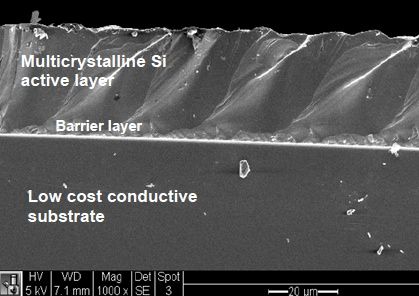

Scifiniti (formerly IPV) deposits a thin silicon layer on a metallurgical-grade silicon substrate in the standard wafer form¬factor. A barrier layer is deposited to prevent impurities from migrating from the sintered substrate into the recrystallized silicon layer; it's 30 to 40 microns thick at 0.5 grams of silicon per watt. I got a brief tour of the demonstration-line manufacturing processes, which are done in a decidedly non-clean-room environment.

According to Scifiniti's CEO, Sharone Zehavi, the Scifiniti wafer will be "a drop-in replacement and be able to be manufactured in volume for significantly less than $0.10 per-watt."

The thrust of the argument from Zehavi is that the solar manufacturing market, despite the current carnage, remains immature and undifferentiated. The company believes its technology can provide some lucky module-maker the differentiation needed in a more mature market. In all likelihood, that manufacturer and partner will be in Asia.

The CEO said, "The way to play the market is to innovate on a segment of the value chain, not replace the whole value chain." In a statement, he added, "The largest opportunity in the value chain is to dramatically decrease the cost of the silicon wafer."

Zehavi claims that the firm's technology can be adopted "without any changes to existing processes and without the need to purchase new capital equipment." Curt Vass, now with Scifiniti, said, “The wafer market represents a $6 billion opportunity that continues to grow."

The company did not share its current efficiency numbers, but the CEO saw a path to 20 percent with possible future versions requiring no back metallization or silver paste.

Zehavi sees the buyer of his firm's wafers getting improved profitability along with compelling cost savings. The firm asserts that 100 megawatts of wafer capacity would cost $14 million, not the hundreds of millions that it would cost to build that amount of capacity with the current technology.

Other kerfless solar silicon firms looking to eliminate the costly ingot-to-sawn-wafer piece of the manufacturing chain include:

- Crystal Solar (with investment from Hanwha), which is using p-type wafers supported by a cover glass.

- Solexel exfoliates an epitaxially grown layer (gas-to-silicon) from a donor wafer and has demonstrated 21.2 percent efficiency. SunPower is an investor.

- 1366 Technologies grows wafers directly from molten silicon (as did Evergreen).

- AmberWave is a DOE award recipient for exfoliated silicon on steel or flexible carriers.

Other startups addressing this technology have already perished. AstroWatt is "dormant." Twin Creeks was purchased at a fire-sale price by GT Advanced Technologies for non-solar applications of its technology. Silicon-film-on-metal-foil company Ampulse, in the direct-gas-to-wafer technology segment, is gone. AstroPower, an early entrant in this technology, is also gone.

The value proposition of cheaper and more efficient crystalline silicon remains valid. Although the cost of solar panels has plummeted, silicon remains a significant cost in the solar panel bill of materials. If less silicon can be used, if cells can be made more efficient, or if processing steps can be eliminated, there is still an opportunity for the industry and for entrepreneurs.

These startups must demonstrate high efficiency, low cost, and manufacturability. It's still early days for Scifiniti -- and the CEO admits to having to continue prove the merits of the technology.

It looks like there is still room for innovation and cost savings in the c-Si solar wafer value chain. And there are still entrepreneurs and investors attempting to bring that innovation to market.

***

The cleantech sector may never see investment intensity like it did in 2008 ($7.5 billion in 350 deals), but there's still activity -- as well as changing VC investment models. Take a look at Greentech Media's Next Wave VC investment event and let us hear from you if you'd like to participate or attend.