California’s large-scale renewable energy market is doing quite well, but the small utility-scale market is struggling. California is a complex market, but essentially, it offers three market niches for wholesale renewables:

- More than 20 megawatts, which bid into the state's renewable portfolio standard auctions

- 20 megawatts to 3 megawatts, which generally bid into the Renewable Auction Mechanism (RAM)

- 3 megawatts and below, which now primarily look to the new Renewable Market Adjusting Tariff (ReMAT) program

The ReMAT program, however, is very limited and has major problems (discussed below). This article looks at how California can save its 3-megawatt-and-below market niche. This is an important niche because these projects qualify for Fast Track interconnection, which has a size limit of 3 megawatts. Fast Track interconnection takes one-fourth the time of the cluster study interconnection process and costs substantially less, so it is a major advantage for both developers and the ratepayers who benefit from this kind of project.

Solar projects smaller than 3 megawatts can fit on 20 acres or less and can be placed on large rooftops or open space. They interconnect to the existing distribution grid and make the entire grid far more efficient because of the highly distributed nature of these projects. This is the opposite of the large central-station model that has dominated utility planning for decades and is still the dominant model in California, even for renewable energy.

Given all the benefits that come with small utility-scale renewable energy projects, one would think that California policymakers would be doing more to support this market. However, the primary program designed for this niche, the ReMAT program, is struggling.

ReMAT is a very small program and is more akin to a pilot than a substantial procurement program, with only about 250 megawatts statewide. PPA awards in the first year have been extremely slow, with SCE awarding only 13 megawatts in its first five contract periods (almost entirely solar in the peaking category), PG&E awarding 28 megawatts (largely solar in the peaking category), and SDG&E awarding 13 megawatts (almost entirely solar peaking).

ReMAT contracts are offered every two months by each utility, but with only 5 megawatts available for each product type by each utility, the available total is only 15 megawatts every two months for SCE and PG&E, and it's even lower for SDG&E. More than 200 megawatts could have been awarded under ReMAT in the first five windows that have already taken place, and yet only 54 megawatts of contracts have been awarded to date. This demonstrates the difficulties of the program as currently designed.

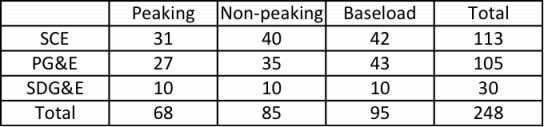

Table 1 shows the remaining megawatts in each IOU’s ReMAT program.

FIGURE: Remaining Megawatts in Each IOU's ReMAT Program Allocation

ReMAT applicants have no way of knowing what contract price they can obtain ahead of time. In contrast, knowing the contract price ahead of time is a substantial advantage of a feed-in tariff. It provides market certainty and confidence that developers can invest the time and money required to get a project to the point where it can win a contract to sell power. ReMAT provides no such certainty because the contract price is only known when the contract is offered in that particular contract window. This is the case because, by design, the ReMAT price adjusts up or down based on market interest. The motivation for this design feature was good: CPUC planners wanted to get the best deal for ratepayers. The problem with this approach, however, is the lack of certainty for developers. And we are now seeing the consequence of this serious problem: a lack of contracts being awarded.

California utilities have a few other programs for procuring distributed generation (DG), but nothing substantial for projects 3 megawatts and smaller, which is the cutoff for Fast Track interconnection eligibility. SCE is planning at least one more auction in its Solar PV Program, which was originally approved for 500 megawatts in 1- to 2-megawatt increments of mostly roof-mounted solar projects. SCE has successfully petitioned the CPUC to transfer the majority of this capacity to the Renewable Auction Mechanism (RAM) program, however, which is designed for projects 20 megawatts and below, an entirely different niche than the 3-megawatts-and-below niche.

PG&E’s Solar PV Program was also approved for 500 megawatts of ground-mounted solar projects up to 20 megawatts. This is, again, a very different niche than the 3-megawatts-and-below niche than can utilize the Fast Track process. Moreover, much of PG&E’s Solar PV Program allocation has also been approved for transfer into RAM.

SDG&E’s Solar PV Program is now ended.

As such, ReMAT is now essentially the only program in California for 3-megawatts-and-smaller DG projects. The problem is that it isn’t working very well and it has extremely limited contract capacity, as demonstrated above.

There is hope, however. AB 327, passed in 2013, requires that the California Public Utilities Commission (CPUC) design a program for utilities to create distribution resources plans (DRPs) that incorporate distributed energy resource planning into the normal distribution grid planning process. In other words, the utilities now need to consider two-way flows of energy in their planning process, rather than the top-down flow that is the traditional model. AB 327’s DRP program requires that the utilities proactively design their grids to optimize distributed energy resources like renewable energy, demand response and electric vehicles. This is a paradigm shift in how utilities do grid planning.

AB 327 includes as part of its DRP requirements that the CPUC and utilities create “standard tariffs” to support distributed energy resources. This phrase, given similar language in other parts of the utility code, is clear authority for the CPUC to create a feed-in tariff to support distributed energy.

Given the serious shortcomings of the ReMAT program, the CPUC could and should act quickly to create a robust and cost-effective feed-in tariff pursuant to AB 327.

There is strong precedent for this kind of program. AB 1969 created a modest feed-in tariff program for projects 1.5 megawatts and smaller beginning in 2009. The price offered under this feed-in tariff was the Market Price Referent (MPR), the proxy price of power from a new 500-megawatt natural gas plant. In the first years of the AB 1969 program, this price was too low to prompt market interest. However, the MPR became a viable price for AB 1969 projects toward the end of the AB 1969 program, and interest in the program skyrocketed before it was phased out and replaced by the ReMAT program.

The problems with the ReMAT program and the severe shortage of contracting opportunities for small utility-scale renewable energy projects weigh heavily in favor of a new feed-in tariff program. AB 327 represents an opportunity that shouldn’t be missed. The AB 327 language demonstrates the legislature’s clear intent to spur development of cost-effective distributed energy resources, so a cost-effective feed-in tariff must be part of that discussion, particularly since ReMAT is doing so poorly and is such a limited program.

***

Tam Hunt is owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii.