The battle over net metering has been brewing for years, but it is beginning to bubble over now. Public disputes have emerged in California, Arizona and Texas, with other states surely close behind. But just as important, and less publicly discussed, is the vital role that utility rate design plays in the economics of distributed solar.

Today GTM Research released a free report on the subject titled Rate Design Matters: The Impact of Utility Tariff Structure on Solar Project Economics. The report was borne out of our ongoing modeling of solar projects in various locations to estimate when they will become economic without any state-level incentives. The good news is that there are places in the U.S. right now (think Hawaii, parts of California, and Arizona residential) where solar is cheaper than grid power when you take into account only the ITC and accelerated depreciation. The bad news is that the existence of this cost advantage depends entirely on a given customer’s electricity rate structure.

Rate structure is too often ignored in public solar discourse, particularly in discussions of “grid parity.” Apart from some issues I have with the concept itself, the main mistake most analysts make is in estimating not the cost of solar, but the cost of grid power. The EIA maintains a great dataset on average electricity prices, but only full retail prices. And as any solar developer/installer knows, solar doesn’t always reduce a customer’s bill by the full retail rate. There are fixed charges on most bills (particularly in the commercial sector), not to mention nuances such as time-of-use pricing and tiered rates, that drastically alter the competitiveness of a solar project.

There are two risks to ignoring these factors. The first is that we overestimate the current competitiveness of solar and, thus, underestimate the need for runway in local and state-level incentives. The second is that the solar industry’s focus on net metering leaves an opening for unfriendly utilities to gut distributed PV markets through tariff revisions.

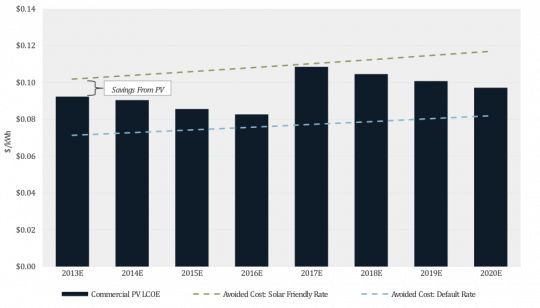

In the report, we use the example of Southern California Edison territory, where commercial solar customers can currently opt into a solar-friendly tariff (TOU-GS-3-R) instead of the default commercial rate (TOU-GS-3-B). The difference in the effective avoided cost for an average solar customer is $0.03/kWh -- more than enough to make or break a project. To put that number in context, $0.03/kWh can be equivalent as much as $0.80/W in PV system costs.

Based on conservative system price forecasts, the average commercial customer on the solar-friendly SCE tariff would see modest savings from PV through 2020 (even after the expiration of the ITC), while the average commercial customer on the default rate runs the risk of never achieving parity.

FIGURE: Commercial PV Economics in Southern California Edison Territory

Source: Rate Design Matters: The Impact of Utility Tariff Structure on Solar Project Economics

Our examples are representative rather than exact, but the contrast is striking. And it is not an issue unique to California. High demand charges in Texas have kept solar companies at bay there for years. In APS territory (AZ), demand charges that make up the default commercial rate (E-32) account for around half of a solar customer’s bill -- which is why we have low expectations for the commercial market after incentives dry up.

Rate design can cut both ways. While the introduction of a solar-friendly tariff can open a new market, negative revisions to existing tariffs can shut one down. So as PV penetration increases, be aware that the arcane, complicated world of utility rates and regulation will shape the future of the market.

Shayle Kann is the Vice President of Research at Greentech Media, where he leads the GTM Research analyst team. To download GTM Research’s just-published free report on rate design, visit here. For more information on GTM Research products and consulting, visit www.gtmresearch.com or contact Justin Freedman at [email protected].