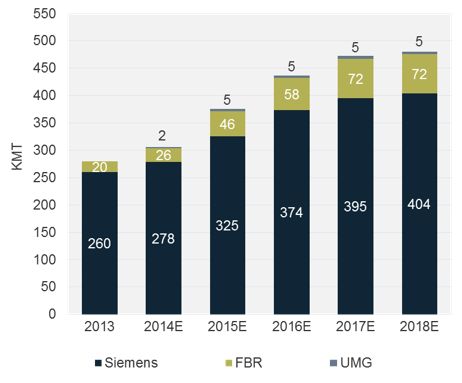

A total of 130 thousand metric tons (kilometric tons or KMT) of polysilicon manufacturing capacity, equivalent to roughly 25 gigawatts of crystalline silicon (c-Si) solar PV panels, is estimated to come on-line in 2015 and 2016, according to GTM Research’s newest report, Polysilicon 2015-2018: Supply, Demand, Cost and Pricing. By 2016, cumulative global polysilicon supply capability will reach 437 KMT, enough to enable 85 gigawatts' worth of c-Si panel production.

FIGURE: Ramped Polysilicon Capacity by Production Technology, 2013-2018E

Source: Polysilicon 2015-2018: Supply, Demand, Cost and Pricing

GTM Research estimates that global PV installations of at least 60 gigawatts will be required to maintain balance between polysilicon demand and supply in 2016. The report notes that the effects of overcapacity on polysilicon pricing could be exacerbated by the fact that by 2018, more than 150 KMT of polysilicon supply will come from plants with cash production costs of less than $15 per kilogram, including REC Silicon, GCL-Poly, Daqo New Energy and TBEA Xinjiang.

Prior to this uptick in production, disappointing end-demand growth in 2011 and 2012, coupled with previously planned capacity additions from both incumbents and new entrants, led to a period of severe overcapacity, falling prices and heavy financial losses from 2011 to 2013. Balance was eventually restored in the second half of 2013 due to strong solar PV demand growth and the forced shutdown of many plants during the overcapacity period.

"After enduring a traumatic period of sustained overcapacity and price troughs in 2011-2013, the global polysilicon market has rebounded strongly in 2014," said report author and GTM Research Lead Upstream Solar Analyst Shyam Mehta. "A sustained uptick in pricing and renewed confidence in end-market growth have spurred the resumption of capacity expansion plans, as well as restarts at a number of previously shuttered plants.”

Reopened plants include those owned by Hankook Silicon, Elkem and LDK Solar.

“Additionally, a slew of new entrants are poised to join the market, making for a dynamic, multi-tiered competitive landscape which we expect to become less, not more, consolidated in the medium term.”

Mehta cautioned that the due to the expected surge in capacity additions, the threat of oversupply, while limited in 2015, could resurface in 2016. He recommends manufacturers keep an open mind with regard to the timing of future expansion plans.

Other findings from the report include:

- GTM Research expects polysilicon pricing to be stable and possibly even increase through 2015, with pricing expected to be in the $18 to $24 per kilogram range

- Global demand for polysilicon is estimated to be between 347 KMT and 416 KMT in 2018, compared to 243 KMT in 2013 and 328 KMT in 2015.

- Although fluidized bed reactor (FBR) polysilicon technology has a lower ultimate manufacturing cost floor than the dominant Siemens process and offers benefits for customers in terms of automation potential and higher charge masses, it will constitute less than 20 percent of global production by 2018 due to its highly proprietary nature.

- Demand from semiconductor applications is expected to account for only 11 percent of total global polysilicon demand in 2018, down from 16 percent in 2010 and 58 percent in 2005.

- Average PV wafer silicon utilization is expected to fall from 5.3 grams per watt (g/W) in 2014 to 4.7 g/W by 2018, with best-in-class firms being able to achieve consumption of 4.1 g/W.

- Silicon costs at the module level will range from $0.07 to $0.08 per watt by 2018, compared to $0.10 to $0.12 cents per watt in 2014, implying that polysilicon will make up 18 percent to 25 percent of total module manufacturing costs for leading Chinese manufacturers, compared to more than 50 percent prior to 2009.

Polysilicon will remain the largest single contributor to total PV module cost.

***

To learn more about the new polysilicon report, download the report brochure today.