OriginOil builds equipment and licenses technology to help convert algae to oil. The firm also believes it has a chemical-free process that could mitigate the issue of polluted water in the oil and hydraulic fracturing industry.

As the domestic natural gas and petroleum industry grows -- so does the challenge of procuring and disposing of the the large volumes of produced and fracked water from drilling operations.

Algae in the Oil Field

I spoke with Riggs Eckelberry, the CEO of OriginOil, on Wednesday. He said, "Our research team has learned that extracting petroleum and contaminants from water is very much like extracting algae."

Eckelberry sees the topic of water remediation as "a red-hot subject" with potential multi-billion-dollar markets being created. Right now, water is trucked in and trucked out to disposal wells at a cost of up to $2 per barrel. The petroleum industry is trying to reclaim petroleum from produced water, and "the industry likes the idea of on-site treatment," said Eckelberry.

Mining shale gas entails a drilling process known as hydraulic fracturing, or "fracking," which involves blasting through rock with a mix of water, sand and additives to split the shale formation and free the trapped gas. OriginOil claims its process can work on this water, as well.

So far in the lab, OriginOil researchers have clarified samples of "flowback water from a Texas oil well carrying heavy concentrations of dissolved organics, known as frack flowback," according to a release. Eckelberry said that the company has a process which pulls solids out of solutions. "We've learned to do it so well with algae -- it's easy to do with produced water."

According to the DOE, globally, an average of three barrels of polluted water is produced from every barrel of oil produced.

The Two Algae Industries: Food Grade and Fuel

There are two algae industries, said Eckelberry. One is the mature "food-grade algae industry" producing products such as omega-3. Companies such as Martek and Solazyme grow algae heterotrophically in big stainless steel tanks with sugar as feed. Eckelberry suggested that sugar cannot be an input for an economical fuel product.

The second algae industry is "trying to make algae sustainably -- that's the new field." The CEO spoke of a hybrid two-phase growth mode -- growing in the sun to start and then boosting growth heterotrophically.

But for algae, the chasm from economic food grade--scale to economic liquid fuels refinery-scale has yet ben crossed. Companies such as Aurora and Sapphire Energy are "starting to get scale," according to the CEO who called it an "Industry in the brick and mortar phase of building things out."

OriginOil's core technology is that of "algae oil services" -- providing algae farmers with technology to harvest, dewater, and break down algae for its component materials. The equipment the firm builds is to "prove out" the process while the business plan goes after Joint Ventures and licensees. The firm has technologies to de-water and rupture algae. The de-watering process is claimed to be a chemical-free way to move from 1000:1 water to algae ratio down to 10:1.

The focus is to take the de-watered and ruptured slurry and send it to downstream partners. The slurry includes oil as well as biomass and it is intended that the full mass is "pushed through the conversion process to diesel or crude."

The algae-fuel industry has a history of over-promising and under-delivering.

Algae production for fuel is not yet economical in any type of growth architecture or feedstock combination. The downstream processes of dewatering, rupturing, separating, and processing are still in early days.

Selling food-grade algae by the kilogram can be a viable business. But fuel from algae at market price is a long way off.

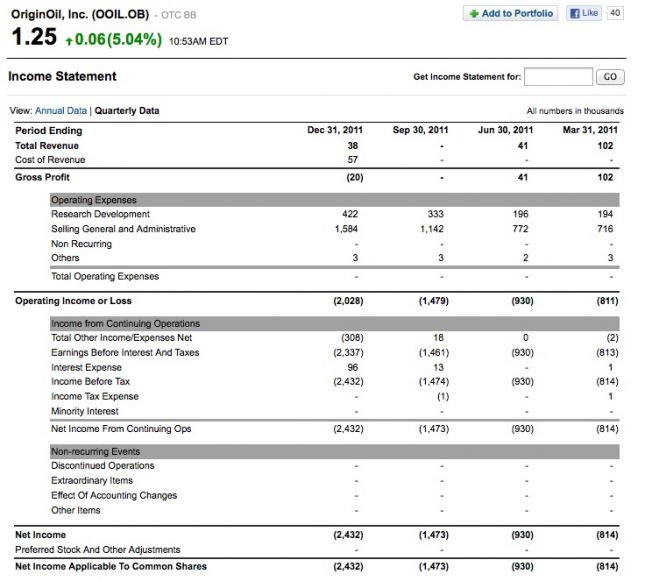

OriginOil has challenges ahead as an OTC company with a market cap of $11 million, annual revenue of $181,000 in 2011 with losses of $5.2 million. The firm needs to survive long enough to see large-scale usage of algae in the oil and gas industries.