Amorphous silicon (a-Si) technology has a troubled commercial track record.

There was the the faceplant of Silicon Valley semiconductor giant, Applied Materials, its customers, and its a-Si photovoltaic efforts.

Recently, Novasolar, the reincarnation of Optisolar, furloughed its employees, and ECD, with one of the longest money-losing streaks of any corporate entity, declared bankruptcy. Both of those firms were multi-junction a-Si PV producers.

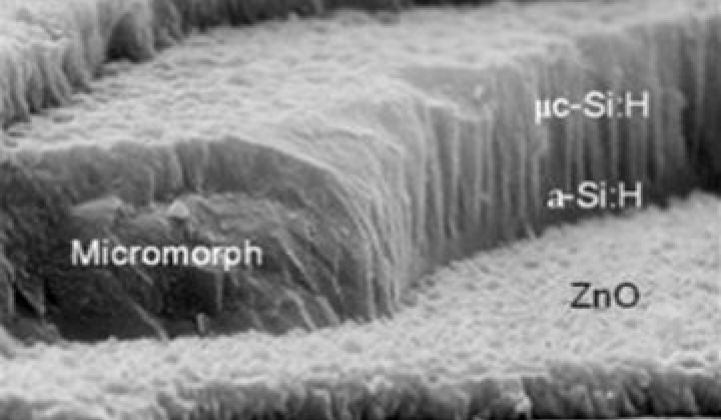

We had been less dismissive concerning equipment vendor Oerlikon's efforts in a-Si because in our many conversations with Chris O’Brien, Oerlikon Solar’s head of market development in North America, he firmly stated that the firm's aggressive cost targets were in reach. He cited first-mover advantages, having a longer legacy in micromorph (tandem-junction) designs, and starting off with an efficiency advantage. He also cited some technical advantages compared to other a-Si vendors and his belief that costs of 70 cents per watt would be achievable by 2011.

But the solar division of Oerlikon has been bleeding money for years. Oerlikon's orders received for the first half of 2010 were down 98 percent (!) since the prior year, with operating losses of $57.5 million. Oerlikon Solar, based in Zurich, Switzerland, is controlled by Russian tycoon Viktor Vekselberg.

Some of Oerlikon's customers include Tianwei and Astronergy.

Those customers are now the charge of Tokyo Electric (TEL), to whom Oerlikon has divested its solar business at an undisclosed price. Dr Michael Buscher, CEO of Oerlikon Group, was quoted in a press release as saying, "TEL is an ideal strategic buyer for our solar business. Its main operations are close to the predominantly Asian customer base and having had a partnership with them for three years, they know our Solar Segment well."

TEL has been a sales representative for Oerlikon in Asia for the past three years and has more than 10,000 employees in a variety of semiconductor businesses.

Other amorphous silicon players include Sharp, which entered a JV with Enel and ST Microelectronics in a-Si a few years ago. Also struggling to remain competitive in amorphous silicon and its variations are Xunlight, AOS Solar, APSTL, HelioSphera, NanoPV, and Sencera.

All of this action takes place against the backdrop of thin film leader First Solar, with 2 gigawatts of 12 percent efficiency solar module capacity at a cost of less than 75 cents per watt.

One company with large aspirations that might have a shot in a-Si is Astronergy, with the backing of the Chint Group, one of the largest Chinese private businesses. GTM Research finds that "Chinese tandem junction a-Si customers of Oerlikon at scale" can be "very competitive with c-Si, especially in hot regions like the U.S. Southwest, India and SE Asia, where there is better kWh/kW performance." Astronergy has landed a 6.1-megawatt a-Si project in Tuscon, Arizona.

I'll leave you with a quote from Chet Farris, the CEO of CIGS PV vendor, Stion, who had this to say about amorphous silicon: it was a "dead duck ten years ago" and "is a dead duck today." It will be "relegated to specialty and niche markets."