A decision at the California Public Utilities Commission (CPUC) on May 24 could determine the future of distributed generation (DG) and, especially, of rooftop solar in the state.

The decision involves two questions, a legality explicitly before the commission and an implied dispute between the state’s three investor-owned utilities (IOUs) and renewables advocates.

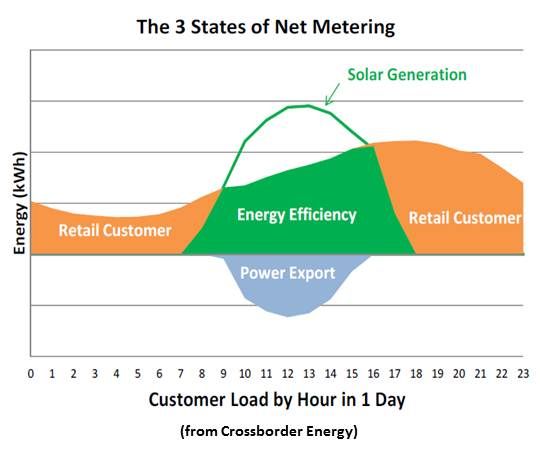

California has a net energy metering (NEM) program that allows owners of distributed generation systems of up to one megawatt in capacity, like small wind turbines, combined heat and power systems and rooftop solar systems, to reduce their electricity bills.

For the kilowatt-hours they send to the grid, system owners’ meters turn backwards as they are credited at the same retail rate they pay for the kilowatt-hours they consume.

When California established its NEM program in 1995, it imposed a 0.1 percent cap but used the ambiguous language of “aggregate customer peak demand” to define what the total megawatts of net metered systems should be divided by to calculate the cap percentage. And that calculation remained undefined, even as the CPUC expanded the cap to today’s 5 percent.

The differing methods used by the IOUs to calculate the bottom term of the cap equation, and the differing percentages thereby obtained, were recently observed by the Interstate Renewable Energy Council (IREC) which, among its other activities, acts as a watchdog group on U.S. net metering programs. IREC filed a motion asking the CPUC for clarity. Commission President Michael Peevey issued a proposed decision April 5.

In it, he noted the legislature had “several goals” in creating the NEM Program, “including encouraging substantial private investment in renewable energy resources and stimulating in-state economic growth.”

He pointed out several differences in how the IOUs calculate the percentage of their NEM, but noted one key commonality: PG&E, SCE and SDG&E all use “coincident” peak demand. Renewables industry advocates argue vehemently in favor of “non-coincident” peak demand.

Coincident peak demand is the designated period when all sectors (residential, commercial and industrial) reach their maximum electricity consumption together. It is the time period when the state’s consumption peaks.

Non-coincident peak demand is the sum of the peaking demand of each individual customer across the three sectors. Residential peak is typically late afternoon, commercial peak is early mid-afternoon, and industrial peak can be at night. It is a larger number because that sum of peaks at different time periods is greater than the total peak demand at any one time of the day.

The installed DG capacity eligible for NEM is the same. Dividing it by the peak demand number gives the cap percentage. When that number gets to 5 percent, the utilities are theoretically off the hook. So they want that bottom number to be smaller. Renewables advocates want just the opposite. As long as the number doesn’t get to 5 percent, renewables developers have what one called their “backbone” incentive in place.

The question before the CPUC is the intent of the law. Here’s what Peevey wrote: “The phrase 'peak demand' is used to refer to coincident peak demand in multiple occurrences in the Pub. Util. Code. [...] The words 'aggregate customer' would be superfluous if the Legislature had intended 'aggregate customer peak demand' to mean coincident peak demand. [...] Use of the phrase 'aggregate customer peak demand' in § 2827 of the Pub. Util. Code to mean coincident peak demand when the phrase 'peak demand' is used elsewhere in the Pub. Util. Code for that purpose would constitute the use of inconsistent and confusing terminology by the Legislature.”

These observations led Peevey to conclude that “The Legislature did not intend 'aggregate customer peak demand' to mean coincident peak demand. […] It is reasonable to interpret 'aggregate customer peak demand' as meaning the aggregation of individual customer peak demands, i.e., customers’ non-coincident peak demands, [... and] SCE, SDG&E, and PG&E should use the aggregation of customers’ non-coincident peak demands to calculate their caps on NEM participation.”

In comments filed by their attorneys, the IOUs dispute these conclusions. PG&E wrote that “the best choice for the denominator for calculation of the 5 percent cap is the highest peak ever achieved in the utility service territory. […] For PG&E, at least to date, this was 20,883 megawatts reached on July 25, 2006.”

PG&E’s filing also complicates the basic dispute by suggesting a change in the way the top number is calculated, concluding, “PG&E estimates that reversing these two decisions would reduce the amount of generation that can fit under the cap by about 10 percent, although the exact amounts will vary depending on participation in each group. PG&E recognizes that this means more net metering. However, [... it] is the better measure of the impact on the grid.”

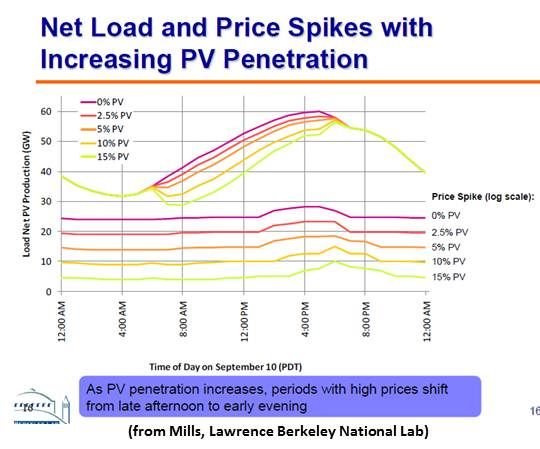

By raising the issue of the impact of renewables on the grid, PG&E opened the door to the implicit debate between the IOUs and renewables advocates.

The utilities point out that of the three parts of the standard electricity bill, only one covers the price of electricity generated. The other charges cover the costs of delivering electricity through the transmission and distribution infrastructure. When NEM customers’ bills are reduced by the retail rate, they escape paying their fair share of costs for infrastructure they use as much as non-NEM customers.

And, the utilities say, it shifts costs to other ratepayers.

More on the costs and benefits of NEM in the next installment in this series.