The semi-annual Black & Veatch Energy Perspective just came out and it's chock-full of forecasts on the North American energy market. We'll report on it in depth in the coming days. In the meantime, here's a sobering or encouraging stat, depending on your worldview.

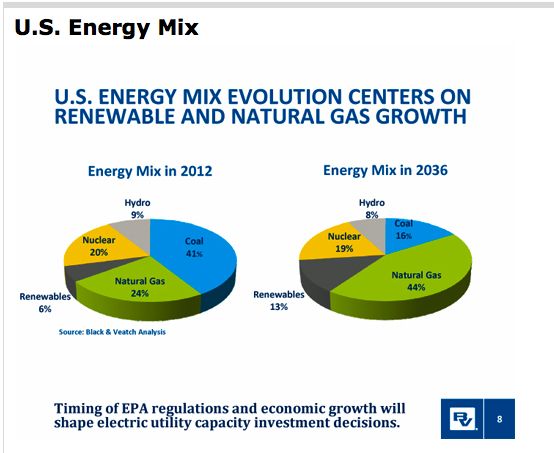

B&V's 25-year prognosis for the North American energy market sees nuclear staying steady at 19 percent, renewables doubling to 13 percent, and while coal drops significantly, natural gas replaces coal as the predominant fossil fuel powering the continent's electricity.

Cheap natural gas and abundant reserves change the game.

B&V notes: "North American natural gas prices have realized a separation from world oil prices and the price of natural gas in Europe, reducing the throughput on U.S. LNG re-gasification facilities and increasing the potential for natural gas exports."

Erilk Straser, a partner at MDV, a VC investment firm, noted yesterday on a panel that this produces some opportunities for entrepreneurs and investors. Somewhere in a VC boardroom is a thesis statement looking for opportunities in a world where natural gas is abundant and cheap with a stable supply.

Here are some comments on natural gas from past articles in Greentech Media.

Dan Reicher, Executive Director, Steyer-Taylor Center on Energy Policy and Finance, Stanford University, said, "Globally, there are immense supplies of natural gas, both conventional and unconventional." (By unconventional, Reicher means shale gas.)

In Reicher's words, "We need the combination of natural gas, renewable energy and energy efficiency," adding, "We need to build this bridge between natural gas and renewables."

T. Boone Pickens claims that the United States has natural gas reserves that are equivalent to 700 billion barrels of oil and it is his personal crusade to move that ocean of natural gas into the American transportation sector. He claims to have already spent $62 million on this quest, known as the Pickens Plan.

Bolder words were uttered by Vikram Rao, former CTO of Halliburton and current Executive Director of RTEC (Research Triangle Energy Consortium). He said that the shale gas supply "is the most important energy event in the U.S. since the discovery of Alaskan oil." Rao saw the shale gas keeping a lid on natural gas prices because of the peculiarities of shale gas extraction. He claimed that "once you have the lease, you can produce gas very quickly -- in 180 days." That turnaround time will keep speculators away and therefore pricing will not spike, according to Rao. He also saw the water transport and contamination issues as solvable.

Carl Pope, Chairman of The Sierra Club, spoke of coal and how utilities have powerful incentives to hold on to coal. Pope said, "Renewables and gas are fighting for table scraps while we should go after coal." He urged, "Make sure that the public utility commissions do not allow irrational investments in upgrading 50-year-old coal-fired power plants."

Pope suggested, "Run the railroads on natural gas, not diesel; [...] run fleet vehicles on natural gas." He also added, "Replace peakers with fuel cells." He then asked, "Can we power locomotives with fuel cells or natural gas?"

Pope finished his remarks by asking the audience to "Look at the system differently." He said that the biggest missing ingredient is that there is no institution where consumers and utilities can communicate. "We need to create a place where that conversation can happen."

***

Extracting shale gas entails a drilling process known as hydraulic fracturing, or "fracking," which involves blasting through rock with a mix of water, sand and a chemical cocktail used to split the shale formation and free the trapped gas.

According to The Oil Drum, water needed for hydraulic fracturing and disposal of produced load water are becoming serious obstacles for Marcellus development. The problem with water sourcing is not availability but getting water management plans approved for the high-volume withdrawals (drilling requires about 100,000 gallons and completions use another 3 million to 4 million gallons). There are few waste treatment plants, and the cost of transporting disposal water from the well may add $250,000 to the cost (Tudor, Pickering and Holt, 2009). Also, there is a widespread belief that hydraulic fracturing will contaminate aquifers and that this is a risk that cannot be tolerated.

Here's an except from a USGS document entitled, "Water Resources and Natural Gas Production from the Marcellus Shale."

The Marcellus Shale is a sedimentary rock formation deposited over 350 million years ago in a shallow inland sea located in the eastern United States where the present-day Appalachian Mountains now stand (de Witt and others, 1993). This shale contains significant quantities of natural gas. New developments in drilling technology, along with higher wellhead prices, have made the Marcellus Shale an important natural gas resource.

The Marcellus Shale extends from southern New York across Pennsylvania, and into western Maryland, West Virginia, and eastern Ohio. The production of commercial quantities of gas from this shale requires large volumes of water to drill and hydraulically fracture the rock. This water must be recovered from the well and disposed of before the gas can flow. Concerns about the availability of water supplies needed for gas production, as well as questions about wastewater disposal, have been raised by water-resource agencies and citizens throughout the Marcellus Shale gas development region.

The Marcellus shale deposit that straddles the U.S.-Canadian border produced 200 million cubic feet of gas per day in July 2008. Two years later, 1.4 billion cubic feet a day were being pumped out. Gulf Coast shale deposits will generate 15 billion cubic feet a day in 2030.

***

According to a website devoted to an anti-fracking movie, Gasland, "For each frack, 80 to 300 tons of chemicals may be used. Presently, the natural gas industry does not have to disclose the chemicals used, but scientists have identified volatile organic compounds (VOCs) such as benzene, toluene, ethylbenzene and xylene." The film also suggests that explosive gases have entered private water wells, causing "flammable water." Here's a link to the FAQ at the film's website and here's a link to a long list of "Chemical Constituents in Additives/Chemicals" used in fracturing identified by the state of New York.

An oil and gas industry website, Energy in Depth, sees it another way and maintains that the typical solution used in hydraulic fracturing is 99.51 percent water and sand and only 0.49 percent additives. They tend to see the glass of (polluted?) water as half-full. The website casts doubts on many of Gasland's claims and asserts it is not a documentary but propaganda.