Startup Gridtest Systems' vehicle charging equipment test and measurement tools, said to be the first for the charging industry, can validate the network’s performance capabilities.

The CPUC-NRG money, a settlement stemming from the 2001 California energy crisis, will pay for a statewide infrastructure of at least 200 public fast-charging stations and another 10,000 plug-in units at 1,000 locations.

The Gridtest Systems tools will enable both the design and in-field testing of the compatibility between the growing array of charging stations and the expanding selection of BEVs.

The first $100 million of the payment from NRG Energy to the state settles claims against NRG’s predecessor Dynegy for March 2001 long-term power contracts it failed to fulfill. It will pay for fast-charging stations, plug-in units and electrical upgrades, at no cost to California's drivers or taxpayers. The infrastructure is expected to drive the state’s transition to BEVs.

The other $20 million from NRG Energy will go to electric utility ratepayer relief.

As the settlement was announced, Governor Brown’s office issued an executive order to drive the deployment of 1.5 million zero-emission vehicles (ZEVs) in California by 2025.

The executive order requires the California Air Resources Board (CARB), the California Energy Commission (CEC), the CPUC and “other relevant agencies” to work with the Plug-in Electric Vehicle Collaborative and the California Fuel Cell Partnership on four key points:

- All major California cities are to have the charging infrastructure to be BEV-ready by 2015

- The state is to have a charging infrastructure that can support one million zero-emission vehicles by 2020

- California is to have deployed 1.5 million zero-emission vehicles by 2025

- California’s personal transportation is to be essentially all-ZEV by 2050 so that greenhouse gas emissions from the state’s transportation sector are 80 percent below 1990 levels.

This effort in California joins efforts by imported oil-dependent states and nations from Hawaii to Ireland and Denmark to Taiwan to move electric transportation to mainstream markets. The demand for BEV charging systems is forecast by Pike Research to reach $4.3 billion per year by 2017.

Yet “charging today is like dial-up internet,” Gridtest Systems founder and CEO Neal Roche said. “The charging station is at the edge of the smart grid [... and] people are building more intelligence into it.” Eventually, he said, chargers will know the intricacies of electricity pricing, home network energy management and vehicle-to-grid power. They will handle billing and authentication for public sites. And they will charge faster.

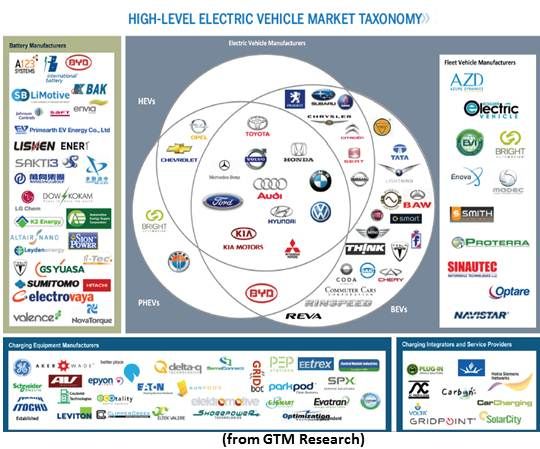

Roche worked for 20 years in the networking industry, working out IT interfaces. There are “75 to 100 companies building charging stations and about 60 different manufacturers building electric cars,” Roche noted, “and I see similar challenges in this electric-vehicle charging market that we had in the early days of networking.”

Roche was working at BEV and battery charging technology pioneer AeroVironment when he saw the interface challenge coming to vehicle charging.

“Everyone’s building charging stations,” Roche said, mentioning multinationals like ABB, Bosch, GE, Siemens, Schneider Electric, as well as small startups like Coulomb Technologies, ECOtality and Clipper Green.

GM has publicly specified “a list of compatibility problems that can prevent electric vehicles from charging” and called for “detailed testing of the compliance of charging stations” to the standard established by the Society of Automotive Engineers.

Roche specializes in the “protocol in the middle” when “two networks are talking to each other,” he explained. The Gridtest Systems tool, for which he projects a $300 million to $500 million market worldwide by 2017, will allow laboratory researchers who are building chargers and field technicians who are installing and repairing chargers to know whether the chargers are in compliance with established standards and therefore are safe for the BEVs to plug into.

“One set of companies builds the chargers and another set of companies builds the cars,” Roche said. “They all have to work together and we can test if the chargers are working correctly and if they are in compliance with the standard.”

“‘Are you ready to charge?’ is our slogan,” Roche said. “The last thing you want is to pull up at a charging station and it doesn’t work.”

Thanks to backing from two Los Angeles-based tech angel investors, Pasadena Angels and Tech Coast Angels, Gridtest Systems will roll out its first production-scale products this spring, a comprehensive $8,000 EVE-100L model designed for the extensive needs of laboratory testing and a $4,000 EVE-100J model aimed at the practical field needs of installer-maintenance workers.

Roche said he is actively seeking additional investors. Many, he said, are waiting for electric cars to become mainstream. “We’re at the front end,” he explained, of what will be “a huge infrastructure build-out.”

Roche is untroubled by the auto market’s so-far limited responses to GM’s Chevrolet Volt and Nissan LEAF. “They are teething problems,” he said. “This is a long-term play.” In the coming year or two, he added, Ford and Toyota and other name brands will come into the market. “The world is going to change.”