In a one-two punch that history may someday see as the first U.S. blows in a trade war with China, the Department of Commerce followed a final determination levying tariffs on Chinese solar panels last week with a similar preliminary determination in its May 30 response to claims brought against Chinese wind turbine tower manufacturers.

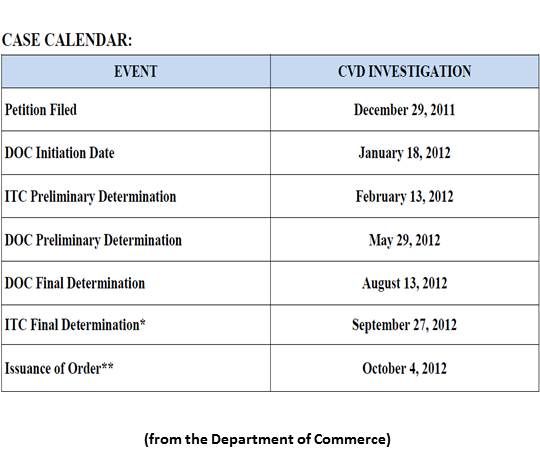

The U.S.-based Wind Tower Trade Coalition (WTTC) petitioned the U.S. Department of Commerce (DOC) and the International Trade Commission (ITC) at the end of 2011 to investigate countervailing duties allegations against Chinese tower makers and to investigate anti-dumping allegations against Chinese and Vietnamese tower makers.

“The Chinese government has targeted the clean energy industries -- a variety of clean energy industries -- with massive subsidies that have distorted the marketplace,” attorney Alan H. Price of WTTC counsel Wiley Rein LLP told GTM when the petitions against imported wind turbine towers were filed. Wiley Rein represented the coalition of solar panel manufacturers in the successful petition of the DOC that resulted in a 31 percent tariff being placed on imported Chinese solar panels.

The preliminary finding in favor of the WTTC “is undeniably a positive event,” said attorney and Wiley Rein Partner Dan Pickard. “This determination by the Department of Commerce is now going to trigger a deposit requirement for anybody importing wind towers from China.”

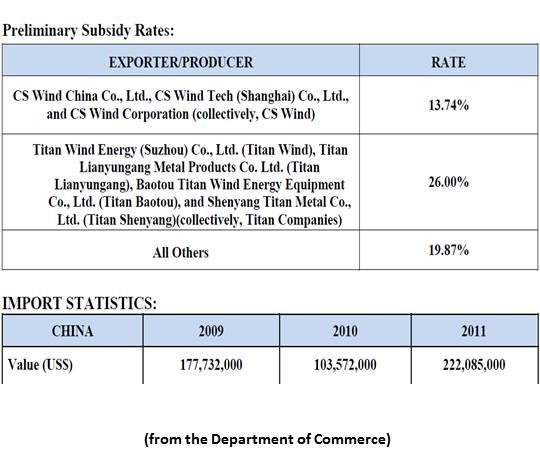

The deposits will, according to a DOC fact sheet, range from 13.74 percent to 26 percent, depending on the Chinese producer/exporter. The deposits must be paid in cash to U.S. Customs.

The DOC’s initial conclusion focuses narrowly on the allegation that China is benefiting from countervailing duties. But it bodes well for what DOC is likely to determine about the other allegations. “We are going to go on to a preliminary anti-dumping determination and there will be final anti-dumping and countervailing duty determinations,” Pickard said, “and that will all be concluded by a final determination by the International Trade Commission.”

The DOC is petitioned when trade practices, though not necessarily criminal, may violate international treaties or domestic laws written to protect domestic businesses and workers. The DOC decisions hinge, Pickard said, on “whether the unfairly priced imports injure the domestic industry.”

Countervailing duty cases, Pickard explained, “are meant to remedy the amount of improper subsidies that companies receive from their home governments. Anti-dumping investigations are meant to remedy products that are sold in the U.S. at below fair value.”

Below fair value, he added, “is generally defined to be prices below prices in the home market or below the cost of production. This case has both a countervailing duty allegation against China and anti-dumping allegations against China and Vietnam.”

Members of the Wind Tower Trade Coalition, which are widely estimated to constitute upwards of 90 percent of the U.S. tower manufacturing business, are Wisconsin-based Broadwind Towers, Inc., North Dakota-based DMI Industries, Nebraska-based Katana Summit LLC, and Texas-based Trinity Structural Towers, Inc. They referred inquiries about the DOC decision to Wiley Rein.

As a result of the DOC determination, China’s CS Wind will have the 13.74 percent deposit requirement. Titan Wind and the other Titan Companies face the 26.00 percent requirement. All other Chinese producers/exporters will be required to post a 19.87 percent deposit.

The WWTC petition applied only to utility-scale (greater than 100 kilowatts) towers on which a wind turbine’s nacelle and blade/rotor assembly are placed. Both the nacelle and the blade/rotor assembly, even if imported attached to a tower, are specifically excluded from the DOC determination.

The final DOC determination will come in August. The ITC is expected to make its final determinations on the anti-dumping allegations against China and Vietnam in September. If both line up with this preliminary finding, DOC may issue a final ruling, with tariffs, as early as October. Rulings, according to Pickard, stand for five years and can be renewed at five year intervals.

Vestas, the biggest turbine manufacturer in the world, has a tower manufacturing facility in Pueblo, Colorado, but was noticeably absent from the coalition petitioning the DOC. Industry insiders have speculated that Vestas sat out the fight because of its large stake and even larger ambitions in the Chinese domestic market.

An argument against such cases is that they unnecessarily inflame international players, only to result in circumvention of the imposed tariffs. Circumvention, Pickard explained, is “the criminal attempt to work around anti-dumping orders or countervailing duty orders.” But, he said, it is different “if it is a small commodity someone is attempting to trans-ship through a third country and fraudulently change the country of origin. It’s probably going to be more difficult with a 150-ton steel tower.”

Satisfaction in the wind industry at the DOC’s decision was compromised by continued refusal by Congress to extend the wind industry’s vital 2.2 cent per kilowatt-hour production tax credit (PTC).

“People aren’t going to build towers in the U.S., because without the PTC, nobody is going to put the farm up,” an independent tower maker not involved in the WTTC action confided to GTM. Orders, he said, have stopped coming into his shop. “It’s really great that they’ve put the tariff on to keep the Chinese and Vietnamese out of here, but unfortunately there probably isn’t going to be much of a wind business in the United States until the PTC passes.”