Yesterday, the Minnesota Public Utilities Commission reviewed a host of questions about the fate of Xcel Energy’s community solar market. Most importantly, the PUC aimed to provide clarity on the eligibility of co-located community solar gardens, which are large scale projects segmented into 1 megawatt (ac) parcels in order to align with program rules. These projects account for well over three quarters of the state’s community solar pipeline.

So what happened? (Drumroll, please.)

The PUC voted in favor of a partial settlement agreement between Xcel Energy and select developers, which sets a 5-megawatt (ac) system size cap on co-located solar gardens.

There are a host of other questions that still need to be addressed. But this decision is unequivocally a major win for Minnesota’s community solar growth potential.

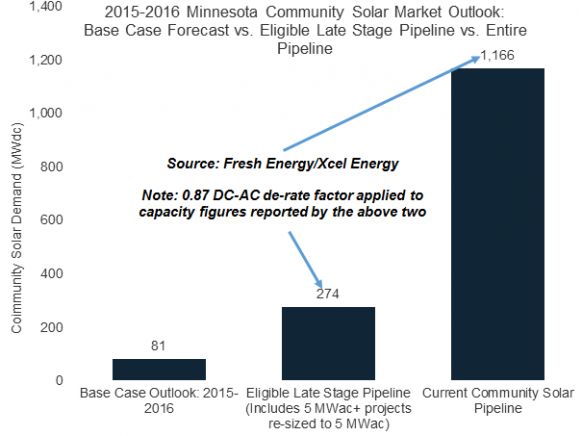

In GTM Research’s recently released U.S. Community Solar Outlook 2015-2020, we forecast that approximately 81 megawatts (DC) of community solar will come on-line in Minnesota between 2015 and 2016. This remains a relatively conservative view on the near term growth trajectory of community solar in Minnesota, considering the massive pipeline in development (see below). As described in greater detail throughout the report, the disconnect between our outlook and the actual pipeline primarily boils down to this longstanding uncertainty surrounding what would happen to co-located solar gardens.

And so now SunShare, SunEdison, SolarCity, and the rest of Minnesota’s developers know that 5 megawatts (AC) is the new system-size cap. But there a number of other questions that will determine just how conservative our base-case outlook is compared to the pipeline of projects in development.

The variance between GTM Research’s base-case community solar outlook and the state’s current pipeline is staggeringly large -- we’re talking gigawatt-plus large. But even with what we currently know, there is little to no chance 1,166 megawatts (DC) of community solar comes on-line in Minnesota by the end of 2016. Why?

A number of legal battles are set to unfold in response to today’s decision, and a number of less contentious, but time-intensive, program administration questions still need to be resolved. Most notably, expect future debates surrounding the eligibility of future co-located solar gardens submitted into Xcel Energy’s queue, the future implementation of a value-of-solar tariff, and proposals to revisit the PUC’s vote in favor of a 5-megawatt (AC) system size cap.

So how much community solar in Minnesota will actually come on-line in 2015 and 2016? That answer depends on two key questions.

The first question has to do with the fact that developers are now incentivized to sell off surplus portions of co-located solar gardens greater than 5 megawatts (AC) in size to other developers, in order to realize some profit from these stranded assets.

With that taken into account, here’s the first question:

Will community solar developers with projects greater than 5 megawatts actually be allowed to sell off 5-megawatt parcels to competitors and still have those secondhand projects qualify as community solar?

The second question is:

How much of the 500+ megawatts of early-stage community solar pipeline, which has not yet been fully reviewed by Xcel Energy, falls under the 5-megawatt system size cap?

The first question will most likely be settled by the Minnesota Department of Commerce, rather than the PUC, while Xcel Energy will shed light on the ongoing status of early-stage projects. Regardless, answers to these questions will determine whether Minnesota is a double-digit- or triple-digit-megawatt opportunity for community solar in 2015 and 2016.

Equally important, an elephant in the room loomed over the expedited decision-making process by the PUC: the federal ITC’s drop off from 30 percent to 10 percent at the end of 2016.

With a closing window of opportunity for community solar to capture 30 percent federal ITC benefits, the PUC made a decision on the fate of community solar with arguably less than 100 percent certainty about what a 5 MWac system size cap means for Minnesota’s community solar growth, and what impacts that growth will have for ratepayers. In spite of that uncertainty, the PUC made a bold and important decision to provide a baseline level of market clarity through its vote to establish a 5 MWac system size cap for co-located solar gardens. This decision is poised to make Minnesota’s community solar market one of the hottest solar growth opportunities in the U.S. over the next 18 months, and one GTM Research is watching closely as future decisions come to light.

***

Learn more about GTM Research's new report on community solar here.