Venture capital firm Lux Capital just announced an oversubscribed closing of its third fund with commitments totaling $245 million.

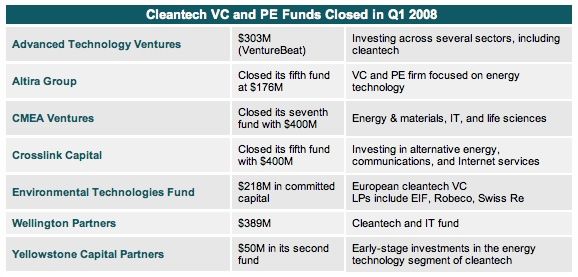

It's one of the few, perhaps only, cleantech-related VC fund closings we've seen this year. As a comparison, I dug out the details of the $2 billion in VC fund raising in cleantech in Q1 2008, five years ago:

Most of the recent cleantech VC news has been about investment firms pulling back their cleantech practices -- firms like Mohr Davidow, VantagePoint, Battery Ventures, and Globespan.

But Lux has a willingness to make contrarian investments -- a strategy supported by the fund's Limited Partners -- though the Lux cleantech portfolio is notable for its lack of solar or battery or biofuel firms.

Lux's energy-related portfolio companies does include:

Gridco Systems is developing digital power electronics in the world of solid-state transformers, grid power routers, digitally identifiable energy flows, and other next-generation power equipment. The firm has funding from Lux, Naimish Patel, North Bridge, and General Catalyst Partners. Michael Rigney, Gridco’s VP of business development, said at a GTM event last year that Gridco’s goal is “the precise control of power flows in the distribution system."

Kurion is a startup innovator in nuclear waste treatment and has already participated in helping clean up Japan's nuclear mess at Fukushima. The disastrous event in Japan accelerated Kurion's development as a company and player in the nuclear industry, with Kurion serving as the only startup in a big-time multinational consortium treating the contaminated seawater at the nuclear plant operated by Tokyo Electric Power (TEPCO). Kurion is now in a partnership with Pacific Northwest National Laboratory (PNNL) to test and demonstrate its Modular Vitrification System (MVS). In the words of CEO John Raymont, Kurion’s goal is to "help nuclear live up to its green potential." Kurion was incubated by Lux Capital with investment from Firelake Capital and private investor Arthur Samberg.

Transphorm of Goleta, California is innovating in electric power conversion with a recent $35 million round from Lux, Innovation Network Corporation of Japan (INCJ) and Japan's NIEC, a manufacturer of power management semiconductors, Quantum Strategic Partners, an investment fund managed by Soros Fund Management, Kleiner Perkins Caufield & Byers, Google Ventures, and Foundation Capital. Transphorm is building an energy-efficient gallium nitride (GaN) power conversion module and claims its power modules can eliminate up to 90 percent of all electric conversion losses. Transphorm looks to address power conversion in servers, motor drives, power supplies and inverters for solar panels and electric vehicles.

“Many of the themes and entrepreneurs we’re excited about -- in 3-D printing, metamaterials, robotics and breakthroughs in solid-state electronics -- are non-obvious, and that’s by design," said Lux Capital Co-Founder and Managing Partner Josh Wolfe in a statement.

Peter Hebert, Managing Partner at Lux Capital agreed in a phone call that the firm was "a little bit different," but that came from being "disciplined and selective" about its investments. "Lux remains committed to energy," said Hebert, adding, "We continue to believe in this space."

Hebert was emphatic when he said, "We are looking for entrepreneurs."