Photo: Jason Henry/The New York Times/Redux

Hundreds of venture capital firms invested tens of billions of dollars in cleantech over the last decade. But only a few VCs have made venture returns or built lasting companies in the process. We're speaking with the surviving and thriving cleantech VCs in a new GTM Squared column called "Letters from Sand Hill Road."

In this month's installment, Nancy Pfund of DBL Partners talks about what she's doing to change the role of women in venture, as well as how her firm has deployed capital to scale fast-growth businesses in billion-dollar energy sectors while still meeting both of DBL's bottom lines.

(DBL is located in San Francisco, and like our last VC interview, is not anywhere close to Sand Hill Road.)

***

Unlike other badass VC investors, Nancy Pfund of DBL Partners is a bit of a fixture on the alternative-energy speaking circuit.

And if you watch closely at these or other events, there is usually another woman executive in Pfund's orbit. It might be the CEO whose startup she's funded, or a principal at her investment firm. Is Pfund mentoring women, young and otherwise, to take on these roles?

"Yes, of course. If I don't, who is going to do it?" said Pfund, who is not willing to wait another generation for millennial women to become partners at VC firms and CEOs of startups.

She noted, "Last week, I did 'Women in Power.' The week before was C3E (PDF)," adding, "I think of our nine most recent investments, five of [the CEOs] are women. I just feel it makes good business sense."

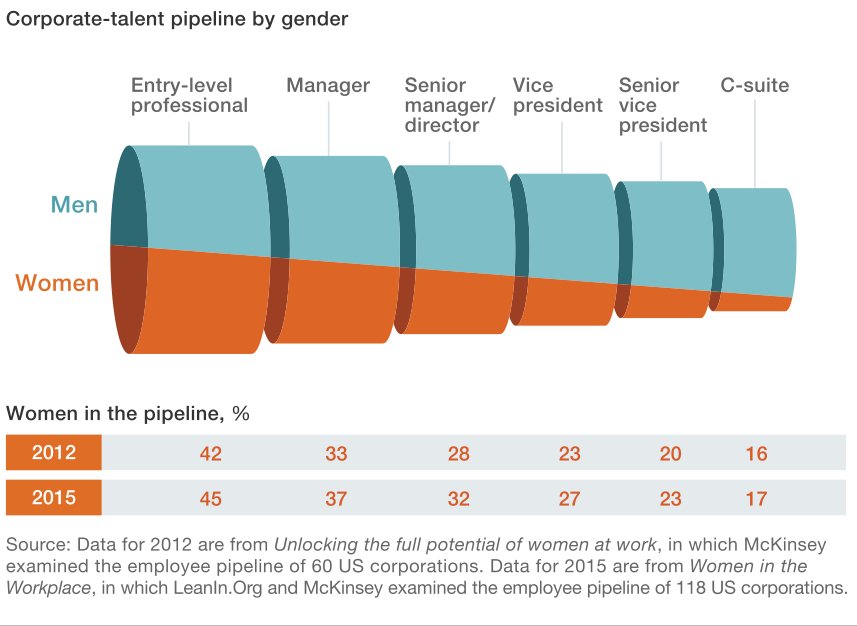

A new study by the McKinsey Global Institute finds that gender equality "still eludes companies around the globe. Despite modest improvements in the past few years, women are underrepresented at every level in the corporate pipeline -- especially the senior level."

The reports suggests that the world economy "could add trillions of dollars in growth during the next 10 years if countries met best-in-region scores for improving women’s participation in the labor force."

Forget about the 100-year fossil-fuel industry incumbency, Pfund is looking to disrupt the incumbency of the patriarchy.

"I don't mean to sound like a Pollyanna, because I really am not. But there is so much happening. Everyone is aware of it. Here's a small example: If there's a conference, I get an email that there are no women on this panel. That's why I'm optimistic -- because it's the right thing to do. If each of us will spend a little bit of time helping younger women make their mark, that's worth a lot. I think it will be exponential."

As for high-profile failures or scandals at women-run firms, Pfund said, "Don't you think there is going to be a distribution just like there is in regular venture capital? They are going to be below the mean, above the mean, and the mean. The fact that we are seeing more women fail is simply [because] we're seeing more women try. Our job is to pick them up and get them back to work."

The home-energy riddle

"We haven't done a lot of home-efficiency investments," said Pfund. "I don't think we've created robust enough information for people. I think the technology is now there to make it more useful to people -- but it isn't just going to be energy-related. It's going to be convenience, it's going to be security, it's going to be comfort. That's what we all spend time thinking about in our homes. You have to kind of glom onto an energy-efficiency or an electricity-related purpose to things that we actually care about."

She adds, "Nest is a good example of that. You put more functionality in some of these home devices so that the consumer can make his or her own decisions. I'm not sure the utility needs to be in all of that."

Things get more interesting when you can start to disaggregate energy use by device. Pfund sees a scenario where a message is sent: "The TV just went on in your home." And that means, "Oh, my kid is home." Pfund called that "a useful piece of information" impacting home security, energy (and parenting).

Her firm has looked at the many firms attempting to perform disaggregation, "but it's not an easy thing to do. I think it's super exciting, but it's not at all ready for prime time. We haven't made a bet yet."

Bigger and bolder than any of us thought

In looking back at her expectations for the market 10 years ago versus where we are today, Pfund said, "It turns out it was bigger and bolder than any of us thought."

"I don't think we realized that there would be the level of opposition, or that there would be this much upside: A company like SolarCity with 15,000 employees going toward installing 900-plus megawatts this year from zero seven years ago."

"I continue to be optimistic, because when I talk to students and younger people, they all want to do this. It's just that when there are incumbents...that aren't competitive by nature [and are] regulated entities, and they've been around for 100 years -- it's not going to happen without being messy. There will be an evolution, and I think we're well on our way toward seeing how we're going to coexist and have each group play an appropriate role. We're not quite there yet."

The new $400 million fund and the DBL portfolio

Earlier this year, we reported that DBL Investors was looking to raise $300 million for its third fund, according to an SEC filing. The filing listed Ira Ehrenpreis as a partner in the firm. At the time, Ehrenpreis was still listed as head of the cleantech practice at Technology Partners. In June, DBL announced the close of a $400 million impact fund focused on investments "that combine value and values." The fund looks to make "investments with positive social, environmental or regional economic impact without compromising financial returns."

The new fund combines partners from the energy practices of DBL Partners and Technology Partners.

Ehrenpreis and Pfund share a common investment edge: Elon Musk, the CEO of Technology Partners' investment Tesla and chairman of DBL's investment SolarCity. Both investors have maintained their board seats with those winning firms.

“The size of this fund puts impact investing squarely in the mainstream, and the sustainability focus included in its mandate puts to rest any concerns that the time for clean energy investing has passed,” said Pfund.

Cleantech exits for the DBL team include SolarCity and Tesla by IPO, and NEXTracker, PowerLight and eMeter by acquisition. The portfolio also has its share of long-in-the-tooth startup misfits such as BSE, Imergy, Siva and Ogin, as well as early-stage firms with great promise such as AMS. Here's the current portfolio.

Advanced Microgrid Solutions: AMS describes its offering as a hybrid-electric building project, which will provide grid support to utilities. Susan Kennedy, CEO and co-founder of AMS, said, “Equipping a building with the technology to store and manage its own electricity turns that building into a standalone storage unit,” adding, “Combine a dozen buildings into a fleet, and you have the utility equivalent of a peaker plant.”

BrightSource Energy: BrightSource's 392-megawatt Ivanpah installation, the world’s biggest concentrating solar power tower project, went on-line in 2014. Investors include VantagePoint, DBL Ventures, DFJ, Alstom, NRG Energy, Bechtel and Google.

CSP technology has the potential to achieve massive scale at low cost, but it has faced environmental headwinds, as well as permitting, cost and financing challenges. In 2012, BrightSource had to pull its IPO registration statement with the SEC.

As GTM's Stephen Lacey has reported, there are now 1,685 megawatts of CSP plants in operation in the U.S., the result of a boomlet supported by the DOE over the last eight years. But little new business is foreseeable in the U.S., so BrightSource and the industry are looking at international markets. BrightSource is bidding on two projects in South Africa and partnering with Shanghai Electric to build a series of projects in China.

Pfund adds, "BrightSource is finding very strong reception overseas in the international market. No one ever predicted that. You have to pivot, everyone pivots, and if you don't -- if you're not nimble -- you won't survive. I do believe that large scale is still important. It's just not important in most of the United States. It's going to be important in other areas."

"People don't like transmission. They don't like disturbing public lands. What I didn't anticipate is that people would be so laser-focused on that. Especially when fracking is going on, or nuclear power plants are having their issues in Japan."

"The BrightSource story is not over. It's not a success. It's not a failure yet. In venture lifetimes, they are living to fight another day. It's a very international story. There are other governments and other insolation areas on the planet that are more amendable to that system. Even though BrightSource hasn't been an economic success, it's an historic step in the right direction. There are a lot of ways to make money in this world. We chose this not just because we think we can make our investors great returns. We have done that. We want to change the world for the better. Not every company is going to be a Tesla."

EMeter: Late in 2011, Siemens acquired eMeter, a meter data analytics startup that had raised a total of $70 million from DBL, Foundation Capital, Sequoia Capital, Siemens and Northgate Capital. The sale price was never disclosed.

Imergy, the former Deeya, has raised more than $100 million from Technology Partners, NEA, DFJ, BlueRun Ventures and SunEdison. The company pivoted from its original iron-chromium flow battery chemistry to a vanadium electrolyte in 2013. Jack Stark, Imergy’s CFO, told GTM, "If there's a need for discharge duration in excess of two hours or for a relatively fast charge or multiple cycles, no other battery can do those things well, and it's in those markets that we will thrive."

Imergy looks to build its 5-kilowatt/30-kilowatt-hour battery for cellular towers and remote applications. Larger formats are being designed, including a 30-kilowatt/120-kilowatt-hour containerized system for microgrids or building backup power. Imergy is aiming to deliver its flow batteries at $500 per kilowatt-hour with its current systems, and eventually to drop that to $300 per kilowatt-hour by using recycled vanadium for its electrolyte, according to the company. Imergy has around 160 units in the field.

NEXTracker: NEXTracker, a designer and builder of single-axis PV trackers, got bought by Flextronics in October for $330 million, including an $85 million earnout.

That was CEO Dan Shugar's second major solar acquisition. He helmed PowerLight when it sold to SunPower in the early days of solar. Pfund, an investor in NEXTracker at DBL Partners, was also an investor in PowerLight when she worked at JPMorgan. Last year, NEXTracker announced a $25 million B round led by new investor SJF Ventures, along with Tennenbaum Capital Partners and existing investors Sigma Partners and DBL Partners.NEXTracker CEO Shugar left the CEO position at Solaria to spin out the tracker firm in 2013 after a year of incubation within the PV module-maker. Shugar told GTM in a previous interview, "I don't know anyone who has ramped a company as fast as we have." Shugar just told us, "We delivered about 275 megawatts in 2014...but this year will be north of 2 gigawatts." He said that production capacity is being ramped to over 500 megawatts per month. Shugar rattled off the advantages of his firm's design: maintenance costs are lower, it's easier to clean, it can be driven through, grading requirements are decreased -- but the most prominent edge that NEXTracker has is this: "We [need] less steel, and at the end of the day, we win on less steel."

Pfund, a board member at NEXTracker, told GTM, “As we’ve seen over the past year or two, solar hardware is having an investment moment. Any companies that drive down costs and/or increase performance (think Zep and Silevo) are in a position to be attractive as the industry grows and industry players look for ways to increase system profitability. NEXTracker fits squarely in this space, as tracking systems can boost the economics of ground-mount solar farms in a significant way."

Off-Grid Electric closed a Series C investment worth $25 million to expand its micro-solar leasing platform in Africa, as reported last month by GTM's Katie Tweed. DBL Partners led and provided the majority of the funding, which also included Western Technology Investment and previous investors SolarCity, Omidyar Network, Serious Change LP, and Vulcan Capital. Off-Grid raised $23 million in 2014.

The funds will be used to help the company enter its second African market, Rwanda, and to continue to scale up its partnership with the Tanzanian government to power 1 million homes by 2017.

“Our real intention is to light considerable parts of countries here. We want to provide an electrification solution that’s different and much more cost-effective [than the grid],” said Xavier Helgesen, co-founder and CEO of Off-Grid Electric.Pfund will join Off-Grid Electric as chair of the board. The investment is DBL’s first overseas, but a natural fit given that Pfund is a longtime investor in and board member of SolarCity.

Off-Grid Electric uses a mobile-payment platform to allow customers to purchase energy in small amounts, essentially a micro-solar leasing model.

Ogin: The former FloDesign Wind Turbines has taken more than $100 million from KP, Goldman Sachs, Technology Partners, TriplePoint Capital, New Zealand Superannuation Fund, Bright Capital, DBL Partners and Gentry Venture Partners to develop a shroud-design, midscale 100-kilowatt wind turbine that claims to boost energy output per kilowatt of rated capacity by 50 percent, "while peak energy output from the compact rotor is increased by up to three times per unit of swept area."

Primus has raised more than $60 million from Anglo American Platinum, Chrysalix Energy, DBL Partners, I2BF Global Ventures, KPCB, DOE, ARPA-E and the CEC.

Samruk-Energy, the electric utility owned by Kazakhstan’s sovereign wealth fund, has announced its intention to buy 25-megawatts/100-megawatt-hours' worth of Primus’ zinc-bromide-based, single-tank energy storage systems, or 1,250 units in all, to help it meet its “very significant renewable energy plans,” CEO Tom Stepien said.

Primus uses a single-loop flow battery design, plating zinc on titanium-based electrodes to perform the key energy exchange function, rather than running electrolyte through membranes, as most other flow batteries do. With “other flow batteries, eventually you have to replace the stack,” he said. “Over a 25-year horizon, we win -- we don’t have to replace the membranes.” That brings down the levelized cost of energy for its systems, a critical step for batteries meant to stand for decades alongside grid infrastructure, solar arrays and wind farms.

Primus looks to ship its first batteries to Kazakhstan by the end of this year or early 2016.

Siva Power: CEO Brad Mattson and CTO Markus Beck of Siva Power are focused on developing the world's largest-scale and least-expensive thin-film CIGS production line. The company landed $10 million in new funding earlier this year, which includes a $3 million DOE SunShot grant, a $3 million conversion of debt financing from Trident Capital, DBL Partners, Medley Partners and Acero Capital, as well as $4 million in new capital from the city of Wuxi, China and existing investors DBL and Medley.

According to Siva's CEO Brad Mattson, this capital will allow the company to begin building "the world’s highest-capacity co-evaporation source" and start narrowing down potential sites for its envisioned 300-megawatt factory. California is on the short list.

Most VCs wouldn't take a meeting with a thin-film solar company. This small round of funding proves that there are still a few contrarian investors -- and certainly some solar entrepreneurs -- with an appetite for risk.

Solexel, one of the few remaining standalone solar silicon startups, recently completed a long-in-the-making $70 million round of funding and added Riyadh Valley Company, the VC investment arm of King Saud University of Saudi Arabia, to its list of investors, which also includes GAF, SunPower, KPCB, Technology Partners, DAG Ventures, Gentry Ventures, Northgate Capital, GSV Capital, Jasper Ridge Partners, and Spirox.

The startup hit an NREL-certified cell efficiency of 21.2 percent in 2014 with its back contact cell and looks to produce PV modules at 20 percent efficiency. As we reported previously, Solexel is seeking to partner in Malaysia to build the modules and cells, hoping to mass-produce 35-micron-thick, high-performance, low-cost monocrystalline solar cells using a lift-off technology based on a reusable template and a porous silicon substrate.

View: View has raised more than $500 million since its inception as Soladigm seven years ago from investors including Corning, Madrone Capital Partners, Khosla Ventures, General Electric, Reinet Investments, NanoDimension, DBL Partners, Navitas Capital, Sigma Partners and The Westly Group.

As GTM has reported, View’s dynamic glass uses electrochromic technology and changes through four different tints to save energy and improve use of light in commercial buildings. The windows are coated with metal oxides, which activate the tint when charged with a small amount of voltage. By reducing the heat and glare that’s allowed into a building, the company says it can cut HVAC and lighting consumption by up to 20 percent and HVAC peak load by 25 percent.

Brandon Tinianov, senior director of business development, emphasizes that the 200 projects that View has installed already make financial sense, in addition to the comfort, recruiting, and health benefits provided by the adaptive building envelope. Standard curtain wall costs roughly $100 per square foot, while curtain wall that includes electrochromic glass can cost up to $140 per square foot, according to Tinianov. But the payback math requires a more holistic approach, "not just a bunch of 5 percent solutions." Projects have to make financial sense and take into account HVAC, blinds and operations and maintenance.