Solar firms have been streaming into the small but rapidly growing Latin American PV market looking to diversify portfolios, hedge risk and take advantage of the region's high insolation. According to this quarter’s Latin America PV Playbook from GTM Research, the region will install 805 megawatts in 2014 and 2.3 gigawatts in 2015.

With more than 22 gigawatts' worth of projects in Latin America's growing pipeline, the market is full of opportunity. In the past quarter alone, 2.9 gigawatts of projects were announced, 224 megawatts of contracts were secured and an additional 87 megawatts of PV went into construction.

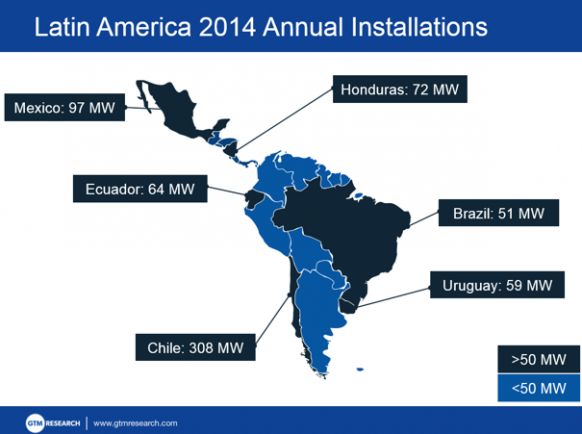

Source: GTM Research's Latin America PV Playbook

Chile currently leads the region, with an anticipated 308 megawatts of PV slated to come on-line by the end of the year. The country is home to some of the largest utility-scale projects in the region and has nearly a gigawatt of projects under construction. The report cites SunEdison as the leading developer in the country and labels Enel Green Power as the “developer to watch,” with 169 megawatts under construction in Chile.

In Mexico, this past quarter’s energy reform legislation has created a competitive wholesale market for solar energy. According to the report, "the new framework provides for issuance and trading of Clean Energy Certificates to ensure power suppliers and qualified consumers meet the mandate for 35 percent of generation in 2024 to come from clean energy. In addition to the opening of a bilateral market, the legislation also provides for building transmission from high insolation areas in the north to high population areas in the south."

"Passage of the historic energy reform legislation will have a transformative effect on the Mexican electricity market, and could be a huge boon for the solar industry,” said GTM Research solar analyst Adam James. "While our forecast for 2014 is 97 megawatts, the change in fundamentals from energy reform has improved the long-term outlook for solar, and we expect 3.2 gigawatts to be installed out to 2018."

The creation of a competitive wholesale market for generation, which includes a bilateral market, issuance of certificates to ensure the country meets its aggressive clean energy target, and building transmission from the high-insolation northern states to the more heavily populated southern states, will boost Mexico's prospects, said James.

Brazil added solar energy to an upcoming power auction in which it will compete against other power sources to supply the nation's reserve margin. The auction will "spur demand" for utility-scale solar construction through 2017. Brazil is expected to install 51 megawatts of PV this year and 110 megawatts in 2015.

The GTM Research report forecasts Honduras to install 72 megawatts this year and 225 megawatts in 2015. Other markets that will help drive Latin American PV growth through 2015 and beyond include Uruguay and Ecuador.

***

Learn more about the Latin America PV Playbook here.