Sonnenbatterie has sold more than 4,000 battery systems across Europe, recently opened a California office, and just raised almost $10 million to grow production for the residential and commercial energy storage startup.

The firm collected $9.4 million, led by Munich Venture Partners, a cleantech VC specialist, and Chrysalix SET, an Amsterdam-based management firm, along with previous investor eCAPITAL, a Münster-based VC firm.

Sonnenbatterie knows how to build and sell battery-based storage for the EU. But will the product and its value proposition translate to American needs? Is this the right market timing to scale a residential battery business like the business at Outback Power? Does the storage system business need a financing piece, as offered by Stem, Coda and Green Charge?

We spoke with the Germany-based software company and hardware integrator earlier this year.

CEO Christoph Ostermann said that German residential customers are fed up with high electricity prices and want independence from the utility. In the U.S., the motivation often seems to be the desire for backup power for when the grid goes down or during natural disasters, as well as a hedge against utility pricing. As GTM has reported, because the typical German home uses less electricity than the typical U.S. home, 4.5 kilowatt-hours' worth of battery power is enough to keep the electricity running all night long. That’s important for a customer aiming for energy independence as an end goal, as opposed to those sizing their battery systems for backup power when the grid fails.

The German startup, founded in 2008, has built a software platform to integrate solar panels, lithium-ion batteries and home energy management systems into an "intelligent" system. These systems range in price from about $13,000 for a 4.5-kilowatt-hour storage system to about $21,000 for a 10-kilowatt-hour system, according to the CEO. The company offers modular systems sized up to 60 kilowatt-hours.

Ostermann said, "Our business plan is not based on some magic reduction of the lithium-ion battery price." The company has stressed safety in battery chemistry and has settled on a lithium-ion phosphate chemistry, sacrificing the energy density of other lithium-ion formulations.

The CEO claimed that the firm was profitable when we spoke with him earlier this year.

Residential and commercial battery storage is still expensive and unproven. Companies such as Coda, Green Charge, Stem and SolarCity (using Tesla's batteries) have started financing energy storage via the same lease and third-party ownership structure that has ignited the residential solar industry, removing the technology risk for the customer.

In February, Green Charge and partner TIP Capital announced a $10 million fund to support new projects. Then, in July, Green Charge Networks brought in $56 million from K Road DG to expand its energy storage program; the company claimed this was “the largest amount of capital raised by any company in the intelligent energy storage space" at the time. That was until Stem banked $100 million for its no-money-down storage.

So the race in the storage industry might not just be about hardware and software, but rather about scaling, financing and cost reduction in the same vein as what SolarCity has accomplished.

And that will require a lot more than $10 million.

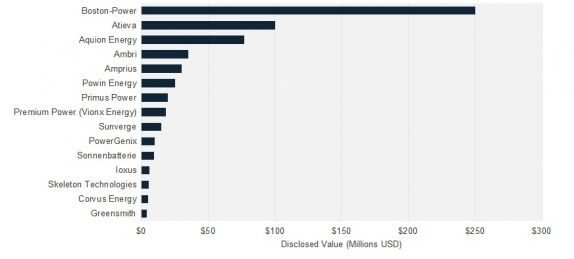

Source: GTM Research

GTM Research has compiled the top fifteen energy storage VC fundings in 2014, and despite word of a purported bubble, the $600 million total (with the largest round going to the as-yet-unproven Boston-Power) does not appear to reveal very much VC momentum.