We've been keeping a tally of recent record-setting solar cell and module achievements and are now adding Heliatek's record for organic solar cells. It's a champion cell on a small area, but it has achieved 10.7 percent efficiency.

The question remains: can organic solar cell technology be successfully commercialized in an unforgiving solar market dominated by crystalline silicon and First Solar? Heliatek of Dresden, Germany thinks so.

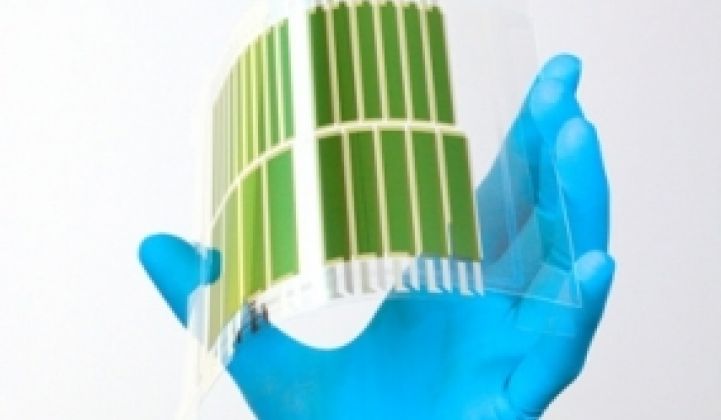

The efficiency value for the 10.7 percent champion cell would be about 9.0 percent when deposited on a flexible substrate.

Organic solar cells (OSCs) are sometimes referred to as third-generation solar technology, after crystalline silicon and thin-film solar technology. OSCs can be divided into two categories: polymer-based (large molecules) and oligomer-based (small molecules).

Heliatek uses vacuum deposition of very homogenous layers of small molecule oligomers at low temperature. It's a process that doesn't use solvents as in a printing process, and it's that process that "separates us from the other guys," according to Heliatek's CEO, Thibaud Le Séguillon, who suggests that the firm's technology can be thought of as an OLED in reverse. Heliatek itself is developing the organic materials used in the process. The firm claims to use just one gram of organic material per square meter in its roll-to-roll process.

Back in late 2009, Heliatek raised $27 million to build its first factory from venture capital investors Wellington Partners, RWE Innogy Ventures, and BASF Venture Capital, as well as industrial giant Bosch. The firm was founded in 2006 as a spinoff of the Universities of Dresden and Ulm. It is looking to raise a larger round this year.

Organic solar cells (OSCs) are lightweight, nontoxic, and semi-transparent. They hold the promise of low-cost manufacturing, but their efficiencies tend to be very low -- until now, at least. And their long-term reliability has been called into question. In 2009, GTM Research estimated worldwide capacity of OSCs to be just 5 megawatts.

Organic Solar Cell Competitors

Other organic and dye-sensitized solar cell (DSSC) developers and aspirants include Konarka (printing large molecule polymers), Dyesol, Solarmer, Plextronics, EPFL, Mitsubishi, Peccell, and G24i.

Konarka's main business for the last decade or so has been raising funding -- they have raised over $150 million so far with little to show in terms of true commercial product. Dyesol, a publicly traded firm, builds equipment to manufacture DSSCs; however, the firm's primary product appears to be press releases.

Recently, Eight19 Limited raised $7 million from the Carbon Trust and Rhodia to develop plastic organic solar cells. (The "Eight19" refers either to the time it takes sunlight to reach the earth or the price per watt.) Ireland's SolarPrint has eliminated the liquid part of DSSC and replaced it with nanomaterials and printing. This means that all of the active elements of SolarPrint's cells are applied through printing. Even Intel has done some research into OSCs.

Heliatek is focused on the promised-land market of building-integrated photovoltaics (BIPV). This includes windows and facades, as well as concrete and other building materials. When it comes to BIPV, this author shares the opinion that Gandhi had of Western civilization: I think it would be a good idea. There is no real BIPV market today in the true sense of BIPV. (See The Realities of Building Integrated PV.)

Performance records are occurring across the board in every photovoltaic materials system, from CdTe (First Solar and Abound) to CIGS (MiaSolé) to CIS (Solar Frontier) to GaAs (Alta Devices) to triple-junction CPV cells (Solar Junction and Semprius) to crystalline silicon (SunPower and Suntech).

Some of the following milestones represent 'hero experiments,' but nevertheless -- the numbers keep rising. Here are some recent announcements of record-setting results:

SoloPower raised the bar a little higher for the CIGS startup building flexible solar panels in a roll-to-roll electroplating process. SoloPower now boasts an NREL-measured aperture area efficiency of 13.4 percent. Module efficiency is significantly less than that. The value proposition for flexible modules from SoloPower and others is that there is less hardware required to install and the installation is easier. This thesis has yet to be proven in volume and scale.

Suntech's (NYSE: STP) Pluto cell technology achieved a 20.3 percent efficiency for a production cell using commercial-grade p-type silicon wafers. Pluto technology is a combination of different elements which combine to improve cell efficiency, with 21 percent efficiency targeted within the next year. These incremental improvements include surface patterning, improved metallization, improved front metal contact dimensions, changes in dopant concentration at the emitter, and improved high-temperature performance. None of these processes come cheap. Plus, the new product has not exactly replaced Suntech's existing lines -- it appears to remain a premium product that is offered at premium prices.

Solar Frontier is number two in thin-film solar and number one in the CIGS/CIS race with 400 megawatts shipped in 2010. The firm just racked up a 17.8 percent aperture area efficiency on a 30-centimeter-square CIS-based PV lab module. The result was claimed to come on a "fully integrated submodule" performed with processes "very similar to what is in place" in Solar Frontier's factories at commercial production scale, according to a release from the firm. The Japanese firm's Kunitomi factory recently built a champion module at 14.5 percent aperture efficiency, equivalent to a 13.3 percent module efficiency.

First Solar (NASDAQ: FSLR) hit a new world record for CdTe PV module efficiency with a 14.4 percent total area efficiency in January. That mark comes six months after First Solar hit a CdTe solar cell efficiency of 17.3 percent. Both records were set at the firm's Perrysburg, Ohio factory.

Alta Devices' most recent gallium arsenide (GaAs)-based solar panel boasts a 23.5 percent efficiency, as verified by the National Renewable Energy Laboratory (NREL). The firm claims that "this is the highest solar panel efficiency yet achieved." The press release did not discuss the size of the panel and the company has not yet responded to our inquiry.

Alta Devices has won more than $120 million in venture funding from August Capital, Kleiner Perkins Caufield and Byers, Crosslink Capital, DAG Ventures, NEA, Presidio Ventures, Technology Partners, Dow Chemical, AIMCo, Good Energies, Energy Technology Ventures, and Constellation Energy. The firm is still in the pilot manufacturing phase. Chris Norris, the CEO of Alta, has said that the company's goal is to "compete with fossil fuels without government subsidies" and get to a levelized cost of energy of $0.06 to $0.07 per kilowatt-hour. The epitaxial lift-off technique pioneered by Alta founder Eli Yablonovitch allows the firm to produce layers of GaAs that are flexible and measure only one micron in thickness.

SunPower has been the heavyweight champion of the world when it comes to commercialized cell and module efficiencies for the last half-decade -- and by a significant measure. The company's back-contact crystalline silicon cell design, in commercial production since 2005, moves the metal contacts to the back of the wafer, maximizes the working cell area, and eliminates redundant wires. SunPower has been able to achieve consistent improvements in efficiency with each successive generation of commercialized cells, and this has translated to gains in the module arena, as well. The firm's Gen 3 cells have efficiencies in excess of 23 percent.

MiaSolé, a CIGS thin-film PV manufacturing startup, placed third in CIGS panel production in 2011, behind Solar Frontier (at 400 megawatts) and Solibro (at 66 megawatts), according to GTM Research. The firm just announced a 17.3-percent-efficient champion device, while the "manufacturing process for 14 percent efficiency is now in production." The firm recently made a rare presentation in Palo Alto, California to the Silicon Valley IEEE PV Chapter.

Solar Junction, a developer of multi-junction cells for high-concentration photovoltaic (HCPV) applications, is working with Semprius and has inked an agreement to deliver multi-megawatts of epitaxial wafers. Semprius claims to have set the world-record CPV solar module efficiency using Solar Junction's III-V multi-junction solar cells based on lattice-matched dilute nitrides. The firm recorded a module efficiency of 33.9 percent.

Abound Solar, a manufacturer of cadmium telluride PV modules, announced the production of 82.8-watt modules at its Longmont, Colorado factory, representing a 12.2 percent aperture efficiency that is now being verified by NREL. The units were produced on "existing production equipment," according to the firm's press release. The startup looks to begin mass production of 82-watt modules in the second half of 2012. Abound claims to have produced its millionth module in December 2011.