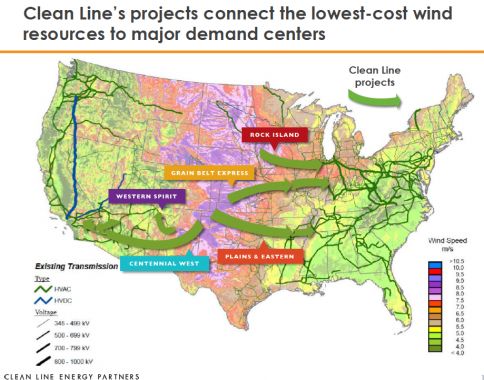

Clean Line Energy believes it can develop long-distance high-voltage direct current (HVDC) transmission lines that will inexpensively move gigawatts of cheap wind (and solar) power -- and still allow competitive pricing at the end of the line.

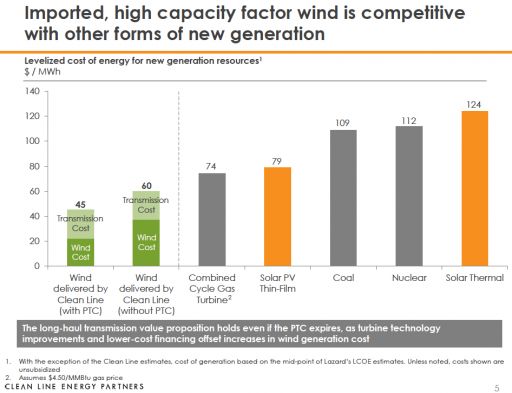

There are wind projects in the Midwest that generate power at 1.5 cents to 3 cents per kilowatt-hour. (That equates to 3 cents to 4.5 cents without the Production Tax Credit.) Yet while these regions might actually be curtailing wind at times and are limited by transmission capacity, other regional grids are hungry for low-cost power or renewable power. Demand is being driven by renewable portfolio standards, the Clean Power Plan, and the retirement of 50 gigawatts' worth of coal power.

The problem is getting that cheap wind power to where it's needed.

The founder and president of Clean Line Energy, Michael Skelly, wants to connect low-cost wind resources to major demand points.

He believes that transmission is the key ingredient to getting more renewable energy on-line. "That's why we started Clean Line," Skelly said during a webcast hosted by Julien Dumoulin-Smith of UBS Securities equity research. Dumoulin-Smith called the concept "wind by wire."

Skelly said, "We believe that an independent [company] is suited for the job," suggesting that most utilities are mandated to meet local needs and are not thinking of the challenge of interstate transmission or providing "the development capital required to get a project like this going."

The founder of the aspiring merchant-model transmission company said that bigger blades, taller towers and lighter materials mean the central part of the country provides a "deep supply base for the resources we want to tap." He notes that there are developers active in the region and what they need is "access to markets."

"We believe our product will be a valuable addition to the grid in the Southeast," said Skelly.

AC ϟ DC

Despite the dominance of alternating current (AC) on national grids, direct current (DC) is still a more efficient way to move power over long distances -- with about half the line losses and less infrastructure than a comparable AC system.

Skelly's firm suggests that DC, unlike AC, "allows complete control of power flow and prevents cascading outages." A Clean Line ±600 kilovolt DC bipole transmission line will have a 3,000 megawatt to 4,000 megawatt capacity.

As Jeff St. John has reported, China is by far the biggest consumer of HVDC technology, spending billions and building tens of thousands of kilometers of new 330-kilovolts-and-up transmission lines. According to earlier reports, HVDC could make up 40 percent of the country’s 300 gigawatts' worth of new transmission capacity.

Clean Line notes, "The last long-distance HVDC transmission line in the U.S was completed in 1989."

According to market analysts, there is strong demand for HVDC transmission. Siemens reports on its website, "In the last 40 years, HVDC transmission links with a total capacity of 100 gigawatts [have been deployed.] Another 250 gigawatts will be added in this decade alone."

An HVDC line requires a converter station on each end; one at the windward end, where the AC voltage of the conventional power grid is converted into DC and one at the delivery end, where the DC voltage is converted back into AC. HVDC equipment vendors include ABB, Siemens, Alstom, AMSC and Schweitzer Engineering Laboratories. Converter stations represent about a third of the total project cost, according to Skelly.

2 cents per kilowatt-hour to get to market

"It will cost producers about 2 cents per kilowatt-hour to get to market," and that's an "all-in delivered cost," according to the company founder.

Skelly suggests that the best business model for a transmission build-out is the "merchant model," where Clean Line would contract with large wind producers looking to get to market. The energy suppliers would buy capacity from Clean Line -- similar to the way the gas pipeline industry works, according to the Clean Line founder.

Typically, most transmission is built through a cost allocation process -- PJM or MISO would get together with various utilities and PUCs and cost would be spread among all users of the grid. Skelly notes, "Because we don't have an inter-regional cost allocation process, we depend on a participant-funded merchant model."

One of the "biggest parts of our job," according to Skelly is to get regulatory approval for the 200-foot-wide, 750 mile-long route. He said "having been at this for six years -- we are working our way through different regulatory processes" and working with the PUC or federal transmission siting authority. He notes that the routing process requires tremendous levels of stakeholder approval.

One of the big challenges in handling this much power, said Skelly, is the interconnect process "that requires a lot of studies" to make sure these lines don't cause issues on the rest of the grid. "We spend a lot of time looking at wind integration," said Skelly. Most high-penetration renewable scenarios employ HVDC.

Potential offtakers for the delivered power include utilities in the Western U.S., Southeastern U.S., and PJM.

Skelly is confident that wind power can be delivered 750 miles from the source at a cost of under 6 cents per kilowatt-hour without the PTC -- making it cheaper than fossil fuels or solar.

Source: Lazard

Skelly said it can take "years for things to unfold" in the space, adding, "The cost of capital for that is reasonably high because it's a really risky business." But once a project is built or contracted, "then there's a tremendous amount of low-cost capital. That's the piece of the value chain investors prefer to focus on."

Clean Line is backed by National Grid, Ziff Brothers Investments and Bluescape Resources.

GTM just reported on the recently released Department of Energy/Lawrence Berkeley National Laboratory's 2014 Wind Technologies Market Report, which sees the wind industry facing policy and supply chain challenges -- but projects that the trajectories of capacity growth, blade-size growth and falling prices for wind will continue. (Here's a link to the slide deck summary in PDF.) Large rotor machines are being used at both low- and high-wind-speed sites. Turbine scaling is boosting wind project performance, even as project costs continue to drop. Annual wind capacity additions rebounded in 2014, with 4,854 megawatts of new capacity -- and there's a great deal of evidence pointing toward a strong 2015 and 2016 to come.

Skelly emphasizes that the transmission development process requires "patience and tenacity" but adds that each of his projects could bring 4 gigawatts of wind to market that previously could not get there due to lack of transmission.