Note: All data and graphs in this article are excerpted from PV Pulse, GTM Research’s monthly global PV data service. For more on the Pulse, go to http://www.greentechmedia.com/research/report/pv-pulse.

After a two-year overcapacity phase that left a trail of crashing prices, financial losses, market exits and severely eroded balance sheets in its wake, the global PV manufacturing sector finally showed signs of recovery in 2013. As robust end-market growth out of China, Japan and the U.S. came into contact with a fitter, leaner supplier landscape, pricing stabilized, inventory levels returned to historical levels and well-positioned suppliers bounced back to profitability in the back half of the year.

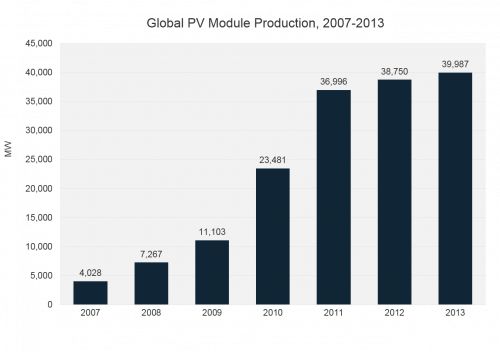

However, the PV supply chain’s resurgence in 2013 did not translate into significant growth in overall production levels. As estimated by GTM Research, global PV module production in 2013 reached 39.8 gigawatts, only 3 percent more than 2012’s figure of 38.8 gigawatts, and much lower than 2013's end-market (installation) growth of 19 percent. This is understandable given that the industry was still grappling with residual inventory overhang from 2012 (particularly in markets such as Latin America and China, where much of the low-spec inventory was eventually absorbed). And in general, producers displayed a much more cautious attitude toward factory utilization and capacity expansion, with the focus being on profitability as opposed to top-line revenue or shipment growth; even supposedly “vertically integrated” suppliers outsourced production during times of peak demand.

The relatively flat-line production profile for 2013, however, masked large differences at the level of individual firms: production levels for the top ten firms increased by 22 percent, with best-positioned suppliers such as Trina Solar and Yingli Solar operating at close to full utilization for most of the year, compared to struggling firms such as LDK Solar and Suntech Power, whose factory utilization rates hovered around the 30 percent level.

Source: GTM Research April 2014 PV Pulse

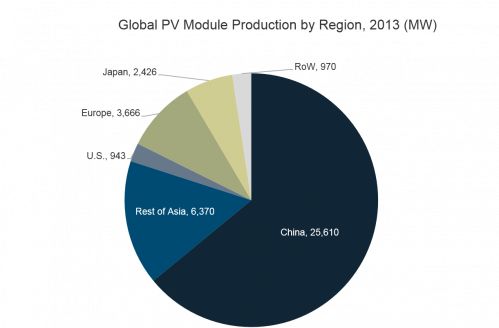

Regional Trends: China Share Stays Stable, U.S. and Europe Decline Further

After a decade of continuous expansion, China’s share of global module production dropped ever so slightly in 2013, ending the year at 64 percent compared to 65 percent in 2012. Factors including a lack of meaningful capacity expansion in China, limitations on Chinese imports into the EU, and significant capacity idling by weaker firms were the main drivers for this incremental decline. Meanwhile, other Asian nations, primarily Japan, Malaysia, South Korea and Taiwan, made up another 22 percent of the global total. Production out of Japan increased by 24 percent in 2013, thanks mainly to explosive end-market growth, which created booming demand for domestic vendors such as Sharp, Kyocera and Solar Frontier.

Source: GTM Research April 2014 PV Pulse

With Asia’s module production share coming in at 86 percent, the remaining 14 percent was divided between Europe (9 percent), the U.S. (2 percent) and Canada (1 percent). The last two years of overcapacity in the PV supply space have taken a particularly heavy toll on European and American producers, with another slew of plant closures and market exits affecting these regions in 2013 (MX Solar in Italy and the U.S., First Solar in Germany, and Siliken, Isofotón and Solaria Energia in Spain). Unsurprisingly, module production out of Europe and the U.S. dropped by 12 percent in 2013, and their share of the global total also fell to just 12 percent, compared to 40 percent in 2007. While the negotiated trade settlement in the EU (which placed a price floor and volume cap on Chinese imports) and the ongoing U.S.-China-Taiwan trade case could create new opportunities for producers based in these regions, a return to the glory days of the past is still doubtful.

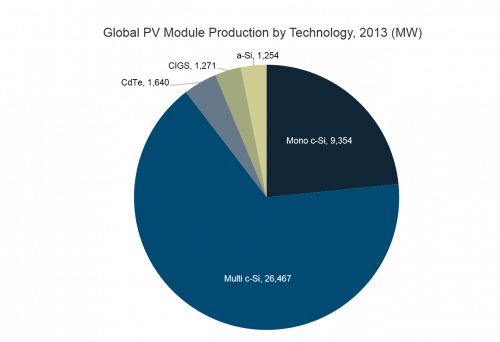

Technology Trends: Thin Film Share Slides to Lowest Level Since 2006

Crystalline silicon (c-Si) technology made up 90 percent of module production in 2013, compared to 89 percent in 2012. Roughly three-fourths of c-Si output was multicrystalline-based, which is a significant change from 2008, when production was split almost evenly between multi and mono c-Si.

Total thin film production declined for the second consecutive year in a row: 2013 production was estimated at 4.2 gigawatts, down from 2011’s high of 4.7 gigawatts. Thin film’s 10 percent share of the overall module market was its lowest since 2006. Generally speaking, thin film's relevance to the solar market at large has been on the wane since 2009, when it reached a high of 19 percent of total module production. The reasons for this are simple: barring some notable exceptions, thin film is more expensive, less efficient, and less bankable than Chinese crystalline silicon technology, which dominates the marketplace today.

Looking at thin film production more closely, CdTe (almost entirely First Solar) made up 39 percent of total thin film production in 2013, followed by CIGS (31 percent) and thin-film silicon (30 percent). As with CdTe, CIGS production was heavily concentrated, with 995 megawatts of the total 1,271 megawatts produced coming from a single supplier: Japan-based Solar Frontier. Overall, First Solar and Solar Frontier made up 63 percent of global thin film production in 2013.

Source: GTM Research April 2014 PV Pulse

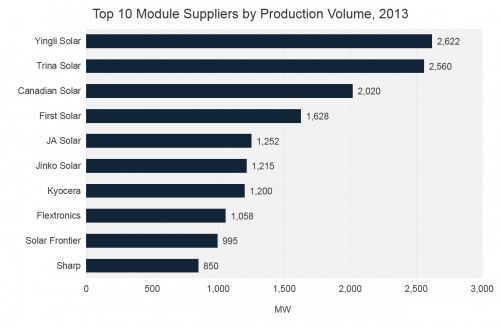

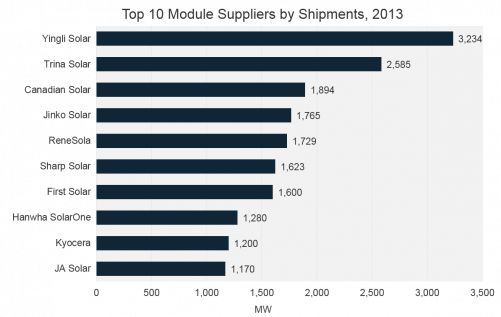

Top Suppliers: Yingli Retains the Crown, Japanese Firms Move Up

For the second year in a row, China-based Yingli Solar claimed pole position as the world’s largest producer of PV modules. Trina Solar, which was fourth in 2012, moved up two slots to No. 2, while Canadian Solar also moved up two slots from fifth to third place. Rounding up the top five were First Solar (2012: No. 3) and JA Solar (2012: No. 7). Given China’s dominance in PV manufacturing, it is not surprising that five of the top ten (Yingli, Trina, Canadian, JA and Jinko) are Chinese firms. The two Japanese firms on the list, Kyocera and Solar Frontier, did not place in the top ten list in 2012, but both expanded production and sales volumes significantly in 2013 thanks to a booming Japanese end market. Overall, the top ten module producers made up 39 percent of global production, compared to 37 percent in 2012 -- suggesting that even after the overcapacity-induced shakeout of 2011-2013, the module market has still yet to really consolidate.

Source: GTM Research April 2014 PV Pulse

Looking at top module firms by shipments instead of produced volumes reveals a similar list, with some notable differences. The top three firms on both lists -- Yingli, Trina and Canadian -- are identical, although it is clear that a significant portion of Yingli’s 2013 shipments were produced by third parties. Contract electronics giant Flextronics, which is an OEM supplier for firms such as SunPower, Hanwha Q CELLS and SunEdison, was the eighth-largest producer of modules, but did not figure into the shipments list. Finally, Sharp and ReneSola, which use large volumes of OEM modules, did not crack the top ten list for producers, but ranked highly in terms of shipments.

Source: GTM Research April 2014 PV Pulse

2014: A New Growth Phase Begins

Looking to 2014, GTM Research estimates global installations to be within the range of 40 to 50 gigawatts, levels that have motivated the best-positioned suppliers to expand their supply capabilities after a prolonged dry spell. Consequently, the last few months have seen a number of expansion announcements across the value chain. GTM Research estimates that the 50 largest PV module suppliers alone will add more than 10 gigawatts in manufacturing capacity in 2014, with similar expansions expected for producers of polysilicon, wafers and cells. While established Chinese incumbents such as Jinko and Yingli will expand capacity primarily through mergers and acquisitions of their weaker Chinese peers, new capacity spending will take place for facilities based in other regions, such as Taiwan and Malaysia, along with a slew of greenfield module facilities springing up to serve local demand in markets such as Brazil, South Africa and Japan.

With 2014 widely expected to be the supply industry’s most profitable year in half a decade and with major capacity expansions across the PV value chain that will continue into 2015, conditions in the global PV supply chain are shifting rapidly toward a new growth phase for the industry. The question, as always, is how long it will last.

***

Shyam Mehta is Lead Upstream Analyst at GTM Research, where he covers the global PV manufacturing sector. For more information and data on GTM Research's coverage of PV suppliers, click here.