Shyam Mehta, GTM Research Senior Solar Analyst, reported on this earlier this week, but it bears repeating.

According to the BSW, average German system prices in the second quarter of 2012 were estimated at EUR1.776 per watt peak, or $2.24 per watt peak at current exchange rates. Since Germany is dominated by rooftop systems (72 percent of installations in 2011), this is an impressively low number. Assuming a module price of around $0.90 per watt peak, this implies an average balance of system cost of $1.34 per watt peak.

This is one of the reasons why, as Mehta puts it, the German downstream market is still alive and well. While only 650 megawatts were installed in January and February (typical for Germany), preliminary results from the BSW indicated deployment of 1.15 gigawatts in March, largely due to pull-in effects of an expected April feed-in tariff cut, which was subsequently delayed. Second-quarter installation run-rates are proceeding at a healthy clip, in large part due to the deployment of “grandfathered” ground-mounted projects under the pre-April 1 feed-in tariff regime.

GTM Research is currently estimating 2012 installations in Germany to come in at around 6.5 gigawatts, compared to 7.5 gigawatts in 2011.

On the other hand -- as just detailed in GTM Research's U.S. Solar Market Insight -- the U.S. average system price was $4.44 per watt in the first quarter of 2011.

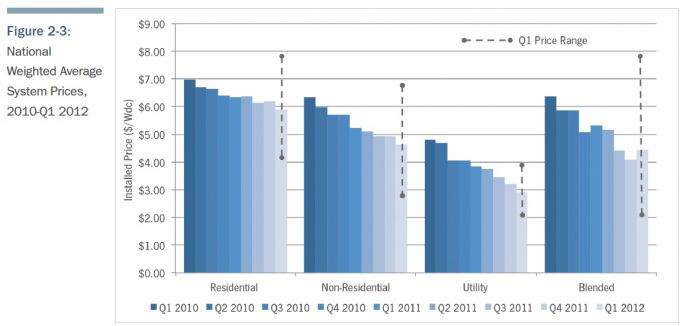

Residential system prices fell by 4.8 percent from Q4 2011 to Q1 2012, with the national average installed price falling from $6.18 per watt to $5.89 per watt. Non-residential system prices fell by 6 percent quarter to quarter, from $4.92 per watt to $4.63 per watt. Utility system prices declined for the eighth consecutive quarter in a row, dropping from $3.20 per watt in Q4 2011 to $2.90 per watt in Q1 2012.

This is an enormous discrepancy in the average price per watt in Germany versus the U.S.

Assuming the module and inverter pricing is roughly the same for both countries, the culprit for the high prices in the U.S. lies in the soft costs of permitting and financing, as well as in the engineering, procurement, and construction (EPC) process. Add in the potential increase in module pricing due to the China trade tariffs, and the U.S. market faces some headwinds in driving down the cost of solar.

These stubborn soft costs are why the DOE Sunshot program is working on lowering the cost of financing and other soft costs. And why programs like the ten-day permitting process in Vermont shines some hope of reducing soft costs in the U.S.