Shayle Kann, Managing Director of Solar Research at Greentech Media (and his staff), testified today in front of the U.S. House of Representatives Committee on Natural Resources.

He was invited to testify on “Creating American Jobs by Harnessing our Resources: U.S. Offshore and Renewable Energy Production.”

We are reprinting his testimony in its entirety because he's brilliant, he's right, and we're proud of him and our organization. Watch it live right here at 10AM EST.

***

Chairman Hastings, Ranking Member Markey and members of the Committee, thank you for the opportunity to testify before you today. I am Shayle Kann, Managing Director of the solar program at GTM Research, a market analysis and consulting firm focused on renewable energy and smart grid technologies. Our team monitors and forecasts dynamics in the U.S. and global solar markets.

GTM Research formed a partnership with the Solar Energy Industries Association in 2010 to begin collecting, aggregating, and analyzing data on the U.S. solar market with greater detail than had previously been available. This partnership has spawned a series of quarterly reports tracking U.S. solar manufacturing and installations. We have also published two iterations of an annual report entitled U.S. Solar Energy Trade Assessment, which analyzes trade flows and value creation in the U.S. solar market.

Utilizing data from these reports, my testimony will address three topics.

First, I will provide a framework to understand issues of trade, competitiveness, and job creation in the solar industry. When surveyed in its entirety, the U.S. solar industry shines as one of the few bright spots in a continuing difficult macroeconomic climate. Installations more than doubled last year, the U.S. ran a trade surplus both globally and specifically with China, and 73 cents out of every dollar spent on a U.S. solar installation stayed in the U.S.

Second, I will discuss the future of domestic solar manufacturing, whose fortunes rest squarely on the shoulders of the continued development of innovative technologies that can compete with established, low-cost players in China and elsewhere. The intellectual property and research behind these technologies still largely resides within U.S. borders, and the U.S. can remain a leader in such early manufacturing. Continued innovation, however, requires significant investment in research and development.

Finally, I will provide recommendations for how the federal government can sustain and build upon this momentum to make the U.S. the world’s largest solar market by 2015 with a global market share of more than triple what it was in 2010.

The U.S. solar industry is strong. Demand, private investment, and most importantly, employment are on the rise. A stable and reliable policy landscape will ensure that solar can serve as an engine of economic growth throughout the U.S.

The State of the U.S. Solar Market

Let me begin by providing an update on the state of solar in the U.S. I will focus my attention on solar photovoltaics, or PV, since this technology currently comprises approximately 82 percent of the total U.S. solar industry by economic value.

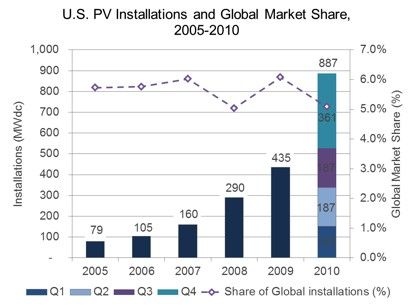

In 2010, the U.S. PV market grew 104 percent to install 887 megawatts, the equivalent of 160,000 residential installations. The first half of 2011 saw the market on track to grow another 72 percent this year. GTM Research anticipates an even stronger second half and a near-doubling of installations again in 2011. Still, from a global perspective the U.S. has a long way to go to become a market leader. From 2005 to 2010, the U.S. market share of global PV installations hovered between 5 percent and 7 percent. In other words, the U.S. solar market grew in line with the rest of the world. In 2011, a slowdown in major European markets such as Germany and Italy, combined with continued rapid growth in the U.S., has meant that the U.S. is becoming an increasingly important end-market for solar power.

We anticipate that U.S. market share of global installations will more than triple to 17 percent by 2015.

Figure 1: U.S. PV Installations and Global Market Share, 2005-2010

Source: SEIA®/GTM Research U.S. Solar Market Insight: 2010 Year-In-Review

The extraordinary market growth that we have seen in the U.S. has been driven by many factors, but two stand out.

First, the Section 1603 Treasury Program, named after its section of the federal tax code, has been absolutely vital since its introduction in 2009. This program is an offshoot of the Investment Tax Credit (ITC), the cornerstone of federal policy to support solar installations. The ITC, which was enacted as part of the Energy Policy Act of 2005, offers a 30 percent tax credit on solar installations and has been the primary driver of industry growth in the U.S. However, the program relies on the ability to monetize tax credits, which has historically been solved through tax equity investors in solar projects. In the wake of the financial crisis and recession, Congress introduced the Section 1603 program, which enabled commercial solar project owners to receive a grant in lieu of the ITC. That program was extended in late 2010 but is currently scheduled to expire at the end of this year. This leaves the industry facing a looming shortfall in available tax equity for solar projects that would otherwise move forward. Although Section 1603 is not under the direct jurisdiction of the Natural Resources Committee, it is a critical program nonetheless.

The second factor enabling growth is that prices for PV panels have fallen substantially over the past three years, and even over the past six months. Since the end of 2008, average panel prices have fallen over 61 percent. Much of this price decline has taken place this year, with panel prices already falling 30 percent in 2011 alone. While this has created an exceedingly difficult landscape for panel manufacturers, which I will discuss later in this testimony, it has also created an increasingly attractive environment for solar installations.

Given the right market conditions, we forecast that the U.S. will become the world’s leading PV market by 2015 with an annual installation rate of more than six gigawatts, more than ten times the 2009 total.

Where Can Solar Create Economic Value for the U.S.?

There is a common misconception that stimulating demand for solar in the U.S. just adds to the revenues of foreign manufacturers. Generally, this assessment is determined solely by the location of the PV module (panel) assembly. That is, if the module itself comes from abroad, the solar array is said to be foreign-sourced. Given that module assembly increasingly takes place in lower-cost regions such as China, this has led many to believe that U.S. solar installations are largely channeling value to foreign manufacturers.

This faulty line of reasoning ignores two key points:

1) Most PV modules are manufactured through a multi-step process, and different stages often take place in different locations.

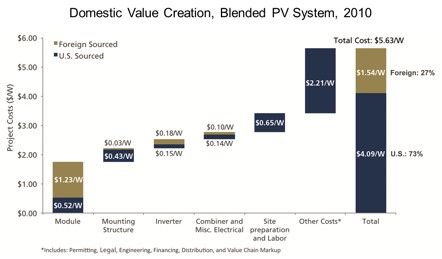

2) The module itself comprises less than 50 percent of the total PV system value. Other components such as mounting structures, as well as non-hardware costs, make up the majority of the investment in a PV installation.

Sources: Hemlock Semiconductor, Schott Solar, PV-Tech, Suntech Power Holdings, National Park Service

Our recent study, U.S. Solar Energy Trade Assessment 2011, examines the location of final module assembly as well as production locations for early steps in the value chain, including polysilicon (raw feedstock) and manufacturing equipment. It also accounts for elements of the solar value chain such as installation labor, site preparation, legal costs, and financing costs, the value of which accrues directly to the U.S. for domestic installations.

Our first major finding was that, on average, 73 percent of PV system value was created in the U.S. in 2010. This means that 73 cents out of every dollar spent on a PV installation in the U.S. in 2010 stayed in the U.S. This equates to a total of $3.6 billion in domestic value creation out of a total $5 billion market in 2010, and the numbers will undoubtedly be higher in 2011.

Figure 2: Domestic Value Creation, Blended PV System, 2010

Source: U.S. Solar Energy Trade Assessment 2011

Much of this value comes from outside the panel itself. The “soft costs” associated with a PV system, described above, contribute as much as 51 percent of total system value and are rarely, if ever, outsourced. To be clear, there is real economic value and real job creation in the installation portion of the industry. To provide a few concrete examples:

- SolarCity, a national provider of solar solutions and financing, has over 1,200 employees, of which nearly 500 were added in the past year. SolarCity plans to hire 200 to 300 more by the end of this year, including 16 new employees starting this week. The company operates in 25 physical locations across 11 states.

- Mainstream Energy, a company that includes a solar project developer and a solar product distributor, hired 245 permanent employees over the past 12 months and expects to hire an additional 280 to 300 over the next 12 months.

- Sungevity, a residential solar financing provider, has quadrupled its workforce in the past 12 months and now employs 300 people.

- SunRun, a residential solar service provider, tripled its staff to over 100 employees in 2010. The company provides financing solutions for a network of installers that support over 3,000 jobs.

In contrast to the early days of the solar industry when projects were sparse and many installation jobs were temporary, these are pure solar companies running at full steam and the jobs they create are permanent -- as long as the market exists.

Do We Still Manufacture?

Solar manufacturing in the U.S. has become a highly contentious topic in light of three recent bankruptcy filings from U.S.-based panel manufacturers. Indeed, it has been a difficult period for PV manufacturers globally. The competition for share of the module market has been brutal; the industry is currently dominated by large, vertically integrated Chinese firms that have received billions of dollars in low-cost loans from Chinese state banks and have access to a well-developed domestic supply chain for solar manufacturing.

Recent industry dynamics have strengthened these headwinds for manufacturers. Since early in the second quarter of 2011, solar manufacturers have been thrust into an environment of over-supply by an unexpected slowdown of end-demand in Germany and Italy, which together comprised 63 percent of the global PV market last year. As a result, panel prices have already fallen by 30 percent in 2011. These factors led to a number of announced factory closures in the U.S. over the past six months from manufacturers that could not compete with today’s pricing.

Although some companies have folded, competitively positioned firms are still investing in domestic panel manufacturing facilities. First Solar, for example, has begun construction of a new 250-megawatt plant in Mesa, Arizona for which it expects to hire 600 people. Other companies such as General Electric are also planning new large manufacturing facilities in the U.S. In total, there are at least seven new module manufacturing facilities planned for the U.S. with a total capacity of over 500 megawatts. This also relates to the U.S. as a growing end-market. Suntech Power, a Chinese panel manufacturer, opened a 50-megawatt facility in Goodyear, Arizona last year in order to serve demand in the U.S. and has stated its intention to expand the facility to 120 megawatts if the market environment continues to thrive.

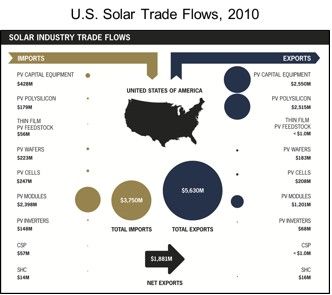

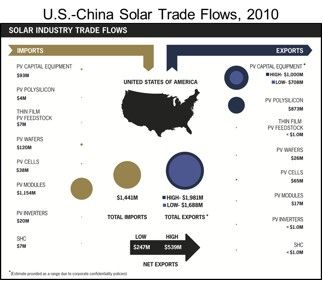

Moreover, the U.S. continues to be a world leader in PV research and development, polysilicon feedstock manufacturing, and capital equipment for PV manufacturing. In U.S. Solar Energy Trade Assessment 2011, we found that the U.S. was a net exporter of solar products by $1.9 billion in 2010. Even more notably, the U.S. ran a trade surplus with China by at least $247 million. Figure 3 displays overall U.S. solar trade flows, while Figure 4 isolates those trade flows that occurred with China. In essence, the U.S. sold a great deal of manufacturing equipment and polysilicon feedstock to China, while China primarily shipped finished PV modules back to the U.S. To the extent that the U.S. remains a world leader in these elements of the value chain, it will benefit from every expansion of the global PV industry.

Figure 3: U.S. Solar Trade Flows, 2010

Source: U.S. Solar Energy Trade Assessment 2011

Figure 4: U.S.-China Solar Trade Flows, 2010

Source: U.S. Solar Energy Trade Assessment 2011

It will be difficult for the U.S. to compete with China at its own game -- namely, high-volume manufacturing of a commoditized product -- given the cost advantages available for Chinese manufacturing. However, the U.S. can and should continue to develop and commercialize innovative technologies that offer lower costs than traditional panels. These new technologies are generally proprietary, require a more skilled labor force, and are difficult to duplicate. First Solar is an example of this; the company’s Perrysburg, Ohio manufacturing facility is cost competitive with any foreign supplier, and no other company has been able to successfully copy First Solar’s technique with any degree of success.

The future of domestic solar manufacturing lies squarely on the shoulders of innovative technologies that can compete with Chinese players on a cost basis. The intellectual property and research behind these new technologies still largely resides within U.S. borders, and the U.S. can remain a leader in such early manufacturing. However, this necessitates continued heavy investment in research and development. Programs such as the Department of Energy’s SunShot Initiative provide enormous value in this regard. Just last week, the DOE awarded more than $145 million to 69 PV research and development projects in 24 states. Many of these technologies have the potential to bring PV costs down even further.

Many of the most innovative solar companies in the world have been spun out of U.S. universities and are building manufacturing facilities in the U.S. Suniva, a Georgia Tech spin-out, manufactures its cells and modules in Norcross, Georgia. Meanwhile, 1366 Technologies is building a 20-megawatt facility in Massachusetts to drastically lower silicon wafer costs with technology developed at MIT. National laboratories also play a role; the National Renewable Energy Laboratory (NREL) has spawned more technological innovations in PV than any other single source.

What Policies Will Enable the Solar Industry to Remain an Engine of Economic Growth?

The first action that the federal government can take to enable the continued growth of the U.S. solar industry is to support market demand with a clear, stable policy landscape. Most immediately, Congress can extend the 1603 Treasury program to allow the market to expand without creating a tax equity bottleneck. There are over 10 gigawatts of large PV projects that have power purchase agreements signed by U.S. utilities, many of which are just awaiting financing to begin construction. Given slow overall economic growth, tax equity availability will unnecessarily constrain these projects.

Ultimately, policymakers should disentangle solar incentives from taxes altogether. Ideally, this would be achieved through an extension of the Section 1603 program through 2016 to match the tenure of the ITC. However, even a one-year extension would enable continued strong growth of the domestic solar market. Even though the Section 1603 program is not the direct purview of the Natural Resources Committee, I urge Committee members to support the program’s extension this year.

Financing is the primary barrier remaining for solar deployment in the U.S. Apart from extension of the 1603 Treasury Program, creation of the Clean Energy Deployment Administration, or CEDA, would enable technologies to bridge the so-called Valley of Death between proof-of-concept and mass production. CEDA passed out of the Senate’s Environment and Natural Resources Committee in 2009 with bipartisan support, and a very similar version of this program passed in the House this year.

Congress should also continue to support R&D investment in solar technology. Programs like the SunShot initiative will maintain the U.S. lead in technological innovation and early-stage manufacturing.

Conclusion

We stand at a critical juncture in the development of the solar power market in the U.S. Many companies, both manufacturers and installers, are just beginning to invest in the U.S. market to gain a foothold in case it truly reaches a tipping point. The U.S. has spent the last few years building up the early infrastructure and business models that will support this level of growth. Now we need continued private investment and a stable, reliable policy landscape in order to realize the market’s potential.

At the same time, solar manufacturing in the U.S. is growing overall but being outpaced by expansion abroad. Still, the U.S. remains a breeding ground of technological innovation in solar manufacturing. By continuing to invest in research and development and supporting promising technologies through commercialization, we can place the U.S. in the driver’s seat as solar travels down the cost curve.

On behalf of GTM Research and its parent company, Greentech Media, I’d like to thank Chairman Hastings, Ranking Member Markey and members of the Committee for the opportunity to testify today.