After an agonizingly long gestation period, concentrating photovoltaics (CPV) is gaining a foothold in the solar market.

According to GTM Research, CPV is showing the potential to reach a gigawatt of installed capacity per year within the next few years.

The CPV news has been encouraging of late:

- SDG&E has signed 305 megawatts in PPAs for CPV projects with Soitec CPV technology.

- Amonix CPV is being deployed at a 30-megawatt Xcel installation.

- Solfocus CPV has a number of new deployments.

- Solar Junction set efficiency records for triple-junction solar cells and is closing on a new funding round.

- Morgan Solar received a new VC funding round of $16.5 million for its CPV system design.

GTM Research's Brett Prior provided a CPV State of the Union last week with an optimistic forecast while delving into the results of GTM's CPV report. The report (details here) and the webinar (details here) offer a comprehensive analysis looking at levelized cost of energy (LCOE) in CPV, as well as comparing CPV to other solar technologies. The report profiles 70 CPV firms and lists 170 CPV projects either already built or under development.

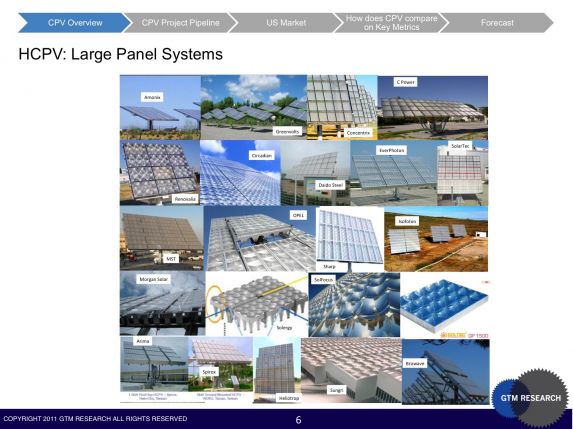

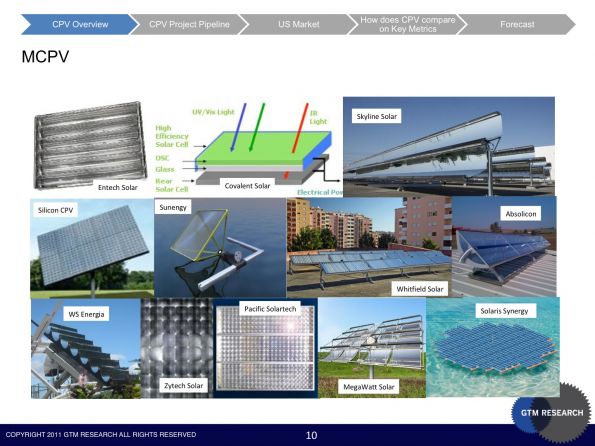

Prior parsed the CPV market into three subsets (see graphics below) based on concentration factor:

- Low concentration PV (LCPV) with 2X to 8X concentration

- Medium concentration PV (MCPV) with 10X to 150X concentration

- High concentration PV (HCPV) with greater than 200X concentration

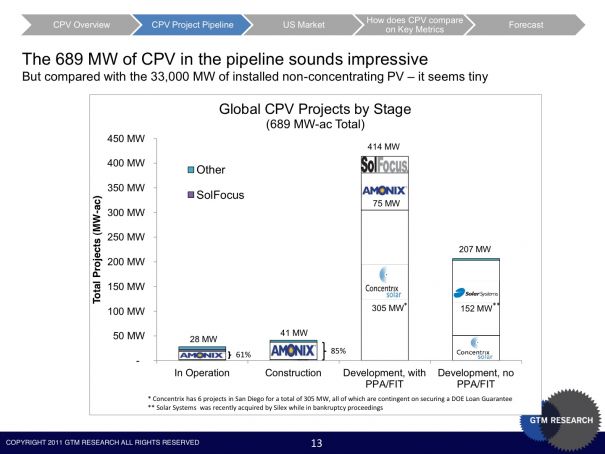

There are 689 megawatts of CPV in the project pipeline and although that sounds impressive -- it has to be put into the context of the 33,000 megawatts of non-concentrating PV currently installed.

The emerging global CPV ecosystem is composed of CPV vendors like Amonix, Solfocus, and Concentrix aligned with developers like Cogentrix, SolOrchard, and Tenaska respectively. Other vendors like JDSU or Emcore supply chips, while EPCs like Johnson Controls, Mortenson Construction, and Bechtel manage the project construction. Finally, electricity purchasers such as SDG&E, Xcel Energy, and SoCal Edison are off-takers for the power.

The CPV market is dominated by the U.S. and best suited for California, Texas, Colorado, Nevada, Arizona, and New Mexico. The "U.S. has a massive addressable market," according to Prior, but CPV manufacturers don't have internal development arms like First Solar.

CPV in the U.S. is currently only 3.4 percent or 448 megawatts of signed PPAs in high-DNI states out of the 13,102 megawatts-AC of signed PPAs for solar power in high DNI states, The market is owned by CSP and PV.

So, who are the gatekeepers that need to be won over for CPV to succeed?

According to Prior, Independent Power Providers (IPPs) are the likely best targets for CPV because they're not reliant on banks. IPP players include NextEra, NRG, and Tenaska. Solar developers like Fotowatio and Silverado Power are somewhat less likely partners for CPV because they are relatively "cash-poor."

The report also goes into detail on the key metrics to use when comparing CPV against other solar options. These metrics, in order of importance, are LCOE, bankability, modularity, water usage, and capacity factor.

The key input in LCOE is module efficiency, and while the efficiency curves of SunPower and First Solar are relatively flat, Prior believes there is much more room to improve efficiency at the module level in CPV. Concentrix should have module level efficiency at 27 percent in 2011, with the hope to reach levels greater than 30 percent by 2014.

But bankability is one area where CPV still struggles, and to address that weakness, all of the CPV leaders have teamed with larger, more confidence-instilling partners. Amonix is working with Boeing; Concentrix is now part of the larger Soitec acquisition; and Solfocus is insured by Munich Re.

Although land use advantages are trumpeted by the CPV industry, Prior contends that land use is not a huge issue in permitting HCPV and land cost does not have much of an impact on LCOE.

The report forecasts over 1,000 megawatts in new CPV installations in 2015, which represents a massive growth rate -- 200 times today's annual installed CPV, although still a tiny percentage of the overall PV market.

A much deeper analysis of the issue can be found in the GTM Research report.