As recently as 2009, a module maker’s price of entry into the marketplace was proof its product met basic UL safety and IEC performance standards. Now it must exceed those standards to earn make-or-break backing from a financial institution.

Proof of bankability comes from module testing. In 2008, according to TUV Rheinland VP and Field Manager Richard Bozicevich, there were six laboratories doing module testing. In 2012, there were 46.

In recent weeks, GTM has been asking some of the leading labs what they do and why.

Renewable Energy Testing Center (RETC) Engineering and Operations Senior VP Cherif Kedir explained that banks are concerned about the return on their investment. Developers tend to be more interested in the shorter term. Between the two, “they end up getting the whole gamut of tests because each has slightly different needs and they don’t want to concede them.”

RETC does both performance and reliability testing. “What a lot of developers and banks are saying,” Kedir explained, “is that the basic certifications are a manufacturer’s price of entry into the market.” But the gate of entry into purchase agreements, he said, is proving “they are better than the rest.” (See the article "Testing and Ranking Solar Module Quality" for more details.)

The stakes riding on performance are now high, according to Intertek Group (LON: ITRK) testing services Regional VP for Renewables Sunny Rai. Manufacturers want to prove their products provide the promised return on investment (ROI). Banks and developers want to verify they will get the promised ROI.

Intertek’s bankability testing, Rai said, “is all about performance and ROI.” The tests for bankability are the same as those for safety “but they last longer and output is monitored more closely.” (See the article "What Do Solar Module Test Procedures Prove?" for more details.)

PV Evolution Labs (PVEL) has been referring manufacturers seeking safety certification to other labs, explained PVEL CEO Jenya Meydbray. PVEL is focused on the downstream PV market. “The needs of bankers and developers are different than those of manufacturers,” Meydbray said. “They want more than just raw data test reports.”

"PVEL's services start with the test report to the manufacturer, they don’t end there,” Meydbray said. “We can help established manufacturers access buyers.” PVEL has also developed statistical models for randomly sampling modules that allows developers to choose a level of certainty and a cost, Meydbray explained, “and decide their risk tolerance.” (See the article "A More Realistic Take on Solar Module Testing” for more details.)

The Fraunhofer USA Center for Sustainable Energy Systems (CSE) began pursuing its Photovoltaic Durability Initiative (PVDI), a set of panel tests that go beyond safety and performance, in 2010, along with Germany’s prestigious Fraunhofer Institute for Solar Energy Systems (ISE).

PVDI is “a protocol to provide quantitative comparative data for modules in various operating environments,” explained Fraunhofer senior technical staff member David Meakin, and “to identify the field performance capabilities necessary to reduce risk to investors.”

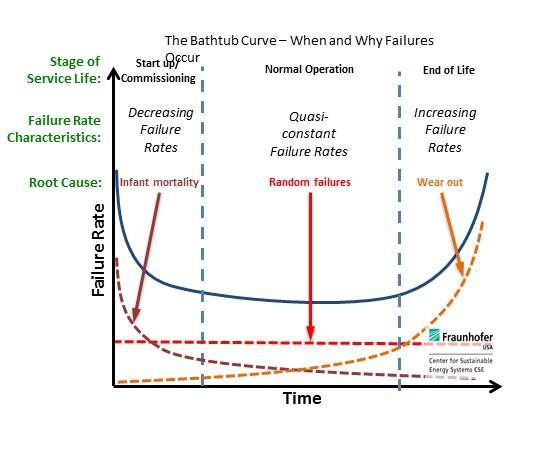

In reliability, he explained, there are three basic failure mechanisms at work. “Put the three together and you get the classic bathtub curve.” The bathtub curve is a probability curve that shows an initial short period during which there is a high risk of failure, known as infant mortality, followed by a long period of stability. “The unanswered question about PV modules, Meakin said, “is how long until the probability of failure starts increasing.” (See the article "Focusing on Solar Panel Durability, Not Bankability" for more details.)

Underwriters Laboratories (UL) (NYSE:BRK.A) 1703 Standard for Flat-Plate Photovoltaic Modules and Panels is the industry gold standard for baseline safety and performance.

“UL 1703 is not only the gold standard for safety in the U.S.; it is the basis for the IEC 61730 document which is the international safety standard,” explained UL Renewable Energy Principal Engineer Christopher Flueckiger.

“But we are not limited to just the basics,” added UL Energy Business Development Director Evelyn Butler. UL now certifies to international IEC performance standards (61215 and 61646) and, along with the rest of the solar industry, “is thinking about durability and reliability and how they affect bankability,” Butler said.

“A PV module follows the bathtub curve,” Flueckiger said. But, he added, there is not yet a scientific basis to go beyond the bathtub curve’s first vertical line.

“We don’t have an official bankability program,” Butler said. “We don’t have the science for that.” (See the article "The Solar Industry Module Testing Gold Standard" for more details.)

The earliest bankability tests, said TUV Rheinland VP and Field Manager Richard Bozicevich, “were derivatives of the IEC testing. They took some of the induced stresses and multiplied them.”

TUV Rheinland’s “science guys have concluded the tests done now get you about the first eight years of performance,” Bozicevich said. “But modules have a 20-year to 30-year life expectancy. That is the part that people are working on now.”

TUV Rheinland’s bankability program has four elements, Bozicevich said: basic certification testing to the UL and IEC standards, performance testing, reliability testing, and validation of the supply chain.

Supply chain validation will likely become more important because, Bozicevich said, “Manufacturers will be looking for ways to trim margins by easing production costs on things that impact the build.” (See the article "TUV Rheinland Takes On Bankability Testing for Solar Modules" for more details.)