Last week GTM Research released the Q4 2014 edition of the Latin America PV Playbook. Here are four takeaways from the Playbook that showcase the region's growing large-scale solar market.

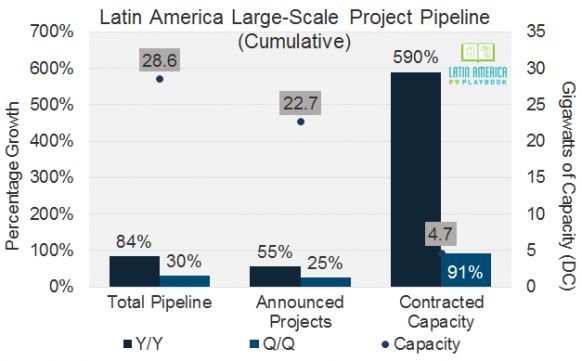

A 30-gigawatt project pipeline

At almost 30 gigawatts, the total project pipeline in Latin America exceeds the pipeline of announced projects in the U.S., as well as the oft-touted number of permitted projects in Japan. Let’s break that down a little more, since growth has been occurring in every category.

- The project pipeline is up 84 percent over 2013, and up 30 percent over the third quarter

- Project announcements are up 55 percent over 2013, and up 25 percent over the third quarter

- Contracted capacity is up 590 percent over 2013, and up 91 percent over the third quarter

- 277 megawatts of large-scale PV came on-line in the fourth quarter alone, more than had been cumulatively installed through the end of 2013

- There is more than 1 gigawatt currently under construction, and 698 megawatts of large-scale projects are operational today

Source: GTM Research Latin America PV Playbook

Chile was the top market for installed capacity in 2014

Chile has had the most installed PV capacity, with more than 500 megawatts at the end of 2014. This means Chile has well over 70 percent of the region’s operational large-scale PV, with Mexico, Peru and Brazil accounting for another 20 percent, and the final 10 percent spread throughout 12 other countries, with no single country having more than 10 megawatts.

Honduras and Peru break into the top rankings for project pipeline

In terms of total pipeline, Chile also leads with 16 gigawatts -- over half the regional total -- followed by Brazil with about 5 gigawatts, and Mexico with 3.7 gigawatts. Also ranking quite high were Panama, Honduras and Peru, with more than 500 megawatts each.

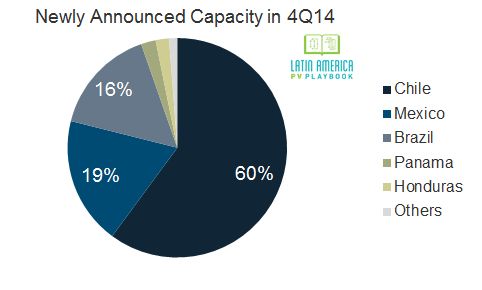

New project announcements in the fourth quarter roughly correspond to the trend, with most activity in Chile, Mexico, and Brazil.

- There were nearly 4 gigawatts of newly announced capacity in Chile. While this is partly driven by strong fundamentals, it is also encouraged by the low early transaction costs, such as environmental permitting, in the country. Solar development is also subject to a viral mentality, and Chile has certainly attracted its share of speculation.

- More than 1 gigawatt of newly announced capacity was in Mexico. This was largely spurred by a rush to secure pre-reform permits, which have some benefits that may not be extended.

- A total of 1 gigawatt of newly announced capacity was in Brazil, where recent auctions have drummed up more interest in the market, despite taxation and financing challenges.

Source: GTM Research Latin America PV Playbook

While not all announced projects will get built, the steadily increasing amount of contracted capacity indicates a growing willingness by offtakers to sign long-term agreements for solar power. The 590 percent annual increase in contracted capacity is certainly related to a small base, but it also shows the massive change that has occurred in the market over the last year. For example, a year ago, virtually no projects had secured power-purchase agreements. These contracts are being signed primarily in Chile, Brazil, and Mexico. (The latter is something of a false signal, however, since contracts procured under the old permitting process are very unlikely to move ahead -- and are instead being secured for better positioning once the reform in that country is completed.)

Not all pipeline is created equal: Watch Chile, Mexico and Peru

While increasing amounts of project announcements and contracts are good for the industry, this does not mean that all of these announced PV plants will materialize. What are realistic expectations for the market moving forward?

In Chile, a huge boom is expected next year. There are many bankable contracts with large offtakers, including mining companies and utilities. Most power-purchase agreements (PPAs) are likely to translate into actual installations, although the vast majority of announced and permitted capacity will not. It’s important to remember that the entire Chilean grid is only 18 gigawatts, with 12 gigawatts needed between 2013 and 2030. It is highly improbable that the entire current pipeline of 16 gigawatts of solar will be built, particularly given that many projects are focused around certain substations that have limited capacity.

In Mexico, several projects could be built in 2015 under the old permits. One project in Baja California Sur is moving ahead with a floating-price contract, and another 400 megawatts have signed PPAs as self-supply projects. This means a highly ambitious, but feasible, scenario would result in about 430 megawatts being built in 2015. Any additional development will hinge on new contractual models being issued by the regulator this summer, and any such projects would be unlikely to proceed until 2016.

In Brazil, last year’s auction in the unregulated market and this year’s reserve auction for the regulated market have yielded nearly 1 gigawatt of contracted capacity. In our view, all of these projects are high risk and depend on tax breaks, financing, development of local content and some degree of capex reduction.

In Honduras, there is a significant incentive to connect before August -- and to be one of the first 300 megawatts to connect -- so that the additional bonus payment for doing so can be received. There are 459 megawatts with contracts, and 216 megawatts under construction, so we do expect a lot of development in 2015. However, we continue to view this as a very high-risk market -- with political, country, and counterparty risk all presenting very serious challenges to the long-term viability of the market.

Peru is holding another renewable auction this year. Previous auctions were the main driver for solar deployment in the region, and we expect that this year they will continue to contribute in a meaningful way. Companies are definitely tuned into the market -- with over 1 gigawatt of provisional licenses getting issued to scope out projects ahead of the auction. Most of these are held by Enel Green Power.

Panama has issued about 60 megawatts' worth of PPAs to five projects in its recent auction. The pricing for these contracts was very low -- one at $79 per megawatt-hour, and another three below $100 per megawatt-hour. Thus, successful development in Panama hinges on selling some power into the merchant market and finding financiers to take projects structured with this kind of business model. We are optimistic that this will be the case. The final risk is grid connection, as there have been major issues around finding substation capacity in desirable locations.

Finally, the Uruguay market is a wild card. There have been several contracts signed in the last year, but again, at very low prices. Several projects have secured financing, however, so it is definitely a country to watch.

***

For more information on the Latin America PV Playbook, visit http://www.greentechmedia.com/research/report/latin-america-pv-playbook or contact [email protected].