The big renewables winner in the fiscal cliff legislation was wind.

But the solar industry was also spared some pain.

Wind's $0.022 per kilowatt-hour production tax credit (PTC) was extended through the end of 2013. Crucial language changes allow wind and geothermal projects “under construction” by year-end to qualify for the incentive instead of only those “in production.”

But for solar, “the automatic federal spending cuts, termed sequestration and slated for January 2013, were postponed until March,” REC Solar Legislative Director Ben Higgins explained. “If sequestration had happened, it would effectively have taken still-pending 1603 grants, which provide cash upfront instead of a tax credit, from 30 percent of the investment down to about 27.7 percent.”

The 1603 provision, Higgins explained, “provides two benefits: One, you don’t have to have tax liability, and, two, you get the funds now in the form of a check instead later in the form of a tax credit.” Having it reduced, Higgins said, “would have been a major blow to investor and industry confidence.”

The two-month delay on sequestration “is probably the most important thing this package did,” agreed tax specialist CohnReznick’s Senior Manager Lee J. Petersen. “I would suspect the amount of safe-harbored 1603 projects was fairly robust,” he explained. “We’ve talked to folks in the process of safe-harboring up to $4 billion worth of projects. The bill has given them at least two full months of breathing room.”

renewables

renewables

There were two other important provisions in the legislation, Higgins said, “that will have a beneficial effect on commercial solar in 2013 for taxpayers that meet the eligibility criteria and have the tax liability.”

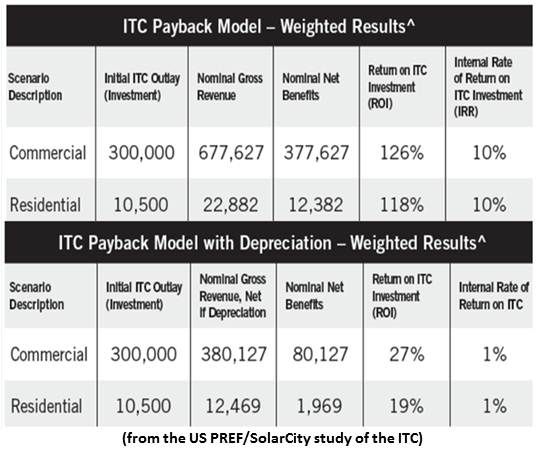

The most important, he said, “is the one-year extension of the bonus depreciation rule that allows commercial solar owners to depreciate 50 percent of the cost of the system in the first year rather than over the typical five-year MACRS schedule.”

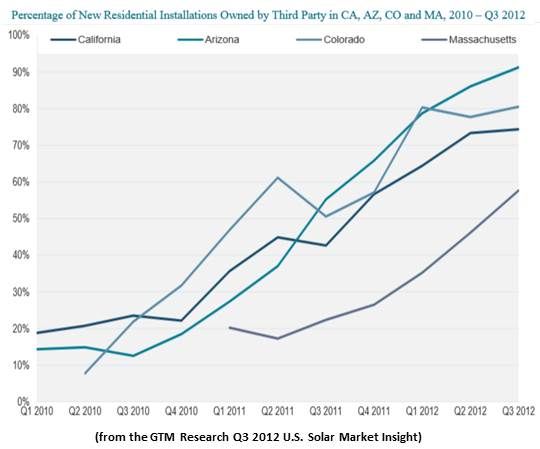

Instead of expiring on December 31, bonus depreciation will be available to owners of commercial systems placed in service before January 1, 2014. Though more marginal than the 30 percent investment tax credit (ITC), Higgins said, it could be important because “70 percent or more of residential solar in prominent solar states is third-party-owned (TPO) and treated under the tax rules as commercial property.”

Third-party-ownership players like Sunrun, Clean Power Finance and SolarCity (NASDAQ:SCTY) may be able to use depreciation to ultimately cut costs in the residential arena.

“Accelerated depreciation can be good or bad, depending on your tax position,” Petersen observed. “If you get a fairly substantial amount of depreciation in year one, that may be a good thing for you in year one. But if you're holding on to the investment for a number of years, and in the out years you have burned off all of your depreciation, you don’t have deductions to offset the income.”

Petersen agreed the depreciation provision will apply to TPO. “It is a valuable option; more options mean additional flexibility and flexibility is generally a good thing. It just comes down to a deal-by-deal basis.”

Source: GTM Research’s Q3 2012 U.S. Solar Market Insight

“The second provision of interest to the solar industry,” Higgins said, “was Section 179 expensing that allows for the immediate write-off of qualifying assets.” But, Higgins added, “bonus depreciation is fairly straightforward. Section 179 tends not to be.”

The limit on Section 179 expensing “was slated to drop from $125,000 in 2012 to $25,000 for 2013,” Higgins said. “The fiscal cliff legislation -- the American Taxpayer Relief Act of 2012 -- increases it to $500,000 for 2012 and 2013.”

Commercial solar owners, he explained, “may potentially write off up to $500,000 of the cost of their system.” The asset value limitation for Section 179 expensing is $2 million, Higgins said. “At $4 per watt, you’re talking about 500-kilowatt systems.”

This provision, Higgins and Petersen agreed, probably will not affect the TPO sector.

“You have to be careful with Section 179 expensing,” Petersen cautioned. “You can actually lose your ability to claim tax credits. With bonus depreciation, you still are allowed the full amount of the ITC. But with Section 179, “the rules don’t work that way because it is an actual expense, not a depreciation deduction.”

A two-year extension of the federal New Markets Tax Credit (NMTC) was also potentially important, Petersen said. “One of the most complicated provisions in the code,” he explained, NMTC money can be borrowed at extremely low rates to finance projects in economically depressed regions that might not otherwise find investors. “A developer might be able to borrow money at 1 percent rather than have to pay the local bank 7 percent. The value to the solar project is that it reduces the cost of financing.”

Because most investors are not familiar with solar and the NMTC is complex, Petersen said, it has been little used until the last two years. But “we have seen an increase in the number of renewable projects using New Markets and we expect that trend would continue.”

The bottom line, Petersen said, “is that this bill was not about solar. The ITC is available until 2016. Solar was in a pretty strong position going into this, so what we get are these residual impacts.”