First Solar (Nasdaq:FSLR) has revealed its consolidation plan.

The thin film market leader joins SunPower, the conversion efficiency leader, which is closing its 125-megawatt Fab 1 in the Philippines and moving some of those operation to Fab 2.

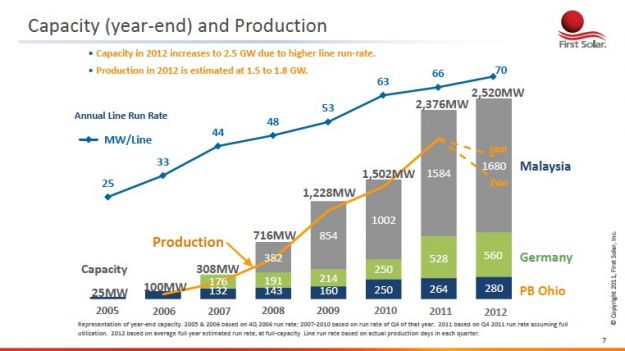

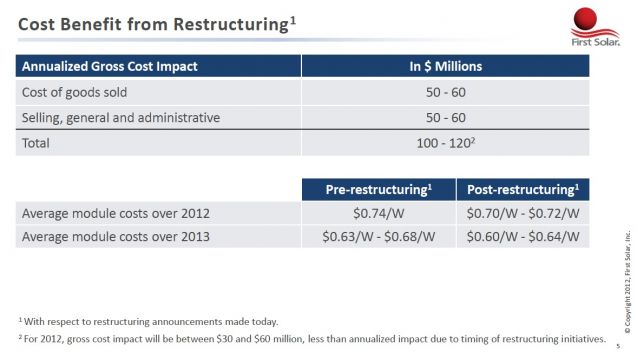

First Solar is closing its Frankfurt (Oder) manufacturing facility and indefinitely idling four production lines of the 24 lines in Kulim, Malaysia. The firm reports that it expects a savings of $100 million to $120 million annually as a result. First Solar also paid down $145 million in debt. The company is slashing headcount by 2,000 positions -- about 30 percent of its workforce. The firm wants to get opex down to 8 percent of revenue.

Last quarter, First Solar closed four production lines at the Frankfurt Oder plant and put its Mesa, Arizona production facility on hold indefinitely.

First Solar stock is trading at $21.52. That's up 3 percent, but still hovering near record lows.

This restructuring is being done "in response to deteriorating market conditions in Europe and to reduce costs and align its organization with sustainable market opportunities," according to a statement by the firm. “After a thorough analysis, it is clear the European market has deteriorated to the extent that our operations there are no longer economically sustainable, and maintaining those operations is not in the best long-term interest of our stakeholders,” according to Mike Ahearn, Chairman and Interim CEO of First Solar in a statement.

Hari Chandra Polavarapu of Auriga USA offered this analysis: "We view the restructuring as a sensible and realistic response to dislocated market conditions in solar PV that are aided by fickle subsidy policies in Europe impacting demand, and abetted by asymmetric competition/subsidies on the supply side from China."

First Solar expects to see a benefit in price per watt post-restructuring.

First Solar is still the largest solar module firm by market capitalization, the largest thin-film solar firm, one of the largest solar firms by capacity and shipments, and certainly by cumulative profits. The company is in the crosshairs of every other solar firm and continues to set the bar in terms of solar panel value and corporate performance.

Here are the highlights and lowlights from the most recent quarterly earnings call:

- Fourth-quarter production was 540 megawatts with net sales of $660 million, down from $1 billion last quarter.

- Net sales were $2.8 billion for 2011.

- Average conversion efficiency improved by 0.6 percent over the course of the year to an average of 12.2 percent -- an encouraging number.

- Average module manufacturing cost was reduced to $0.73 per watt, down $0.02 from the fourth quarter of 2010.

- The company's project pipeline is 2.7 gigawatts AC.

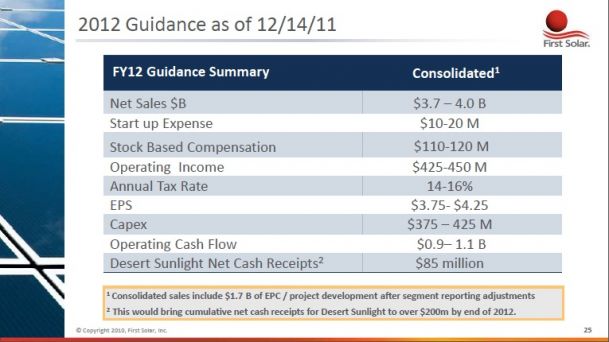

First Solar's 2012 guidance:

- Net sales reduced from $3.7 billion to $4.0 billion down to $3.5 billion to $3.8 billion.