First Solar (Nasdaq:FSLR) announced its Q1 earnings yesterday and posted its second-ever loss.

As reported yesterday, the company appointed Jim Hughes as new CEO, and as reported last month, First Solar idled lines in Malaysia, closed down its German factory, and fired 30 percent of its workforce, or about 2,000 employees.

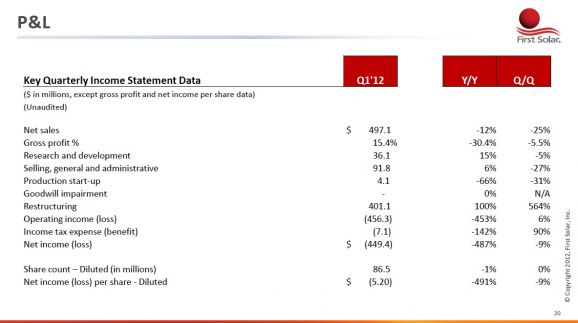

The quarter's loss was $449.4 million on $497.1 million of revenue versus net income of $116 million for the same quarter last year.

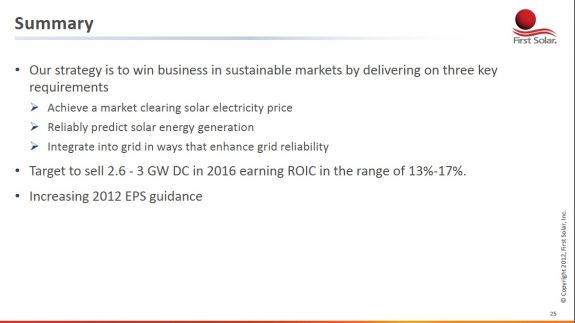

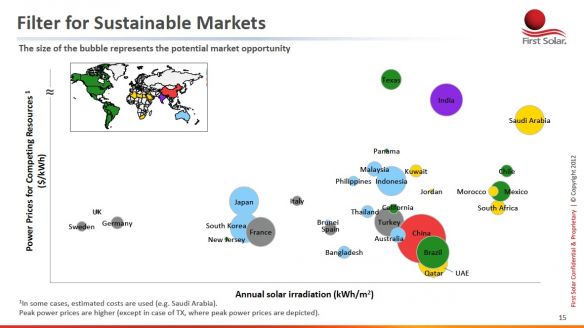

The company unveiled a five-year plan focused on emerging markets in the Sun Belt with a goal to ship 2.6 to 3.0 gigawatts at system prices, enabling a levelized cost of energy (LCOE) of $0.10 to $0.14 per kilowatt-hour. The stock is down and trading at close to 52-week lows:

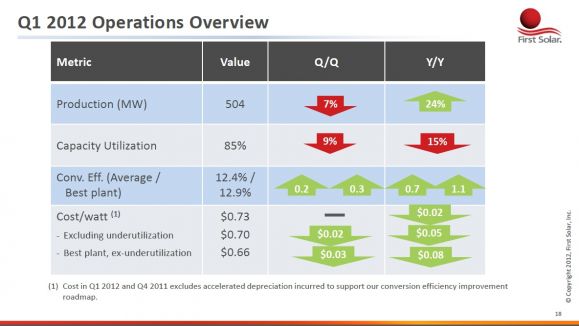

The once high-flying thin-film solar firm had 2,520 megawatts of production capacity at the end of the fourth quarter, and anticipates producing 1,500 to 1,800 megawatts this year.

Analysts are all over the map on the quarter's results and hopes for the company. Here's a sampling of analyst reactions:

“Closure of the German operation is indicative of permanent change in Europe,” according to Rob Stone of Cowen & Co. in a May 1 research note. “We expect sizable charges for capacity adjustments to overwhelm operating results.” Stone calls a Neutral rating on the shares.

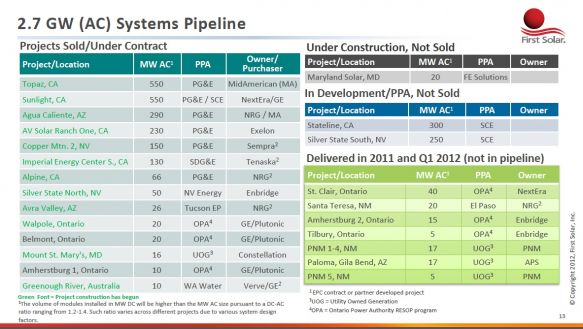

Hari Chandra of Auriga calls the stock a Buy with a $53.00 price target. Chandra notes that revenue guidance remained intact at $3.5 billion to $3.8 billion and that the "business model is well cushioned -- investor cynicism needs to change: We see First Solar's existing 2.7GW (AC) project pipeline providing it with sufficient earnings cushion/flexibility to navigate the current industry dislocation, and believe investor focus on module dynamics is increasingly irrelevant to First Solar, and more so as it moves into a non-subsidized utility-scale solar power project paradigm. Utility-scale solar offers cost, scale, and efficiency advantages and delivers a need based solution in several key geographies of the world."

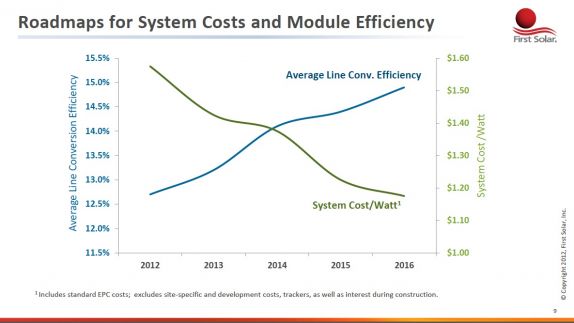

Chandra adds that "First Solar's transition to non-subsidized markets rests on delivering solar power at $0.10 to $0.14/kWh based on system costs of $1.40 to $1.60 per watt by 2016, so solar can be a compelling value proposition without any subsidies."

Sanjay Shesthra of Lazard writes that "bifurcation is in fact starting to unfold in the sector with leading players delivering profitable performance and strong cash flow in the current unprecedented industry downturn." Shesthra has a $50 price target.

Aaron Chew of Maxim has a Sell rating on the stock and a price target of $9, saying, "Even amidst low expectations, Q1 results missed by a wide margin." He added, "With module ASPs down (12 percent) to ~$0.86 per watt and module cost per watt flat at $0.73, gross margin (x-warranty charges) of 23 percent trailed the Street at 26 percent." FSLR has net debt (x-restricted cash) for the first time at $115M.

Canaccord Genuity's analyst Jonathan Dorsheimer maintained his Hold rating on the company and lowered his price target to $20 from $22. One of his concerns was "the latest warranty expenses relating to a prior 'manufacturing excursion' raises the question as to whether these improvements were too good to be true and if future problems from its break-neck pace of innovation may surface down the road.” He added, “With the maturing of the traditional markets, First Solar is hoping emerging countries will provide it with necessary growth. Given the company’s scale, these projects will have to individually be quite large. Aside from the clear difficulties in simply making PV (photovoltaic) economics work in what will likely be unsubsidized markets, we question the readiness of these markets for potential hundred-million-dollar deployments.”

Barclays Capital writes, "Though First Solar appears to be taking the necessary initial steps in attempting to optimize the company's operations, it is difficult to look past the numerous fundamental challenges facing the company. We believe management will have a difficult time easing a majority of investor concerns when it reveals its 3-year plan during its 1Q results tomorrow. In our view, while its pipeline provides some level of cash support, there are simply too many unknown variables to justify a floor valuation at this juncture." Barclays suggests a per-share rate in the $18-$20 range, although it notes there "are too many unknowns to call a floor."

Baird reiterates its Neutral rating with a $25 price target, saying, "We are positive on its cost-reduction efforts and strategy of identifying partners to move into new markets, but at this point, there is still limited visibility into the origin of FSLR's new pipeline."

The Hedge Zone writes, "The sheer magnitude of First Solar's rise and fall has been monumental. At $18 a share, it would need to gain well over 1,000 percent to reach its '08 high of $311. We do not necessarily call that upside, but there does exist some potential for outsized gains from current levels should things change positively in the industry," adding "Yet, we think First Solar, through its painful restructuring away from subsidy-driven markets, is actually better positioned than most in the industry to survive and profit once we see a reversal of current trends. Of course, those trends may not reverse over the short term, which would mean more pain for shareholders. In that case, however, we believe First Solar may still be a takeover candidate, given its discounted price relative to book value."

Here are some of the more interesting slides from the Q1 presentation deck: