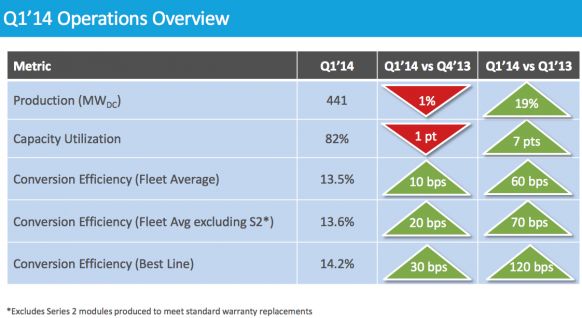

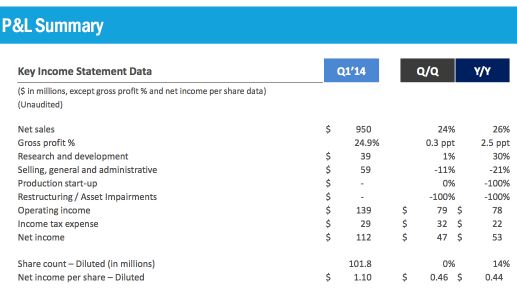

Vertically integrated thin-film solar supplier First Solar almost doubled Wall Street estimates with earnings of $112 million on a posted first quarter revenue of $950 million, an increase of $182 million from the fourth quarter of 2013.

Jim Hughes, First Solar's CEO, noted a positive book-to-bill ratio and "strong utility-scale growth" in the U.S., as well as sustainable demand in Latin America and Africa.

Vishal Shah of Deutsche Bank noted the strong beat and guidance raise as a positive, along with strong solar industry pricing, demand and U.S. utility demand. The DB analyst said, "We see upside to [the] 2014 earnings outlook," adding, "We also believe 2016 targets are conservative and given the strong demand from U.S. utility segment, we see upside to 2016 earnings targets."

Baird observes, "Bears may focus on Q1 bookings of 312 megawatts, but growing pipeline should support bookings throughout the year. Total outstanding bookings increased from 2.7 gigawatts to 2.8 gigawatts. Additionally, FSLR’s total development pipeline increased to 12.2 gigawatts from 10.6 gigawatts DC, with ~600 gigawatts coming from the U.S., including the Southeast U.S. where solar has historically been underutilized."

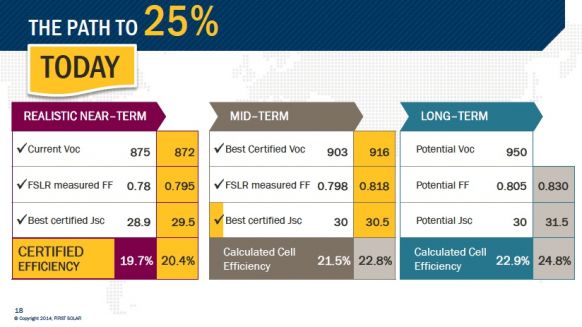

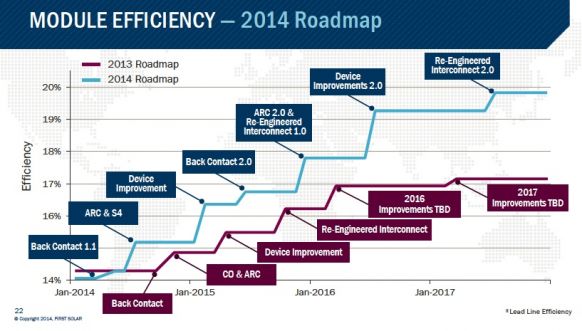

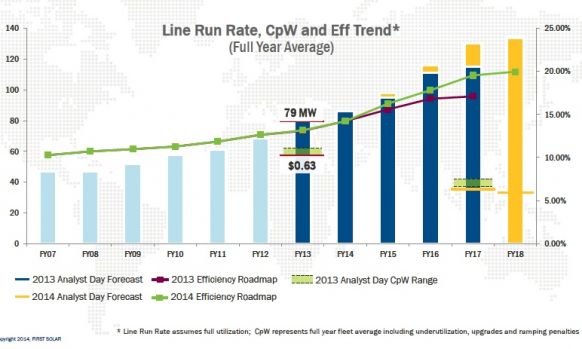

First Solar's CFO noted the improvement in module conversion efficiency as part of a company-wide change in "back-contact material." He said that the rollout of the back-contact program over the last few days had brought "nearly all twenty-four of our lines" to running at 14 percent efficiency or better. There are two remaining efficiency programs to be instituted in the third and fourth quarters of this year.

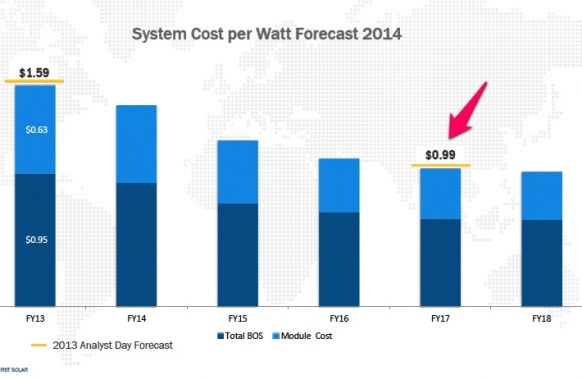

The CFO noted that First Solar was no longer disclosing cost per watt "for commercial reasons."

The CEO mentioned that the firm is involved in a 5-megawatt hybrid solar and diesel project at a mining site in Australia and sees hybrid installations as an emerging market.

Analysts repeatedly asked the CEO about First Solar's YieldCo plans. The CEO noted that First Solar has been more likely to take on construction risk "because the value of the asset justifies the risk." He said that First Solar had thought about that long before the current YieldCo wave and that the firm noted all YieldCo filings and announcements but did not feel compelled to make an urgent decision.

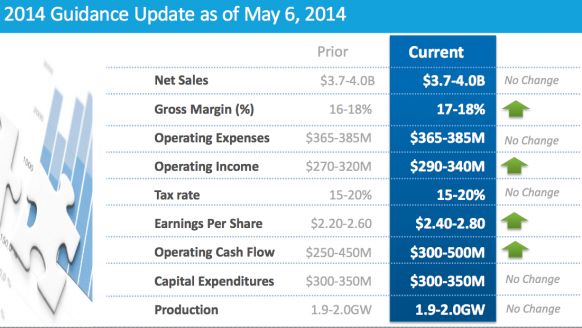

Update to guidance

First Solar is boosting 2014 guidance as follows:

- Gross margin of 17 percent to 18 percent, compared to previous guidance of 16 percent to 18 percent

- Operating income of $290 million to $340 million, compared to previous guidance of $270 million to $320 million

***

Here's a bit of our coverage from First Solar's analyst day in March:

- First Solar updated its module efficiency with a guidance that confronts average Chinese c-Si performance head-on by 2016

- Company representatives are speaking of a "split" manufacturing line that decouples front-end and back-end processes -- a markedly new approach for the firm

- The firm's new systems cost forecast is less than $1.00 per watt by 2017

- The new module cost forecast is less than 40 cents per watt by 2018

- More than 4 gigawatts of deployable capacity will be in place by 2017

- First Solar bumped up the CdTe module efficiency record to 17 percent, from the April 2013 mark of 16.1 percent