First Solar, the vertically integrated solar power plant and module manufacturer, just announced third-quarter 2016 financial results.

Here are the highlights and lowlights:

- Net sales of $688 million for the quarter fell short of expectations, dropping 46 percent year-over-year, a decrease of $246 million from the previous quarter. The miss was due to project timing.

- Results beat analysts’ profit estimates once again, and the company raised its full-year gross margin forecast.

- GAAP earnings per share of $1.49 beat consensus.

- The company has cash and securities of $2.1 billion and net cash of $1.3 billion.

- Bookings this quarter were lower than expected, at approximately 250 megawatts.

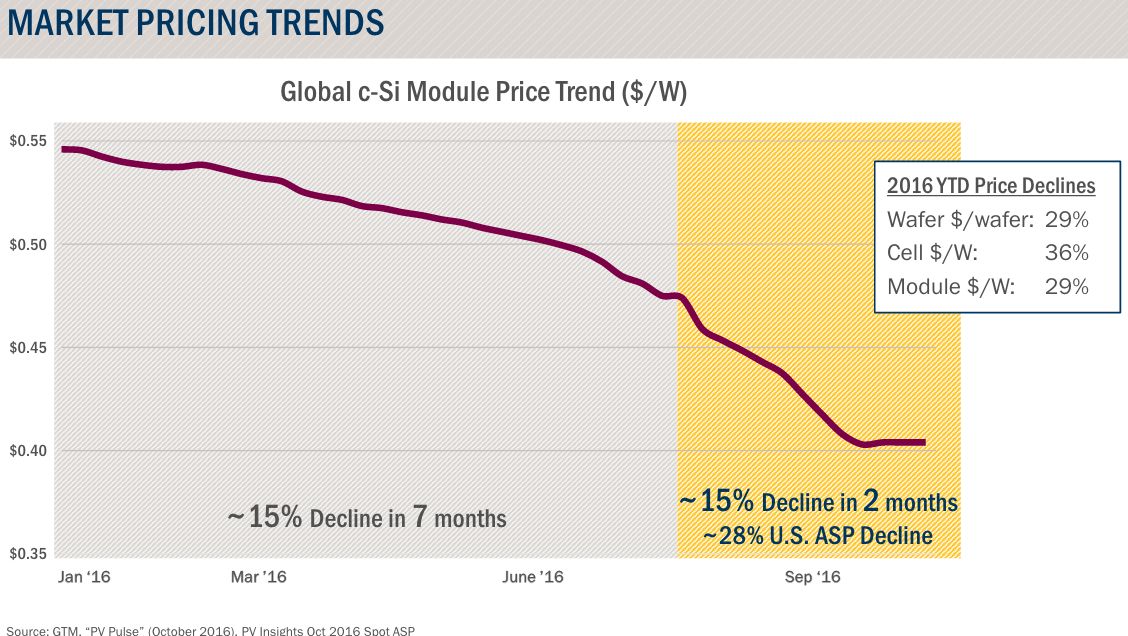

Dramatic pricing declines

First Solar's CEO Mark Widmar said, "Module pricing has declined at a dramatic rate in the third quarter," adding that the company is "in the process of evaluating certain decisions related to our production capacity, module product transitions, and operating expense rationalization."

Transition straight to Series 6?

First Solar has a solar module technology roadmap that advances from its current Series 4 module to a larger form-factor in two stages, Series 5 and then Series 6 with its 400-watt peak power output. The new form factors can reduce production costs, balance-of-system costs and soft costs.

But those plans might be changing -- or at least accelerating.

According to the CEO, "In the current ASP environment without further cost reduction, Series 4 and Series 5 margins may be challenged. We expect that our Series 6 module would be our most competitive product and enable us to capture greater gross margin per watt." He added, "In regard to Series 5, we are looking very hard at the cost structure and how to bring the module cost per watt down further in this competitive environment. In terms of our Series 6 product, we have dedicated significant resources to focus on how to accelerate the roadmap and product availability."

Is First Solar going to skip over Gen 5 and go straight to Gen 6? Our sources say that this is going to happen sooner rather than later -- expect a verdict on the November 16 outlook call.

"Our long-term plan has always been to have the two products coexist. But given the current market environment, we're re-evaluating that and we're trying to make a decision that if we can get the cost profile of Series 5 down to a level...we think it needs to be to give us acceptable margins on the sale of that product, then we'll move forward with that transition."

"If we're not able to do that, we may look to move straight into a Series 6 platform with a view of trying to pull that product forward as quickly as possible. We have been having ongoing discussions with our internal teams. We've had ongoing discussions with subcommittees within our board, and we'll have our final review with the board next week and we'll make a decision from there."

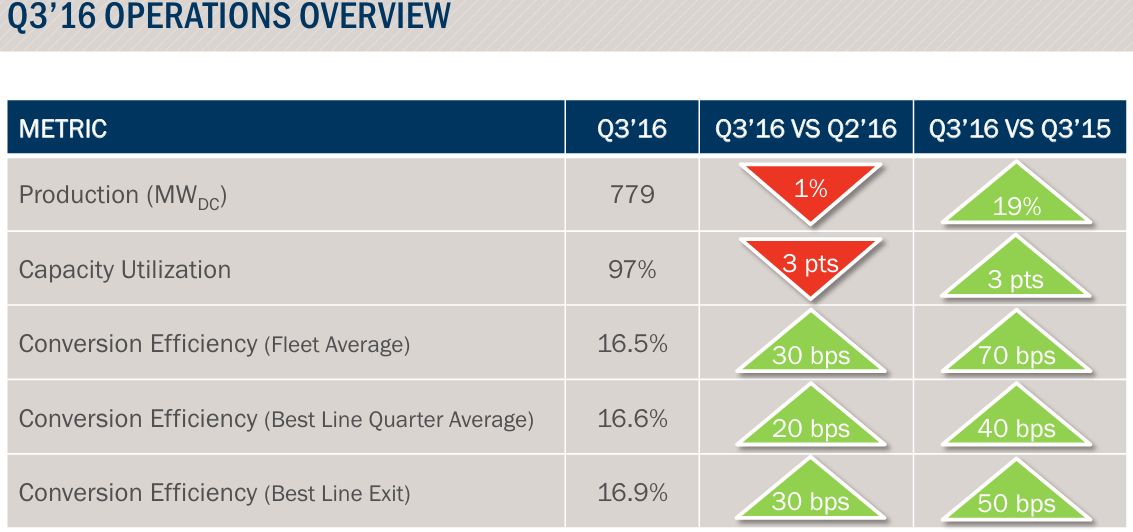

Operations and efficiency

CEO Widmar noted, "Our entire fleet module efficiency for the past quarter was 16.5 percent." Module conversion efficiency on First Solar's best line averaged 16.6 percent this quarter, and the lead line exited the quarter at 16.9 percent.

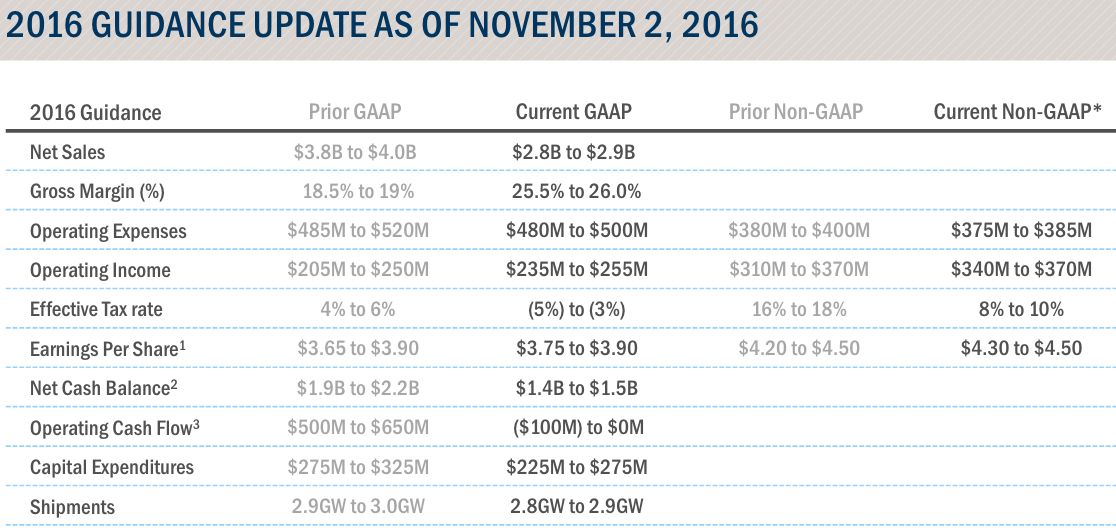

Updates to guidance

Net sales guidance for 2016 was revised to $2.8 billion to $2.9 billion from the prior guidance of $3.8 billion to $4 billion. "This change is due to project timing, as we now expect to complete the sale of our Moapa and California Flats projects in 2017." The company now expects 2016 gross margins of 25.5 percent to 26 percent, versus its previous range of 18.5 percent to 19 percent. The company maintains its expected GAAP earnings per share in the range of $3.75 to $3.90.

The state of utility-scale solar

GTM Research VP Shayle Kann recently said that although procurement is down, "It's worth reiterating just how big the existing [utility-solar] pipeline is."

"Even just as of today, there's still about 9 gigawatts of utility-scale solar that has a contract in place and an expected 2016 commercial operation date. Aside from that, you have another 12 gigawatts with a contract in place for after 2016." Additionally, the renewable portfolio standard is receding as the dominant driver for utility-scale solar, and new drivers are emerging.