Microinverter maker Enphase Energy (ENPH) just announced financial results for its third quarter.

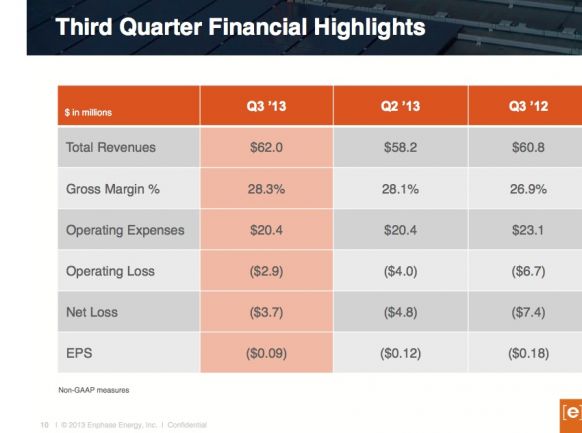

The company reported record-breaking revenue of $62 million and gross margin of 28.1 percent, while keeping its operating expenses flat. The stock is trading at $8.25 (up 4 percent) and finally showing some buoyancy as the stock price flirts with its original IPO price. The company shipped 426,000 units (amounting to 94 megawatts) this quarter.

As the company shipped its 4 millionth microinverter this quarter, losses narrowed to $6.3 million.

CEO Paul Nahi noted that the firm is bullish on business in 2014, especially in the U.S., U.K., and Australia, along with growth in commercial-scale business. (Approximately 15 percent to 20 percent of the company's business is in the commercial sector today.) Nahi cited a 3-megawatt project for several facilities across the San Diego Unified School District as an example of the move to the commercial scale.

Nahi said that market share is steady, and that competition, in the U.S. at least, is not in microinverters but in traditional string or central inverters. He added that he is not seeing a change in the fundamental inverter market landscape. He went on to note that business was soft in the EU countries like France and the Netherlands because of the slowdown of FIT programs. He also alluded to a degree of weakness in the Hawaiian market.

Guidance for Q4

- Enphase expects revenue for the fourth quarter of 2013 to be within the range of $62 million to $65 million

- Fourth-quarter margin is expected to be within the range of 29 percent to 32 percent

As in previous earnings calls, the CFO of Enphase looked out to breakeven when operating expenditures hit $24 million, with $80 million per quarter in revenue at a 30 percent gross margin.

Here's an incomplete list of competitors and aspirants in the microinverter sector:

- SMA is still the dominant inverter company in a volatile, consolidating $7 billion market. SMA "is now shipping the [SMA microinverter] to the U.S. market."

- SolarBridge is a microinverter maker in the business of AC modules, getting to market in partnership with module makers.

- ReneSola is delivering 10,000 units per month in the U.S., according to Brian Armentrout, the firm's marketing director.

- Enecsys VP Kevin Bushby claims Enecsys has 160,000 microinverters worldwide through distributors and in cooperation with module makers.

- Power-One, acquired by ABB, has a microinverter and is offering installers a $20 per unit rebate for its 250-watt and 300-watt units.

- Petra Solar has installed over 170,000 AC modules, according to Mary Grikas, VP at Petra.

- Altenergy Power Systems has shipped more than 100,000 microinverters, with the majority going to the Australian residential market, according to a spokesperson from the firm.

- Chilicon Power has just started building microinverters for its first large design win of 170 kilowatts (680 modules) in Simi Valley, California, according to a release.

- SPARQ Systems is partnering with Solartec Mexico, a solar panel manufacturer, to deploy solar on 1,000 "small homes" with PV modules using SPARQ's microinverters.

- CyboEnergy builds a "mini-inverter" with per-module-MPPT for four modules.

- The firm iEnergy has been shipping into the U.S. market since late last year.

- Involar, LeadSolar, and Samil Power also build microinverters.

Within the greater module-level panel electronics market, Enphase, SolarEdge (SolarCity is a customer), and Tigo account for 93 percent of the market share, according to GTM Research's MJ Shiao.