This is the first piece in a three-part series offering insights and perspectives from GTM Research’s latest smart grid report, Distribution Automation 2012-2016, Technologies and Strategies for Grid Optimization. Click here to learn more.

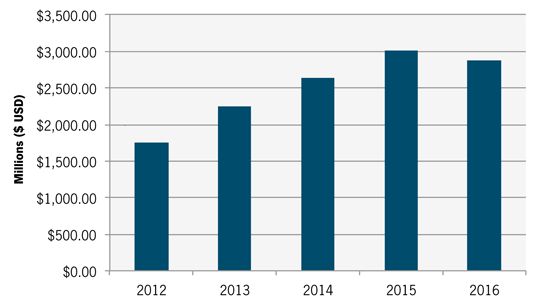

Stimulus funding gave many utilities the money to get the first generation of distribution automation (DA) projects in the ground. To attract the next level of investment -- utilities will have to get state public utility commissions to approve capital recovery rate cases. Without capital recovery approval, distribution automation investments will remain in the purgatory of a utilities operations and maintenance budget, where little money is left after tree trimming, maintenance, and asset replacement. Evidence from various pilot projects of high returns on investment, without any change in customer behavior, will provide the necessary support to drive DA investment outside of California, positioning the DA market to eclipse $3 billion in 2015.

FIGURE: Distribution Automation Market Forecast, 2012-2016

Source: GTM Research

The Golden State

Although ARRA funding provided the capital for many early DA projects, the bulk of current investment in DA is occurring outside of ARRA. Not surprisingly, California’s IOUs are leading this trend, investing between $1.03 billion and $1.08 billion from 2011 to 2015* to keep pace with regulation and maintain the stability of the distribution grid.

Extensive rollouts are planned throughout the Golden State, including: improving communications and control of grid assets, enabling Volt/VAR optimization, fault location, isolation, and service restoration (FLISR), managing disruptive generation and loads from distributed generation (DG) and electric vehicles (EVs), and incorporating intelligent asset management to lengthen asset lifetimes.

Overall, distribution automation spending in American Recovery and Reinvestment Act (ARRA) smart grid projects has been anemic. Through the second quarter of 2011, only $120 million had been spent on DA over 10 quarters, while those same projects doled out $529 million to Itron for AMI hardware, software, and professional services. Quarterly spending on DA from ARRA-funded projects is rapidly increasing, from an almost non-existent base of $11.5 million during Q3 2010 to $41.4 million in Q2 2011.

This upward trend will continue into 2012, as utilities finish their AMI deployments and focus more attention on DA. The ascendance of DA investment under ARRA will be far less drastic than that of AMI, as the majority of the DA projects are pilots, much of the ARRA funding has already been spent, and the final projects are scheduled to conclude in 2014. A few months after the completion of its ARRA-funded Volt/VAR optimization study, Oklahoma Gas and Electric announced a second round of investment beyond its ARRA project to expand its Volt/VAR optimization solution to an additional 400 circuits. As more results from these ARRA pilots are analyzed over the next few years, GTM Research expects many of the utilities that received ARRA funding to follow Oklahoma Gas and Electric’s lead.

FIGURE: California IOUs' Planned Capital Expenditures (Millions $USD)

Source: GTM Research

The Rest of the States

GTM Research has identified 71 smart grid projects with a DA component in the United States. More than 40 of these projects are in part funded by ARRA stimulus funds. Twenty of the 71 projects are valued at over $100 million; however, most of the money in these projects is devoted to AMI deployments. Exceptions to this include projects undertaken by Electric Power Board of Chattanooga, Southern California Edison, San Diego Gas and Electric, Pacific Gas and Electric, Con Edison, and Oklahoma Gas and Electric.

FIGURE: Selected DA Projects in the U.S. by Utility and DA Technology

Source: GTM Research

The Second Wave

Growth in the DA market will be driven by a larger second wave of investment approved by state public utility commissions. The evidence gathered during ARRA and non-ARRA pilot projects is demonstrating the fast return on investment, sometimes as quick as 18 months, that various DA technologies provide. Utilities can leverage evidence of the strong benefits from DA to convince public utility commissions to authorize capital recovery plans to expand the scope of these projects.

Pilots around the country are proving the social and direct monetary value of DA projects. As more of these results are made public, GTM Research expects utilities around the country to make significant investments in DA projects to seize some of the lowest-hanging fruit of the smart grid.

For more information on Distribution Automation 2012-2016: Technologies and Strategies for a Digital Grid, visit http://www.greentechmedia.com/research/report/distribution-automation-2012-2016.

* does not include Southern California Edison’s 2015 investments

_540_151_80.jpg)

_540_278_80.jpg)