Advancing another potential renewable energy trade war, the tariffs imposed on Chinese and Vietnamese wind turbine tower manufacturers in June have been affirmed by the U.S. Department of Commerce (DOC).

The U.S.-based Wind Tower Trade Coalition (WTTC) petitioned DOC and the International Trade Commission (ITC) at the end of 2011 to investigate countervailing duties allegations against Chinese tower makers and to investigate anti-dumping allegations against Chinese and Vietnamese tower makers.

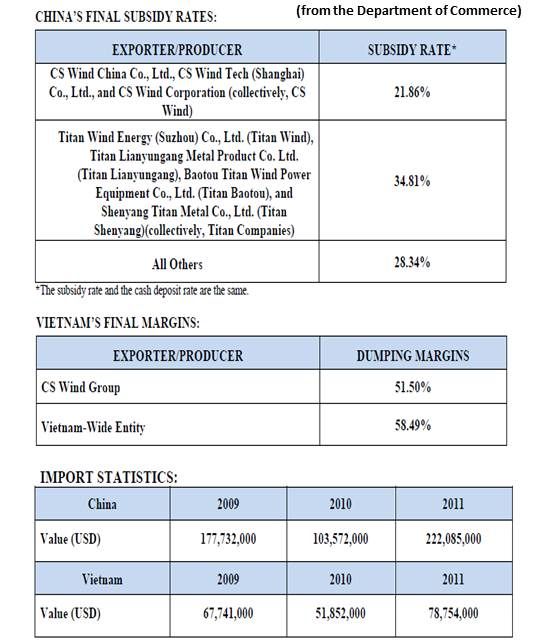

In 2011, imports of utility scale wind towers -- towers for turbines of over 100 kilowatts in nameplate capacity -- from China were valued at an estimated $222 million and those from Vietnam were valued at an estimated $79 million.

“Today’s Commerce Department decision was expected,” said Dan Pickard, one of the two Wiley Rein lead attorneys for the WTTC. “The big one will be early next year, when the ITC rules on whether the Chinese and Vietnamese import practices have materially injured the U.S. companies. If the ITC rules affirmatively, tariffs will be imposed for five years, can be re-imposed every five years and will be subject to yearly re-evaluation.”

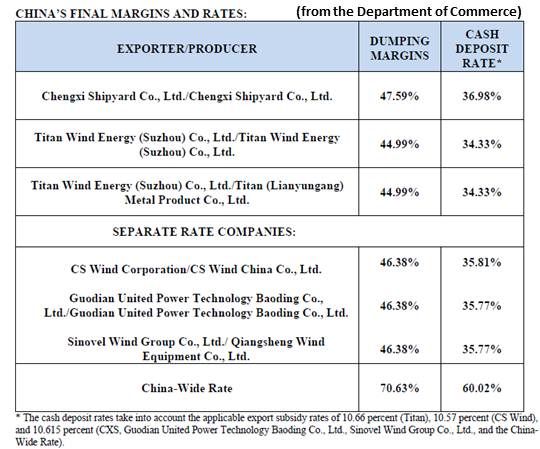

The DOC’s final determination is that producers/exporters from China have sold utility-scale wind towers in the United States “at dumping margins of 44.99 percent to 70.63 percent” and those from Vietnam have sold at dumping margins “of 51.50 percent to 58.49 percent,” DOC reported. “Commerce also determined that producers/exporters from China have received countervailable subsidies of 21.86 percent to 34.81 percent.”

For the Chinese companies, the DOC will require cash deposits equal to the dumping margin less an adjustment (the cash deposit rate) plus the subsidy rate.

A cash deposit will be required of the Vietnamese companies equal to the dumping margin.

If the ITC affirms the DOC ruling, these cash deposits will become tariffs.

“These are substantial margins,” Pickard said. “They will have a real effect on the marketplace.”

“The Chinese government has targeted the clean energy industries -- a variety of clean energy industries -- with massive subsidies that have distorted the marketplace,” Alan Price, another Wiley Rein attorney, told GTM when the petitions against imported wind turbine towers were filed. “The subsidies are well documented,” Price added. They can be found, he said, in official government documents, including China’s most recent five-year plans.

Wiley Rein represented the coalition of solar panel manufacturers in the successful petition of the DOC that resulted in an almost 32 percent tariff being levied on imported Chinese solar panels.

The WTTC comprised four companies when the petition was filed. Stressed by economic pressures, DMI Industries and Katana Summit have left the business, sold their assets and are not expected to come back. Trinity Structural Towers and Broadwind Energy continue to struggle.

While the new tariffs are intended to protect U.S. companies, many believe they will be counterproductive to wind’s newly announced target to bring its costs down enough to be incentive-free by 2019. The rule of thumb is that the tower accounts for 10 percent to 20 percent of the $1.5 million to $2.5 million turbine price.

The impact of Chinese and Vietnamese imports on Trinity, Broadwind and the rest of the U.S. market is somewhat clouded by the huge strains on the wind industry from the failure of Congress to extend wind’s production tax credit (PTC).

“People aren’t going to build towers in the U.S., because without the PTC, nobody is going to put the farm up,” an independent tower maker not involved in the WTTC action told GTM in the spring. Orders, he said, had stopped coming into his shop. “It’s really great that they’ve put the tariff on to keep the Chinese and Vietnamese out of here, but unfortunately there probably isn’t going to be much of a wind business in the United States until the PTC passes.”

“The impact of dumping in a down market is even greater,” Pickard said, “because competition is greater for fewer buyers.”

An official with a national railroad that handles wind tower transport told GTM that soon after the tariffs were imposed in June, their business shifted from the transport of imported towers from West Coast ports to the transport of domestic towers loaded regionally.

It has remained busy, the railroad official added, because the second half of 2012 has been a record year for wind as developers rush to finish projects by December 31, 2012, when the PTC expires. But the railroad is forecasting a 50 percent drop off in wind industry transport activity for 2013, he said.

An argument against such cases is that they unnecessarily inflame international players, and only result in circumvention of the imposed tariffs.

Circumvention, Pickard explained, is “the criminal attempt to work around anti-dumping orders or countervailing duty orders. It is not unusual in Chinese import matters. There are efforts by CBP to prevent it and action on Capitol Hill to create stiffer penalties.”

But, he added, it is different “if it is a small commodity that someone is attempting to trans-ship through a third country and fraudulently change the country of origin. It’s probably going to be more difficult with a 150-ton steel tower.”