After spending more than $250 million, Solexel (rechristened as Beamreach last year) has joined its brethren on the list of failed solar startups. This follows a late-in-corporate-life shift to low-weight modules and away from its original thin-silicon aspirations.

In 2008, no solar entrepreneur or investor envisioned photovoltaic module costs of 30 cents per watt -- which is where we are today. A startup founded in 2008, like Solexel, based its business plan on module costs of about $4 per watt and falling.

The firm received $3 million in DOE funding in 2008 for a project with this description: "Solexel plans on commercializing a disruptive, 3-D, high-efficiency mono-crystalline silicon cell technology, while dramatically reducing manufacturing cost per watt. Solexel plans to deliver a 17%-19% efficient, 156 x 156 mm2, single-crystal cell that consumes substantially lower silicon per watt than conventionally sliced wafers. Solexel aspires to be a GW scale PV producer within five years."

That last thing didn't happen.

The first time the company unstealthed in 2012, it was focusing on its thin-silicon technology and looking to mass-produce 35-micron-thick high-performance, low-cost monocrystalline solar cells using a lift-off technology based on a reusable template and a porous silicon substrate. The startup hit an NREL-certified cell efficiency of 21.2 percent in 2014 with its back contact cell.

Solexel aimed to ship 20-percent-efficient photovoltaic modules at a cost of $0.42 per watt by 2014.

That didn't happen.

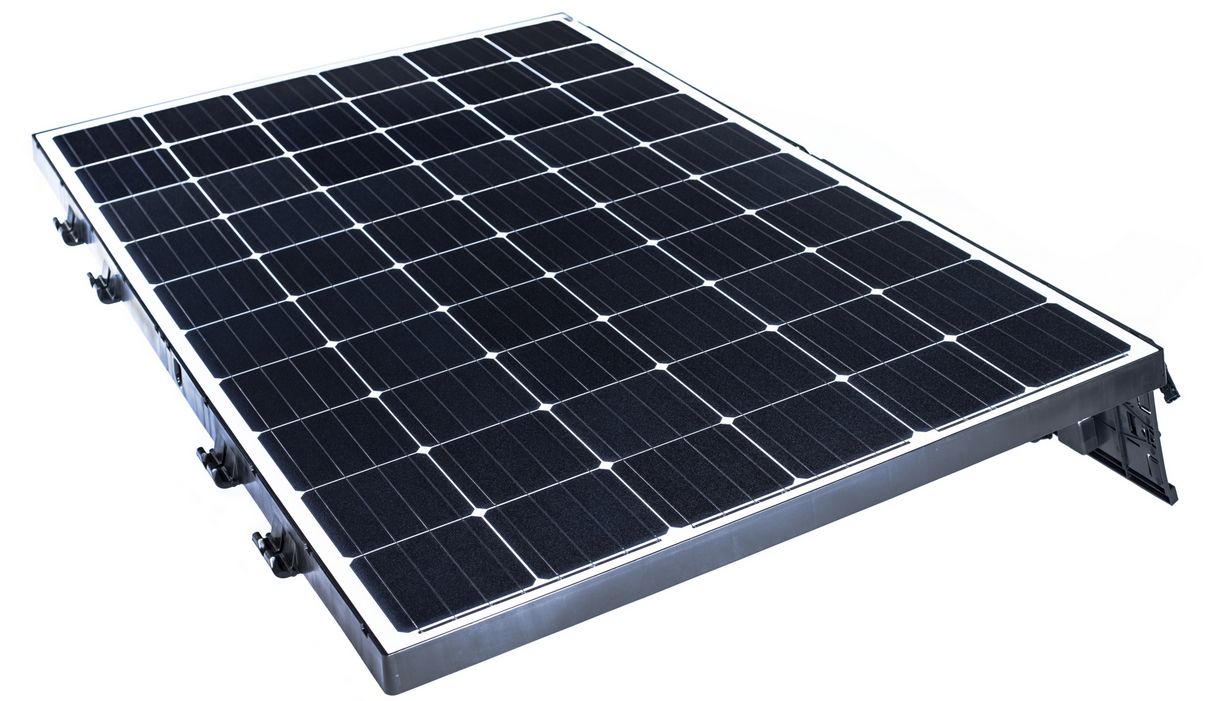

Last year, the rebranded Beamreach pivoted to go after the commercial and industrial rooftop market with a lightweight, easy-to-install module with the use of thinner front sheet glass, a composite material for the frame, an integrated mounting structure and an adhesion method for low-slope commercial rooftop surfaces.

That product received a positive market reception.

But debt has come due and the company's venture investors are walking away.

Beamreach raised its quarter billion from investors including Riyadh Valley Company, the VC investment arm of King Saud University of Saudi Arabia, and GAF (a large roofing materials manufacturer), along with SunPower, KPCB, Technology Partners, The Westly Group, DAG Ventures, Gentry Ventures, Northgate Capital, GSV Capital, Jasper Ridge Partners, and Spirox. The firm's board of directors includes Jan van Dokkum of KPCB and, until recently, Ira Ehrenpreis.

Somewhere along the line, the board saw fit to spend millions building a manufacturing facility in Milpitas, Calif.

The firm has few employees remaining after a series of recent and not-so-recent layoffs. Vendors are not getting paid. According to sources close to the firm, this is bankruptcy and liquidation -- not a Chapter 11 reorganization. Beamreach picked up $25 million in senior debt financing from Opus Bank in 2015.

Commercial market potential, but too late in the game

When Beamreach was a thin-silicon or high-efficiency player, it might have been competing against SunPower, SolarCity, Panasonic, Samsung, Suniva or 1366 Technologies. After its shift, Beamreach looked a bit like tenKsolar, which offers high-efficiency photovoltaic systems for commercial rooftops and ground-mount projects, or even a bit like SunPower with its integrated solution.

Certainly, the commercial market is ready to grow. In the recently published report U.S. Commercial Solar Landscape 2016-2020, GTM Research forecasts the U.S. commercial solar market to "rebound and nearly triple in size by 2020."

But, nine years of legacy misspending have left Beamreach with "loans due" and "a catastrophic cash flow situation," despite what sources suggest is substantial demand and "sales traction" for the new commercial product. It's a smart market niche to chase -- but it's too late for Beamreach.