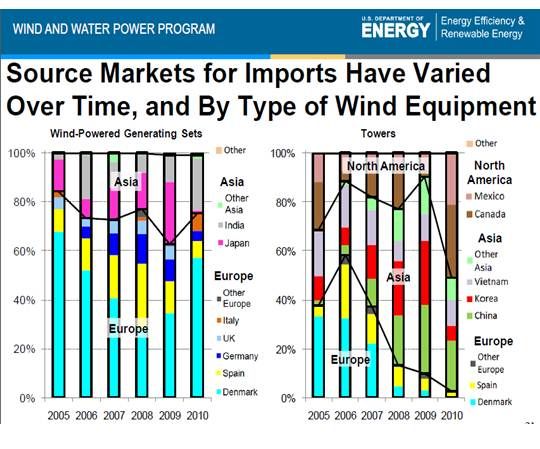

The U.S.-based Wind Tower Trade Coalition (WTTC) wants the U.S. Department of Commerce (DOC) and the International Trade Commission (ITC) to investigate Chinese and Vietnamese tower makers. A petition charges that those countries’ government subsidies allow them to sell towers to U.S. wind manufacturers at below-market prices.

"The Chinese and Vietnamese industries are using unfair pricing practices to capture critical sales from the U.S. industry,” Alan H. Price of WTTC counsel Wiley Rein LLP said in a statement. The petitions request anti-dumping and countervailing duty investigations and charge “dumping margins of 64.37 percent for China and 59.11 percent for Vietnam,” according to a Wiley Rein statement.

Wiley Rein’s petition defines dumping as “when a foreign company sells a product in the United States at less than fair value.” A countervailing duty investigation looks at subsidies that “are financial assistance from foreign governments, provided to foreign manufacturers, that unfairly benefit the production, manufacture or exportation of goods in that country.”

A similar petition on behalf of solar panel manufacturers was filed with the DOC and the ITC by Wiley Rein. The Coalition for American Solar Manufacturing (CASM) charges that “illegal trade practices are harming the U.S. economy and causing thousands of good manufacturing jobs to be lost,” according to SolarWorld Industries’ President Gordon Brinser.

According to Wiley Rein, the petitions on behalf of the WTTC ask the DOC and the WTC for “significant remedial duties on Chinese and Vietnamese imports of utility-scale wind towers.” The petitions define utility-scale wind turbines as those of 100 kilowatts or more.

The petitions are similar to a complaint against Chinese manufacturers brought in 2010 by the U.S. Trade Representative on behalf of U.S. wind industry manufacturers and the United Steelworkers at the World Trade Organization. In response, the Chinese government pulled the subsidy program in June 2011. “Other subsidy programs remain in place,” according to Wiley Rein, “providing substantial benefits to Chinese wind tower producers.”

There are also lawsuits against Sinovel, China’s leading turbine manufacturer, that are now working their way through Chinese courts. The lawsuits were brought by AMSC, a U.S. advanced technologies provider. The confession and conviction of a former employee of AMSC subsidiary WindTec make it hard to believe that Sinovel is not liable for damages from intellectual property (IP) theft and collusion to transfer software designed to meet new Chinese transmission system regulations.

Published reports identify the members of the WTTC as Trinity Structural Towers, DMI Industries, Katana Summit and Broadwind Energy. They make up a dominant segment of the U.S. utility-scale turbine manufacturing industry.

“As a result of dumping and improper subsidies,” according to a Wiley Rein statement, “the U.S. industry is suffering severe harm as seen in employment levels, pricing, production, and profits. Chinese and Vietnamese imports of wind towers have escalated significantly, costing U.S. manufacturers sales and injuring American workers.”

The effect of the Asian manufacturers’ practices in both solar and wind is double-edged, according to some observers: They contribute to the falling costs of wind and solar, but could also threaten the viability of the U.S. industries.

The impact of dumping, according to Wiley Rein, affects utility-scale wind tower manufacturing facilities in California, Colorado, Iowa, Illinois, Nebraska, North Dakota, Tennessee, Texas, Washington, and Wisconsin.

GE, Vestas, Siemens and Mitsubishi would be the turbine manufacturers for whose business the tower makers would be competing because they accounted for 80 percent of the U.S. wind turbine manufacturing industry between 2002 and 2010.

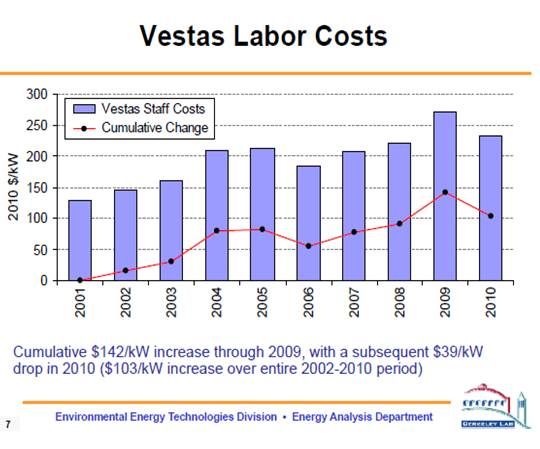

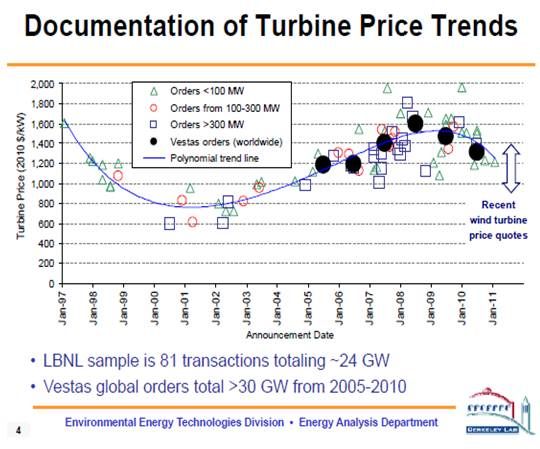

Recent studies from the Lawrence Berkeley National Lab and NREL found that wind turbine prices in the U.S. have fallen by 20 percent to 30 percent since reaching a peak in 2008. This is expected to lead to a 24 percent to 29 percent drop in the levelized cost of wind-generated electricity over the next two years. Researchers attribute the bulk of this drop in costs to gains in efficiency and advancing technology.

The wind industry rule of thumb is that the tower is approximately 10 percent to 20 percent of the total turbine price.

The DOC and the ITC are expected to begin anti-dumping and countervailing duty investigations by mid-January. The ITC's preliminary determinations should come in February 2012 but the DOC’s preliminary determinations will take about six months. Final determinations are expected in nine to 13 months.