Advanced Energy's solar inverter business is for sale, as the company explores other "strategic alternatives" such as a joint venture or licensing arrangement.

This development did not seem to come as a surprise to many in the industry.

In 2012, Advanced Energy acquired REFUsol, a large inverter supplier -- and today it is the No. 2 supplier in the U.S. behind SMA and No. 7 worldwide, according to GTM Research's upcoming inverter report. But that doesn't change the inverter industry's fundamental nature of price pressure, narrow margins and increased competition.

AE has shipped more than 1 gigawatt of inverters globally in 2013 and has maintained leadership in the U.S. non-residential market with a 2014 market share percentage in the low thirties (data from the PV Leaderboard).

But GTM Research Solar Analyst Scott Moskowitz notes, "Due to falling prices and lethargic growth in the commercial market, this has translated not only into lost margins but also into lost revenue."

MJ Shiao, GTM's Director of Solar Research, adds: "AE's solar inverter business has been struggling to keep up with tremendous pricing pressure in the U.S. resulting from European competition, module price stagnation and, more recently, low-cost Chinese vendors. While it tried to pick up margins by shifting its manufacturing offshore, the move came only recently. The gross margin profile for solar inverters has been weak for commercial and utility inverters, especially in comparison to AE's thin film business. Given continuing pricing pressure as Chinese vendors like Chint and SunGrow ramp up their U.S. presence, growing margins will be difficult."

Shiao concludes, "The AE brand remains strong in the U.S., but AE's dependence on the U.S. commercial and utility sectors cloud its easy growth prospects once the ITC drops. While the REFUsol acquisition gave AE a global product line, development in foreign markets has been weak."

The Fort Collins, Colo.-headquartered firm has had a number of recent personnel moves. Yuval Wasserman was promoted to CEO after Garry Rogerson resigned that role in October. In November, it was announced that Danny Herron, the company's EVP and CFO, would step down, to be replaced by William Trupkiewicz, who had been serving as chief accounting officer.

The company has a broad line of power and control products for thin film manufacturing and employs about 1,700 worldwide, with about 500 in Fort Collins. Advanced Energy's stock is currently at $22.89, up 0.84 percent.

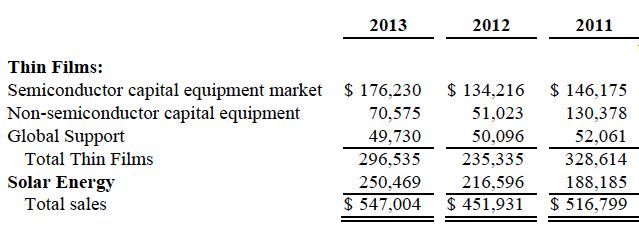

According to its 2013 annual report, 46 percent of AE's business in that year was from its solar unit. Figures below are in thousands: