A few months ago, we published an article that asked, "What is Really Happening at Abound Solar?"

We've just learned the bad news -- and maybe some good news.

Abound is halting production of its first-generation, 10.5-percent-efficiency cadmium telluride (CdTe) PV module in order to transition to building its next-generation, higher-efficiency module. That's the good news. The bad news is that the transition will result "in the temporary reduction of approximately 180 permanent jobs" from its Loveland, Colorado production facilities, according to a release and FAQ from the firm, which was the beneficiary of a $400 million DOE loan guarantee.

We were prompted to ask "What is Really Happening at Abound Solar?" because despite the firm's optimistic pronouncements on efficiency, sales, and capacity -- the company was on its third CEO and two of its senior staff -- Russ Kanjorski, VP of Marketing, and Julian Hawkins, Senior VP -- had left to join Semprius and the now bankrupt ECD, respectively. Why would these executives leave the relatively comfortable confines of Abound to join much more uncertain situations? And in Hawkins' case, to get dropped onto the deck of the Titanic?

Abound has drawn down $70 million of its $400 million loan guarantee in order to fund its first-generation factory buildout. The firm shipped 25 megawatts in 2010 and approximately 45 megawatts in 2011.

Abound builds 2-foot-by-4-foot CdTe PV panels (as does General Electric), inspired by the dimensions of First Solar's panels. Within the CdTe materials systems, there's no standard process. First Solar uses a Vapor Transport Deposition (VTD) process, while Abound Solar and PrimeStar/GE use a Close Space Sublimation (CSS) process for CdTe manufacturing.

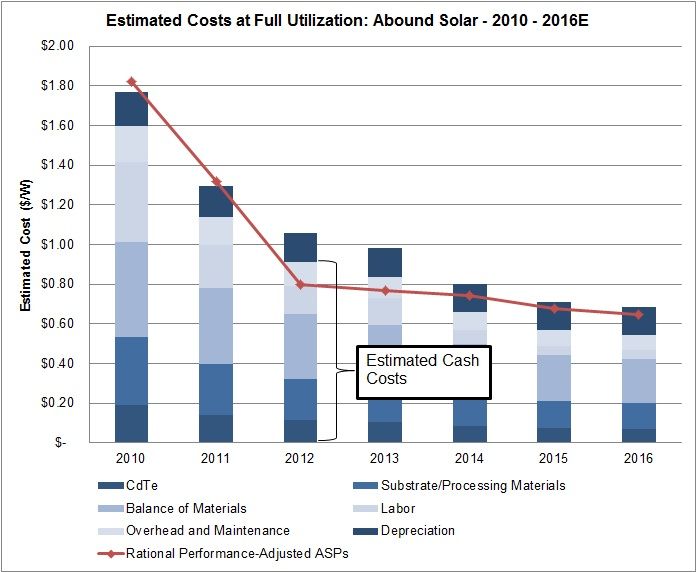

Abound has to compete with thin film leader First Solar. First Solar's 87-watt CdTe panels have a 12.2-percent conversion efficiency and a cost of $0.73 per watt, with expectations of reaching the mid-$0.60 range this year or next. If Abound is not approaching that cost per watt trajectory, the firm can't survive.

GTM Research estimates that Abound's current costs would be just above $1.00 per watt if they were running at full utilization -- which they clearly are not (see chart below and upcoming Thin Film PV report from GTM Research).

At least half of Abound's shipments came from projects installed in India supported by the Ex-Im bank. We have voiced the idea that the success of the CASM trade claim might be a boon to Abound, keeping Chinese panels from being sold at allegedly below-cost prices in the U.S.

Chart from GTM Research's upcoming market research report on thin-film PV