Swiss grid giant ABB has earmarked $9 billion to $18 billion for acquisitions over the next five years, and while it's already spent about $9 billion of that, it hasn't stopped buying. The latest addition to its stable is Tropos Networks, a 55-employee Sunnyvale, California-based wireless mesh networking startup that links up municipal Wi-Fi smart grid networks around the country.

Terms of the deal were not disclosed. Tropos has raised more than $30 million from investors, including Benchmark Capital, Duff Ackerman & Goodrich and Voyager Capital, and serves utility customers including customers including the City of Fort Collins, City of Naperville, Illinois, Silicon Valley Power and Burbank Water and Power -- a testament to its roots as a municipal Wi-Fi vendor.

Last year, Tropos CFO John Eichhorn described Tropos' financial status as "Slightly cash flow negative, but ... right on the cusp of being break-even," with deployments on the way.

“To really make the smart grid smart, distribution automation -- how [to] actually move the electrons around -- is the next big bottleneck,” said Eichhorn. “Substation automation or substation security… [is] not what is holding [utilities] back from having a smart grid. It is being able to manage the reclosers, transformers [and] switchers -- all the stuff that is in the middle of the distribution area network.”

Adding intelligence to the grid, and particularly the last few miles of it, has just begun. GTM Research predicts annual U.S. distribution automation spending willgrow from about $1.75 billion in 2012 to a peak of $3 billion in 2015.

Although Eichhorn believes that “there is a place for cellular, a place for WiMax, and a place for Wi-Fi,” Tropos will continue to pursue aggressive growth, with the hope of winning business that might otherwise go exclusively to Silver Spring Networks, Trilliant, On-Ramp Wireless or another smart grid networking provider.

It's an interesting move for ABB, which hasn't invested heavily in wireless communications amidst its $9 billion, multi-year acquisition spree. ABB’s big buys on the hardware side include efficient motor maker Baldor Electric for $4.2 billion in 2010 and low-voltage equipment maker Thomas & Betts for $3.9 billion in January. On the software side, it bought Ventyx for $1 billion in 2010, and combined its distribution grid software with Ventyx’s market forecasting, planning and data management smarts, as well as asset management from acquisitions like Insert Key Solutions and Obvient.

ABB also bought Powercorp, an Australian provider of technology that integrates intermittent renewables like solar and wind into the grid. Hogan has identified wind and solar power as key growth areas for the company. As for investments, ABB has put money into data center efficiency software startup Power Assure and plug-in car charging startup ECOtality, both involving future nodes -- data centers and plug-in charging stations -- that will need lots and lots of electricity over the coming years.

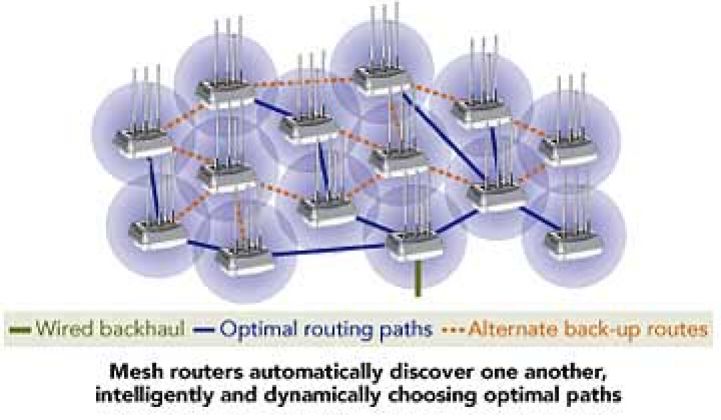

Tropos, for its part, has found a small niche in municipal utilities, where it can promise a smart meter or distribution automation radio network that also supports police, fire, ambulance and even city maintenance work trucks. It's all wireless IP (Internet Protocol) broadband, and ABB plans to integrate it into its existing offering of communications solutions for the power distribution sector. The two started doing distribution automation together in 2009, so presumably they've decided they work well together.

Tropos also offers ABB yet another foothold in the U.S. market, which has just surpassed Europe as the company's top region, driven by the Thomas & Betts acquisition. As Jens Birgersson, head of network management for ABB's Power Systems division, put it in Friday's announcement, “With a strong presence in North America, this acquisition will provide ABB with additional access to US markets, where we still have considerable room to grow.”

Stay tuned for more M&A in smart grid, and not just from ABB. Siemens, Schneider Electric, GE, Alstom and Toshiba have all spent billions over the past few years, and will likely spend more.