Since when did China become an enemy of the United States?

Since it started bailing out U.S. green technology companies that have backing from the Obama administration, that’s when.

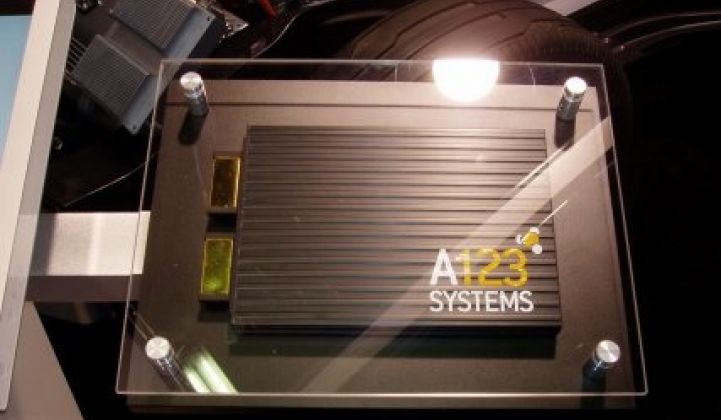

Such would appear to be the logic of U.S. Rep. Cliff Stearns, R-Fla, who came out strongly last week against the proposed $450 million deal that would give Chinese auto parts giant Wanxiang Group an ownership stake in the financially struggling -- and federally funded -- lithium-ion battery maker A123 Systems.

“It appears the Department of Energy and the Obama administration have failed to secure sensitive taxpayer-funded intellectual property from being transferred to a foreign adversary, which raises serious national security issues,” Stearns said in a statement.

Let’s break down that accusation into its constituent parts. First of all, it’s a bit hyperbolic to call China a “foreign adversary” in terms of the energy storage industry. After all, much of the advanced battery manufacturing today is carried out in China, including batteries from U.S.-based companies like A123 and rival lithium-ion battery maker Boston-Power, which announced a big Chinese partnership last week.

A123 does have more than $20 million in contracts with the U.S. military, which could provide some concern among lawmakers that its technology will now be available to a foreign company to study. Indeed, Energy Secretary Steven Chu has said that the federal government must keep a close eye on U.S.-China trade relations and technology sharing, to ensure that sensitive or protected technology remains free from foreign interference or capture, particularly in the realm of the power grid and other critical infrastructure.

But China is also going to be a huge market for energy storage and electric vehicle technologies, presenting a pathway for the two countries to cooperate, rather than compete, on those technology fronts. Given the relatively small market share U.S. companies now have in advanced batteries -- big players like Panasonic, LG Chem, Saft and BYD hail from Japan, South Korea, France and China, respectively -- it seems unwise for the government to pick a fight that could lead to a trade war like the one the solar industry is experiencing today.

What about the U.S. taxpayers’ stake in A123’s intellectual property? To be sure, the Waltham, Mass.-based company came out of the Massachusetts Institute of Technology, which gets federal backing like every other major research university in the country. The firm also got $850,000 in federal small business innovation and research grants after its 2001 spinout from MIT.

But the biggest chunk of federal backing for A123 -- the $249 million Department of Energy stimulus grant it got in 2010 -- has gone into building and operating its battery plant in Livonia, Mich. As A123 CEO David Vieau told reporters last week, the rescue package from Wanxiang will help retain those jobs and that manufacturing, not take them away. That’s because the battery maker, struggling under the costs of a massive recall of its plug-in vehicle batteries, could run out of money and go out of business without the financial help.

Meanwhile, A123 is supplying batteries to Fisker Automotive, BMW, and Chinese automaking giant SAIC, as well as truck and bus makers like Eaton, Navistar, and BAE Systems -- and that’s not counting its grid-scale energy storage work for utilities in the U.S. and abroad.

Finally, it’s important to place the recent A123 attacks in political context. Congressional Republicans have been relentless in bringing up the financial woes of a host of green technology companies that have gotten support from the Obama administration and later ran into financial trouble.

Ever since Solyndra went bankrupt last year, evaporating $535 million in federal loan guarantees for its uncompetitive thin-film solar technology, lawmakers have been ordering investigations into federal grants and loans to companies including A123 and its customer Fisker Automotive, the bankrupt flywheel energy storage Beacon Power and recent solar bankruptcy Abound Solar.

On the A123-Wanxiang deal, Kirsten Kukowski, a spokeswoman for the Republican National Committee, called it “just another example of Barack Obama’s failure to follow through on his economic promises and the millions of taxpayer dollars he has wasted," according to news reports.

Stay tuned for more political handball with this one, as both the U.S. and Chinese governments will have to approve the A123-Wanxiang deal before it is finalized. Here’s our coverage of last week’s announcement:

A123 Systems has found a rescuer in the form of Chinese automotive technology giant Wanxiang, which has offered a $450 million investment that would give it majority control of the struggling U.S. lithium-ion battery maker.

A123 announced the news during its Wednesday quarterly conference call, and shares of the beleaguered Waltham, Mass.-based company were up slightly in morning trading as a result. Even so, A123’s shares have been languishing in the 50-cent range for the past few months, hobbled by the company’s ongoing struggle to stay solvent amidst a $67 million battery recall for its automotive customers.

The company has told investors it needs to raise cash to stay afloat, and only had enough cash for about 4 to 5 months of operation as of July. In May it announced a private offering of $50 million in senior unsecured convertible notes and warrants for institutional buyers, and in July announced plans to raise about $39 million in cash to shore up its finances.

The Wanxiang investment will include a bridge loan of up to $75 million and the purchase of $200 million A123 senior secured convertible notes and warrants, with the potential to purchase $175 million more at a future date. It’s expected to close by the end of the year, and the bridge loan should give A123 "sufficient capital to get through the next several months,” CFO David Prystash said. Forbes reports that the non-bridge loan portion of the investment would value A123 at 77 cents per share, a significant premium to its current trading price.

The news comes as A123 reported a second-quarter 2012 loss of $82.9 million, compared with a loss of $55.4 million in the same period last year. That comes on top of a $125 million loss in the first quarter, more than double the loss from the same quarter last year.

Given A123’s financial challenges, any rescue of this magnitude must be seen as a good thing compared to the alternative of insolvency. Wanxiang, which has $13 billion in revenues, has the kind of balance sheet that could reassure investors.

But a proposal to give a Chinese company effective control over A123 won’t sit well with its political backers or attackers. A123 received a $249 million Department of Energy grant and $100 million in state tax credits to build its its Livonia, Mich. facility, the same factory that produced the defective batteries now being recalled.

A123 has faced questions from U.S. Senators Chuck Grassley, R-Iowa, and John Thune, R-SD, as to whether it should continue to maintain access to its $249 million Department of Energy loan guarantee in the face of its recall and uncertain financial position. A123 has about $120 million left of the $249.1 million grant, and in April received a two-year extension on its deadline to spend the money.

A123 announced an important technological breakthrough in June that could lead to batteries that retain their charge at extreme temperatures without the need for expensive thermal management systems. But the company doesn't expect to see the technology enter volume production until mid-2013.

A123 lost $257.7 million in 2011, a 69-percent increase from losses in 2010. It held long-term debt of $161 million as of May, and its market capitalization as of Friday afternoon stood at $70 million, down from $170.68 million in July and a steep fall from its peak market cap of about $2.3 billion in 2010.

A123 customers include Fisker Automotive, General Motors, BMW, SAIC Motor Corp., Tata Motors and Smith Electric Vehicles, though the company didn't specify which were involved in the recall. A123’s battery defects did end up playing a role in problems for key customer Fisker, however, which has stopped work at its Delaware factory and faced problems meeting the terms of its own $529 million federal loan.

Transportation remains A123's most important line of business, although its grid storage business has been growing in the past year or so, with installations and orders that added up to 100 megawatts by the end of 2011, much of it in partnership with AES Energy Storage.

About a year ago, VC investor Vinod Khosla spoke to about 300 energy storage experts at the annual Energy Storage Association (ESA) meeting and predicted that A123 would not be around in ten years. He cited lithium's volatility and inherent safety issues. That news was less than satisfying for many in the audience (which included A123).