An established Oahu-based solar installer told Greentech Media this week, "We're taking in more signed contracts in volume than we have in our history, but we're installing less than we ever have."

While residential solar remains a strong growth business on the mainland, the solar business on Hawaii's most populated island, Oahu, is in decline -- despite falling installation costs and new financing options.

As the installer mentioned, it's not for lack of consumer demand.

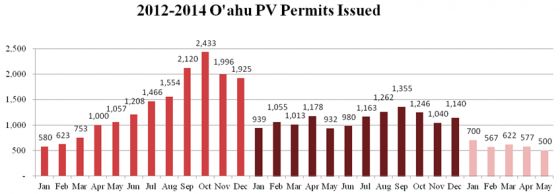

Here's a chart of PV permits issued on Oahu over the last three years:

Chart provided by Marco Mangelsdorf, President of Hilo-based ProVision Solar, with data from the Honolulu DPP.

According to the HECO website, there are more than 40,000 solar PV systems interconnected on the Hawaiian Electric Company’s grids with a total collective capacity of more than 300 megawatts, leading the U.S. in solar watts per customer and solar installations per customer. Approximately 10 percent of HECO's customers now have rooftop solar, a higher percentage than any utility on the mainland.

But the utility has moved into unknown territory at these PV penetration rates. After having its foot on the accelerator for the last few years, the utility appears to be putting the brakes on for new PV installs.

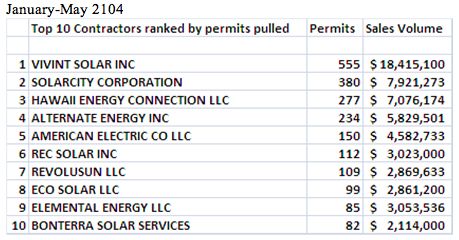

There were 2,966 permits issued in the first five months of this year versus 5,117 permits issued in the same time period in 2013. Vivint is the leading installer so far in 2014, followed by SolarCity and Hawaii Energy Connection.

According to the utility, "This unprecedented rapid growth in rooftop solar in Hawaii has resulted in some neighborhood circuits reaching extremely high levels of photovoltaic [penetration]. An increasing number of distribution-level circuits have rooftop PV capacity exceeding 100 percent of the daytime minimum load, the trigger for interconnection studies and possible implementation of safety measures or upgrades before new PV systems on that circuit can be interconnected to the grid."

Marco Mangelsdorf, president of Hilo-based ProVision Solar, said that there is a "substantial lag from when the sale is made, the PV permit issued, and when HECO gets around to inspecting the system, replacing the meter and registering the new PV kilowatts. But inevitably, these lower PV permit numbers, month after month after month, will equate to less and less PV capacity coming on-line as recorded by the utilities."

Mangelsdorf added, "No relief appears to be in sight for the declining PV permit numbers as contractors downsize their workforce by as much as 50 percent."

Despite NREL studies concluding that Oahu's grid can handle 20 percent wind and solar penetration, keeping the lights on amidst record levels of distributed generation is another thing. And that's the challenge faced by HECO with the Oahu grid.

At what PV penetration rate does a residential utility circuit become unsafe? What real problems does over-generation present? Who pays for the upgrades to handle the new hardware needs of a bidirectional grid? How will solar installers fare amidst this stall in market growth?

The Oahu-based installer sees this as a "wake-up call" to other utilities. He noted that Hawaiian Electric has been "stellar" in allowing the adoption of renewables, but cited September 6 of last year as being when "the gauntlet came down" and HECO required pre-approval for NEM interconnects. Prior to that, it was just paperwork, according to the installer. He said that the NEM program had been "mismanaged" and suggested that the PUC was asking HECO, "Where is the vision; where is the plan?"

It's had an impact on headcount, and solar installers have had to "adjust the size of their firms to be sustainable. We've had to adjust to utility conditions," said the Oahu-based CEO.

MJ Shiao, Director of GTM Solar Research, notes, "At low levels of penetration, PV simply looks like a load reduction -- but at high levels of penetration, it can increase circuit voltage beyond regulated maximums or create other issues at the circuit level. "

"The question, of course, is where the line is between 'low penetration' and 'high penetration' -- or rather, how much PV can be installed before the utility has issues maintaining reliability," Shiao added.

"We understand so little about the actual effects, and it is so locationally dependent, that I don't think there's a good rule-of-thumb answer. Penalties for non-compliance on voltage and outages further incentivizes utilities to be conservative when drawing that line. Having a technical grounding doesn't make the price for interconnection studies or grid upgrades any easier to incorporate for PV installers, though. Also, having homeowners pay for major grid upgrades like cap banks is more severe than the situation in other markets. Then again, in Hawaii, approximately one in every fifteen households has a PV system -- and that far exceeds any other state."

GTM Research forecasts only a 7 percent compound annual growth rate for Hawaii through 2016, compared to California and New Jersey at 32 percent.

GTM Research on solar growth by state through 2016

***

Our earlier reporting on HECO's solar interconnection policy follows.

A new interconnection policy

According to the utility, "This unprecedented rapid growth in rooftop solar in Hawaii has resulted in some neighborhood circuits reaching extremely high levels of photovoltaic [penetration]. An increasing number of distribution-level circuits have rooftop PV capacity exceeding 100 percent of the daytime minimum load, the trigger for interconnection studies and possible implementation of safety measures or upgrades before new PV systems on that circuit can be interconnected to the grid."

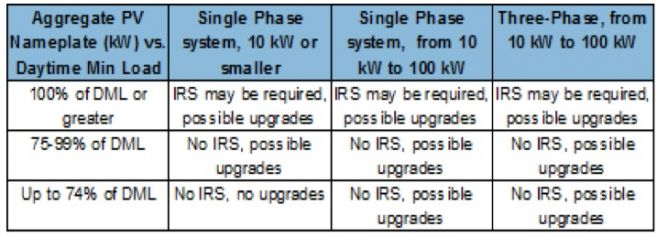

HECO has enacted a new policy which seeks a more deliberate approval of solar rooftops, as well as potentially charging power users for circuit upgrades. Here's a condensed summary of HECO's policies for interconnection requirements study (IRS), drawn from the utility's website.

- Single-phase projects that are 10 kilowatts or smaller on circuits with up to 100 percent (increased from 75 percent) of daytime minimum load (DML) do not require an IRS. (Daytime minimum load refers to electricity demand from 9 a.m. to 5 p.m.)

- In some cases, protective equipment upgrades may still be needed to interconnect safely on circuits with PV penetration levels of between 75 percent and 100 percent of DML. HECO will determine if any circuit or project upgrades are needed through a supplemental review, at no cost to the customer. If the utility installs the circuit upgrades, most customers will pay a prorated share of the cost, based on the proposed PV system size.

- When customers wish to add PV systems larger than 10 kilowatts and up to 100 kilowatts on circuits with penetration levels of less than 100 percent of daytime minimum load, no IRS will be needed. If circuit upgrades are needed, HECO will install them whenever possible, with most customers paying a prorated share of the cost.

- For circuits already equal to or greater than 100 percent of daytime minimum load, where an IRS might still be needed, HECO engineers will "proactively use experience with the supplemental reviews" (at HECO's expense) and past interconnection studies to determine if upgrades are needed, avoiding additional interconnection studies, if at all possible. If upgrades are deemed necessary, customers will only pay a prorated share.

Here's the chart from HECO:

Local Oahu press has quoted a HECO spokesperson as saying that the utility cannot permit circuits to become “dangerous” or “unreliable” because of “too much PV on those circuits.” HECO’s Peter Rosegg said that the utility’s grid was never designed to convey power in two directions, and too much PV on a circuit would cause overvoltage and reliability issues.

Reports published on the investigative journalism website the Honolulu Civil Beat quote HECO vice president Scott Seu as saying, "Although more than 80 percent of circuits on Oahu have room for more solar without the need for detailed safety and reliability studies, we've now reached the point on others where the levels of solar require our utilities and the solar companies to be more cautious."

The situation on the Big Island tracks that of Oahu. A report on the website Big Island Now quotes Jay Ignacio, president of HECO subsidiary HELCO, as saying, "We have, this past year, encountered a situation where the amount of PV that people are applying to connect to the circuit reaches a point where we have concerns, either with the voltage quantity or safety issues." He continued: "We’re currently at the level [on the Big Island] where 10 percent of our circuits have reached that point, where we have to tell people applying to add PV that they need to wait.”

Ignacio added, “If there’s more generation than energy being used, the energy needs to go some place. This is a difficult technical issue, and we’re not aware of another utility in the world that has addressed it. There’s no model for us to follow, no resource for us to tap into. We’re really creating new frontiers on this."