SunEdison just posted a presentation made as a "cash update" to the principals of its second lien lenders last month. It reveals a bit more about the company's dire straits.

SunEdison debtor dive

-

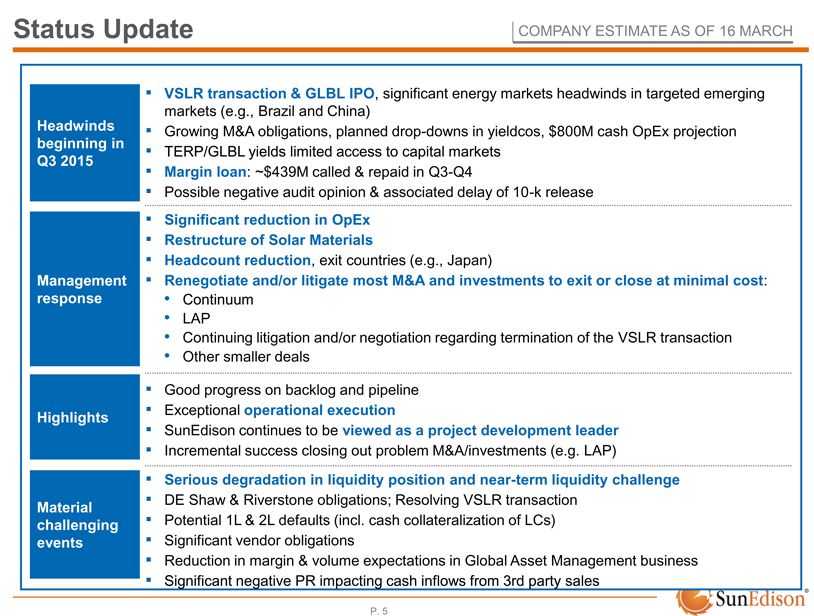

The company confirmed its debtor-in-possession talks and detailed its "headwinds"

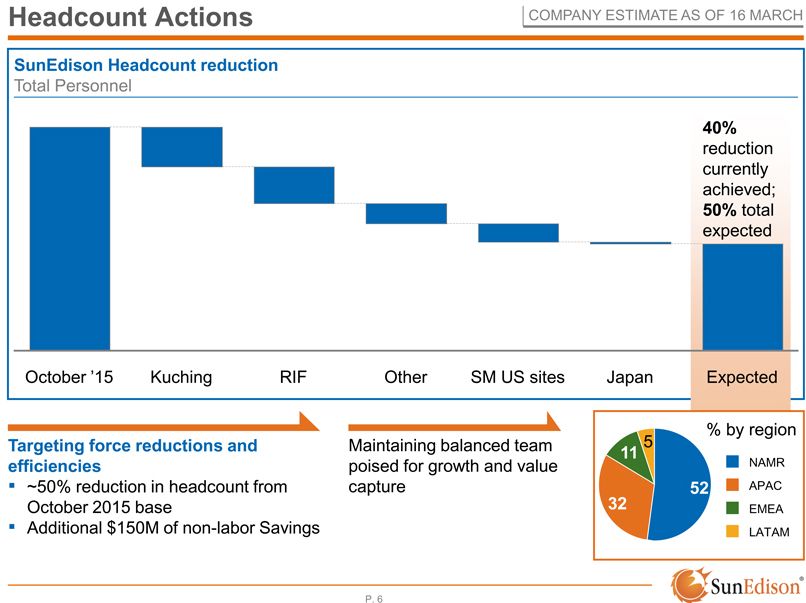

- SunEdison has had a 40 percent headcount reduction since October 2015 and expects to lay off another 10 percent of its workforce

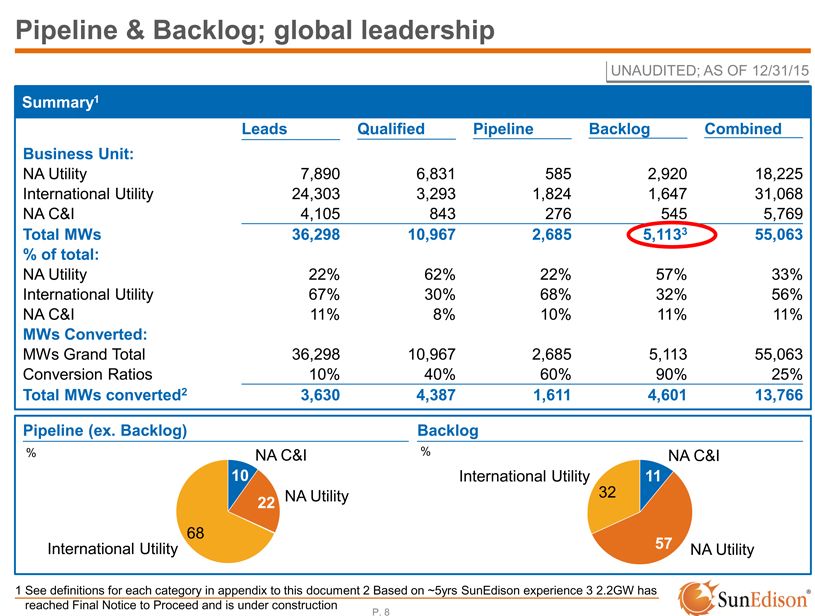

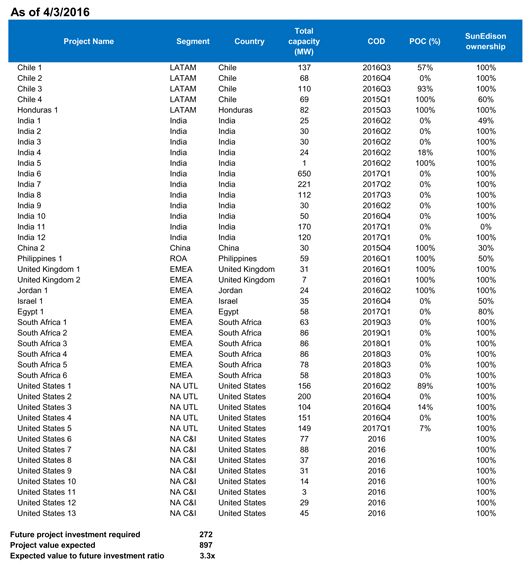

- The company still has an enormous backlog and pipeline, getting more stale each day that SunEdison remains in limbo

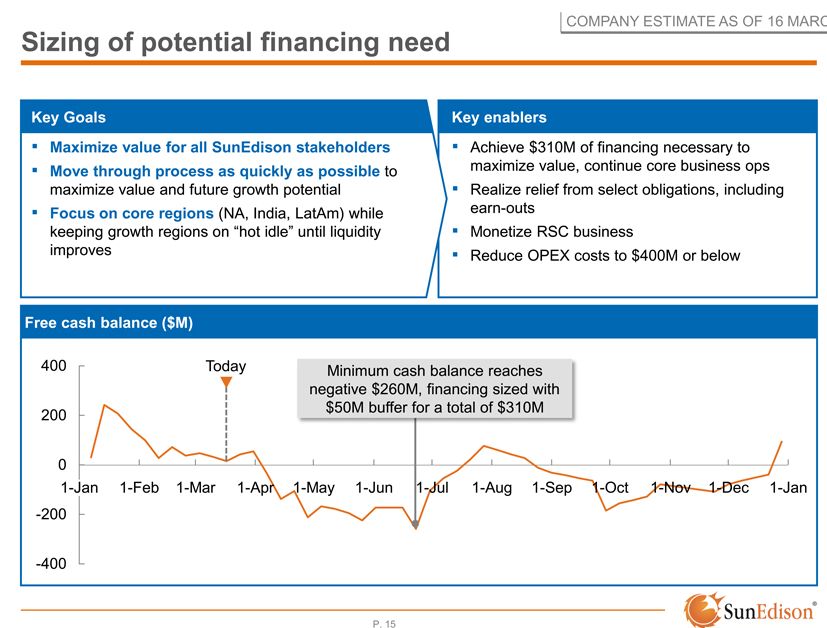

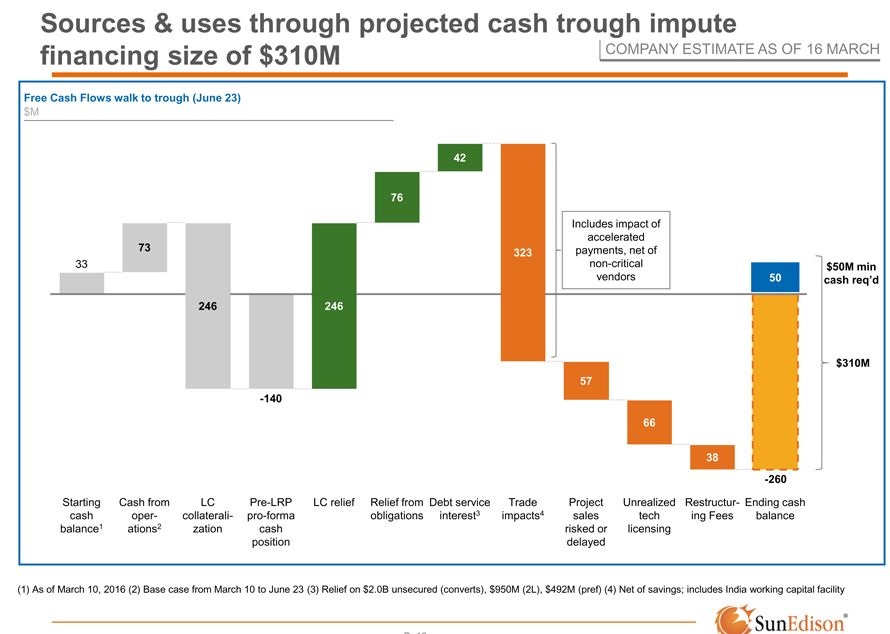

- One scenario has the firm seeking $310 million in financing to keep itself afloat

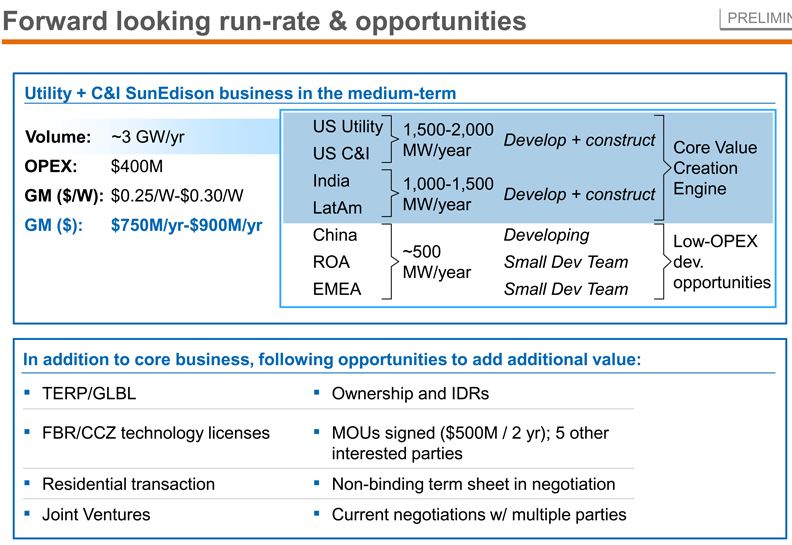

- The plan is to "monetize RSC business" -- which may mean SunEd is looking to sell its residential/small commercial operation

According to an article in yesterday's Wall Street Journal, in a meeting "earlier this month with some senior managers at SunEdison’s offices in California, Mr. Chatila, who has never sold SunEdison shares, said he had a plan to see the company through a swift restructuring. It would emerge, he told them, stronger than ever."

This is another example of what an independent counsel called "the Company’s overly optimistic culture and its tone at the top."

Our sources expect SunEdison's bankruptcy filing to occur next week.

A dive into SunEdison's internal fraud investigation

(published April 14)

SunEdison's internal investigation by its audit committee and independent directors found the troubled solar and renewable developer "lacked certain accounting controls," but found no evidence of fraud, as reported in an SEC filing today. The investigation was based on allegations made by current and former executives and employees.

SunEdison's stock price jumped more than 60 percent on the news -- so if you bought SunEdison stock yesterday, you've done well. Most other shareholders have seen the stock lose 90 percent of its value since the beginning of the year.

SunEdison claimed that it found no misstatements in its financial reporting and “no substantial evidence to support a finding of fraud or willful misconduct of management other than with respect to the conduct of one former non-executive employee."

The company also stated that it needs to implement better cash-flow controls, “including extensions of accounts payable and the use of cash committed for projects.”

The independent counsel "identified issues with the Company’s overly optimistic culture and its tone at the top," and the independent directors "identified issues with cash forecasting and liquidity management practices."

The firm claims "the recent hiring of a chief financial officer designee will act as a remedy," adding that "the Independent Directors have determined to strengthen internal controls at both the enterprise and project level to enhance visibility and control over project status and cash availability, as well as to strengthen legal groups, restructure and strengthen the Company’s financial planning and analysis group, and to replace a departure in its internal audit group."

The company still has not filed its 2015 and Q4 financial reports.

***

Here's some more of GTM's recent coverage of the company.

Reports from The Wall Street Journal that the beleaguered solar developer intends to file for Chapter 11 bankruptcy protection this month.

Bankruptcy is not a surprise to anyone who's been watching closely -- but the actuality of the human and financial scale of this implosion is breathtaking.

According to anonymous sources, the firm is in talks with two creditors to gain operating cash to keep the company alive during the bankruptcy filing period.

The WSJ reported that creditors including senior bank lenders led by Deutsche Bank "are likely to take control of the company and its portfolio of power projects." Another group of creditors includes the hedge funds that joined in a $725 million junior-debt offering earlier this year.

Here's a review of SunEdison's disastrous March.

- SunEdison delayed its 2015 and Q4 financial report to deal with two internal investigations into the accuracy of its financial disclosures.

- Goldman Sachs, Barclays, Citigroup and UBS, the banks loaning SunEdison ~$2 billion for its Vivint acquisition, “have balked at providing [the] loans” according to the WSJ.

- Vivint Solar withdrew from SunEdison acquisition.

- SunEdison and TerraForm Power announced a $28.5 million settlement and termination of the Latin America Power acquisition.

- SunEdison and TerraForm again postponed filing 2015 financials.

- The SEC is looking into whether SunEdison actually had $1.4 billion cash as it reported in November last year or if the company misrepresented its cash position.

- In early March, SunEdison's long-time CFO Brian Wuebbels left that role to join YieldCos TerraForm Power and TerraForm Global as CEO. Last week, Wuebbels, one of the architects of SunEdison's current dilemma, resigned as president, CEO and as a member of the board of directors. According to a release, TerraForm's board has formed an office of the chairman, led by Peter Blackmore, chairman of the firm, to lead TerraForm Power on an interim basis.

- The DOJ is looking into transactions between SunEdison and its YieldCos

What will the bankruptcy look like, and what about the TerraForms?

As the WSJ reports, "A SunEdison bankruptcy filing would be problematic for its two YieldCos." Although the YieldCos "are in far better financial shape than SunEdison," they depend on SunEdison "for many services." The YieldCos "don’t plan to file for bankruptcy protection, but their shares represent much of SunEdison’s value."

How would the YieldCos operate as independent entities? SunEdison’s stakes in the TerraForms are already attracting interested bidders, according to reports.

An industry expert looks ahead to how this will play out:

"SunEdison will have [debtor-in-possession] financing in place. They file a bankruptcy to prevent actions by creditors. I would guess they have a plan for orderly disposition of some assets (which might otherwise have been blocked by creditors if terms were unfavorable). They will want to hang on to development assets and have a plan for continuing the business around those assets and related business. Equity and debt will fight in bankruptcy, but it looks like the equity is worthless. The debt will be held by 'opportunity' firms that will buy up bonds/other debt at a discount, and will argue for an alternative plan; maybe they see more value in current sale of all assets versus continuing business. They will have done various liquidation scenarios -- their interest is in making money off of the bonds, not in saving SunEdison."

There are some winners amidst the rubble: "Given the complexity of the SunEdison financings, I can see this bankruptcy taking a while to sort out. Lawyers will make a lot of money."