Businesses are facing an increasingly complex landscape for installing solar. While the residential market has recently been dominated by third-party financing, the commercial sector has been more evenly split between power-purchase agreements and direct ownership over the past few years.

No matter which way it is financed, solar is an increasingly easy choice. The cost of a commercial solar photovoltaic project dropped nearly 50 percent between 2012 and 2014, according to data from SEIA's report, Solar Means Business. For commercial property owners, the rise of solar loans creates opportunity, but also confusion. A new report from the National Renewable Energy Laboratory, Banking on Solar, examines the advantages and disadvantages of various financing opportunities in the U.S. solar market.

In many cases, the report concludes that solar loans are the better choice -- but with a few important caveats. Here are five takeaways from NREL’s report on what businesses should consider when looking at loans versus power-purchase agreements.

What is your corporate culture?

This may sound like a softball question, but it’s not. In another NREL report that examined the process used by Ikea and Staples when determining whether to own or go with third-party ownership of solar PV, the decision-making process was rooted in the culture of each corporation.

“Ikea believes that careful process management enables it to reap the benefits of owning long-term, high-quality assets,” NREL concluded. “In contrast, Staples’ decision to lease its PV systems through PPAs aligns well with its risk-return preferences.”

Some considerations by early movers to own solar are easier to digest as solar loans become more commonplace. For example, Ikea now requires installers to provide production guarantees, something that has become more standard for solar loans offered today.

Does your business need immediate savings?

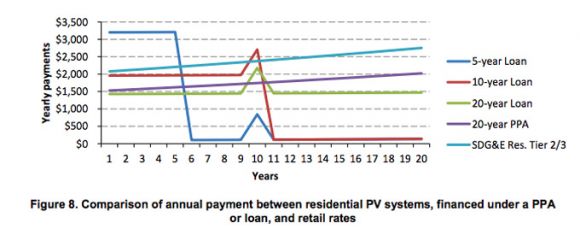

Whether a business or individual, the upfront costs of a solar loan are often higher than a 20-year power-purchase agreement, according to the NREL study. A five-year loan is likely much higher, while a ten-year loan is more in line with a PPA.

For companies that are looking not only to shield themselves from tiered rates and demand charges, but also to lower their energy bills overall, a PPA might bring the immediate savings that they need to get the project approved in the first place. Depending on the loan structure, the early loan payments may even be larger than the utility rate.

For the purposes of the study, solar loans of various lengths and a 20-year power-purchase agreement both outperformed a residential rate with San Diego Gas & Electric. But commercial rates are often far more complex, so the savings could be even more considerable.

For businesses that can take the longer view, however, loans are far cheaper than a PPA, NREL finds. But PPA providers are lowering their cost of capital, NREL notes, from a current 6 percent to 8 percent down to 4 percent to 5 percent in some cases.

Can your business take on additional debt?

Another important consideration is the financial structure of your business and whether you can even incur additional debt. Because PPAs function in a manner similar to an operating lease, the bills fall into operations, not capital, just as the energy bills usually do.

This issue of capital versus operational cost is one of the reasons that PPAs became so popular in the first place. Energy bills are an operational cost, for both families and businesses, whereas the cost of purchasing systems outright or taking on a sizeable loan can make those approaches unappealing even if there are substantial savings over time.

There are other options, such as property-assessed clean energy programs, that could be attractive, especially for small business owners. In some regions, commercial properties can take advantage of PACE financing, where loans are given for energy-efficiency retrofits and distributed renewable generation that are paid back through property taxes.

Can your company take advantage of tax incentives?

Homeowners and businesses can both take advantage of the 30 percent federal Investment Tax Credit. The credit, however, is set to be scaled down to 10 percent at the end of 2016, so projects beyond that date would have a very different tax impact. In his most recent budget, President Obama has requested that the Investment Tax Credit be made permanent.

But there are other tax benefits to owning. Companies can depreciate the cost basis of a PV asset, which NREL notes can be worth up to an additional 30 percent depending on the corporate tax rate. There are a few obvious caveats with depreciation, however.

The business must have enough income that the breaks are worthwhile. For nonprofits, adds MJ Shiao, director of solar research with GTM Research, PPAs are often a better choice, because such organizations cannot take advantage of the investment tax credit.

But there are other incentives, such as taking advantage of solar renewable energy credit markets for companies in the Northeast, that companies should consider when looking at owning a solar array, added Shiao. However, although they offer an added benefit, there has to be someone in the company that is willing to manage those SRECs.

Can you handle O&M?

Although installers are offering loans with many of the same system warranties and performance monitoring services that come with a PPA, there are additional considerations when owning a system outright. The NREL study points to the price volatility of renewable energy credits, interconnection delays, and inverter replacement as issues that businesses should consider when looking at owning a solar PV system.

***

Join Greentech Media at the 2015 Solar Summit in Phoenix where we will discuss financing commercial solar at The Empowered Commercial Customer panel on April 16.