Two recent surveys of power and utility executives reinforce previous research showing that the industry knows that a transformation is coming. But dig a little deeper into the findings, and there is a disparity of opinion in what that change looks like and what is driving it.

Here are five charts that show that the utility industry cannot agree on what the primary challenges are, although in almost all cases they are tied to a regulatory framework that no longer serves the industry or its customers.

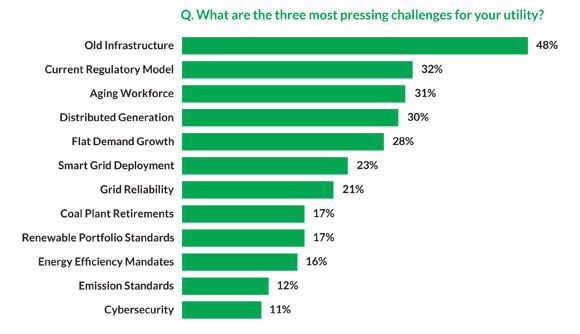

Siemens' Utility Dive survey found that aging infrastructure, an aging workforce and an outdated regulatory model were top concerns for utilities. Many hot topics in the press, such as cybersecurity and grid reliability, scored very low on the list. Distributed generation was near the top, but still far below aging infrastructure.

The results would suggest that utilities are most concerned with what they know, namely, the generation facilities and wires that are core to their traditional business, rather than what the future might look like, an outlook that was recently criticized by NRG’s David Crane.

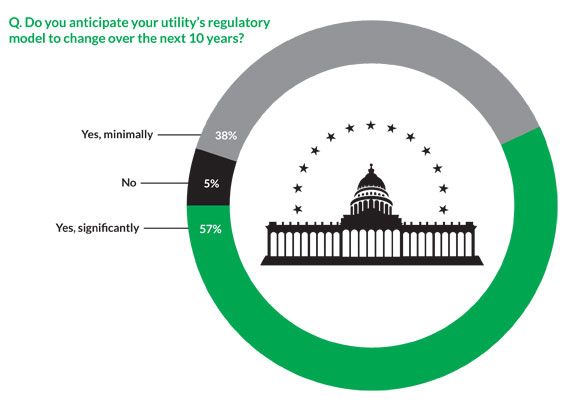

More than half the executives surveyed by Siemens thought that the regulatory model would change in the next ten years, although, surprisingly, nearly 40 percent said that it would only be a minimal change.

Another survey from PwC found that CEOs were less sure that regulation is changing, at least in a positive way. More than half the utility CEOs in that survey were extremely concerned that over-regulation would slow down growth, rather than enable it.

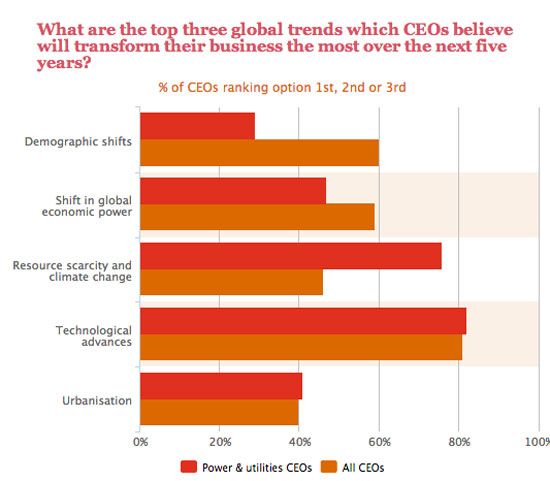

The PwC CEO survey also found that it was not aging infrastructure, but rather resource scarcity and climate change, which were keeping executives up at night. Compared to CEOs from other industries, far more utility execs (76 percent) said that the implications of climate change and resource scarcity would radically alter their business within the next five years.

Last year, 94 percent of participants in a PwC CEO survey said the utility business model would undergo important changes or a complete transformation between now and 2030.

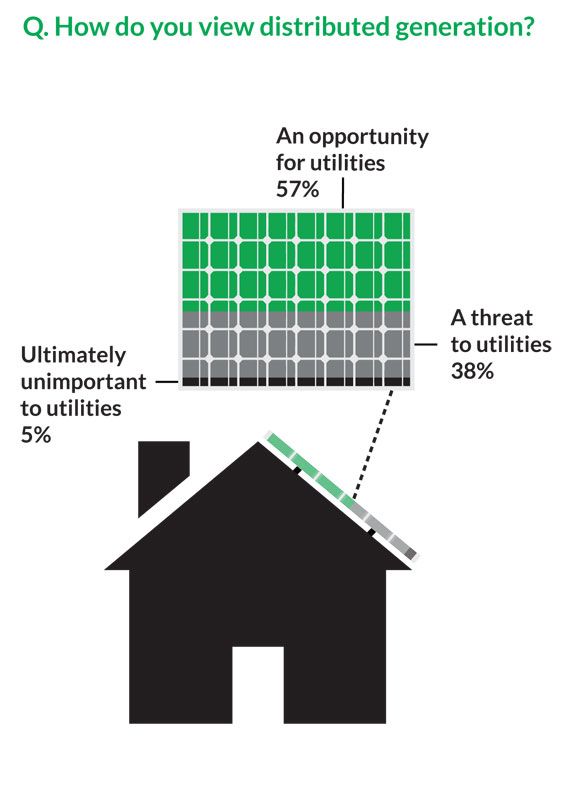

Although only 30 percent of utilities said distributed generation was a pressing challenge for their utility, a more specific question from Utility Dive would suggest that utilities are more concerned.

Nearly 40 percent saw distributed generation as a threat to utilities, and 57 percent see it as an opportunity. For it to be an opportunity, however, many states would need to make regulatory changes. Even if many utilities are ready to embrace new business models, it is unclear that most state regulators are willing to explore significant new business models fast enough to keep up with the changes that are happening in the industry.

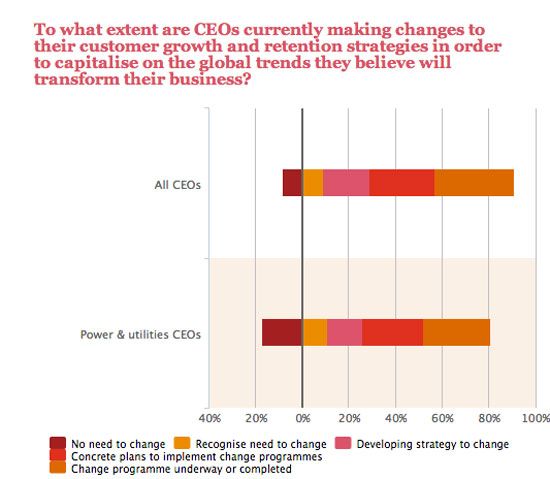

Also related to regulatory issues, most utility CEOs surveyed by PwC (80 percent) agreed that customer growth and retention strategies need to change. However, many utilities in the U.S. are still regulated monopolies, giving customers little choice.

Although utilities acknowledged the need to change the strategy, the number of CEOs who see no need to change was nearly double the percentage compared to CEOs in other industries.