Until recently, the development of the smart grid in Europe was largely centered around the integration of the significant amount of large-scale and micro renewable generation that Europe is planning to install. Currently, 10% of Europe’s power is generated from renewable sources, compared to 2.5% in the U.S., and this share is set to reach 20% by 2020.

Utilities throughout Europe are now starting to roll out smart metering as part of a European mandate to have smart meters installed in 80% of European households by 2020. On the basis of ambitious plans announced by utilities and regulators in France, Spain, the U.K. and a gradual rollout in other European member states, GTM Research forecasts an additional 100 million smart meters will be installed between now and the end of 2016. However, so far, most utilities have used advanced metering infrastructure (AMI) more with the objective of reducing operational costs and non-technical losses rather than for empowering consumers through improved access to information about their power consumption.

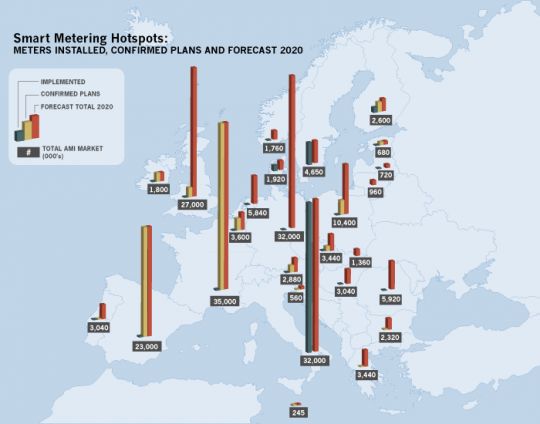

FIGURE: European Smart Metering Hotspots: Meters Installed, Confirmed Plans and 2020 Forecast

The U.S. has a longer history than Europe of frequent meter reading and detailed invoicing to consumers, both of which are often seen as key elements in increasing consumers’ awareness of their power consumption. The consumer was central in the original conception of the U.S. smart grid, encouraging significant activity in the home management and automation arena. Despite this, consumer groups in various U.S. states, most notably California, have shown opposition to smart metering, putting consumer engagement high on the utility agenda. In a recent survey conducted by Comverge in the U.S., ‘consumer education and awareness’ and ‘consumer buy-in’ with smart grid technology were both identified by utility CEOs as key barriers to smart grid deployment.

The considerably lower levels of electricity use per household in Europe (just over 4,000 kWh) compared to the U.S. (around 11,000 kWh) may seem to imply less potential for savings through the use of demand response. Despite this, European consumers, depending on their response to feedback and price mechanisms, can generate very significant savings. In the report The Smart Grid in Europe, 2012-2016: Technologies, Market Forecasts and Utility Profiles (available at http://www.greentechmedia.com/research/report/the-smart-grid-in-europe-2012), we estimate the potential annual savings from peak load reduction through demand response in Europe to be up to €9 billion and the potential savings in consumer energy bills to be between €3.6 billion and €18.2 billion, a wide range that speaks to the uncertainty of whether EU utilities can achieve higher levels of customer engagement their customers.

Based on the significant differences in household electricity consumption and a longer history of more frequent meter readings, as well as the multitude of smart energy home initiatives in the U.S., one would expect savings to be more substantial in the U.S. than in Europe. However, a comparison of 57 demand response studies around the world by Ehrhardt-Martinez (2010) showed lower average levels of savings in the U.S. (8.8%) than in Europe (10%) from these types of programs. The difference seems to be consumer engagement. Savings in most U.S. tests were reportedly concentrated among only 20% of participating consumers. The longer tradition of energy efficiency in Europe -- an indirect result of policies in Europe that make power significantly more expensive than in the U.S. -- leads to higher levels of participation and response to consumption feedback.

Smart metering rollouts are not only about technology; they are also very much about the process of rollout and the level of engagement achieved with consumers. Denmark’s SEAS-NVE, for example, paid careful attention to this aspect, to the point of training installers in how to talk to customers in their homes. As a result, the utility’s complaint rates dropped significantly and customers now save an average of 16% on their power bills.

Rather than focusing solely on technology, the key to persistent and effective consumer engagement is the provision of clear, timely and detailed information and actionable advice, placed in the context of larger societal objectives. Lowering transaction costs for consumers and strengthening social interaction, norms and values around energy use are key levers for increasing consumer engagement that are largely underutilized by utilities and regulators.

FIGURE: Level of Implementation of Smart Metering by European Country

Forward-looking European utilities will take the opportunity to use the additional 100-million-plus smart meters that will be installed across the continent over the coming years as a communications hub, which will allow each utility to improve its relationship with end consumers.

If utilities don't increase their consumer marketing/education budgets to support the massive rollouts planned in Europe, all of these millions of smart meters could be ‘a bridge to nowhere.’ A lack of consumer engagement, combined with additional costs for end-consumers, is likely to cause a consumer backlash against smart metering technology in Europe, as has happened in the U.S. This is a scenario that utilities, regulators and Mother Nature will wish to avoid.

_540_314_80.jpg)