Last year got off to a difficult start for U.S. solar, when in January the Trump administration announced tariffs on solar cells and modules that the industry had awaited in angst for months.

All told, the impacts of that policy ended up being relatively modest compared to the industry’s worst fears. And after the lead-up to the announcement, state solar policy ended up defining 2018 more than federal actions.

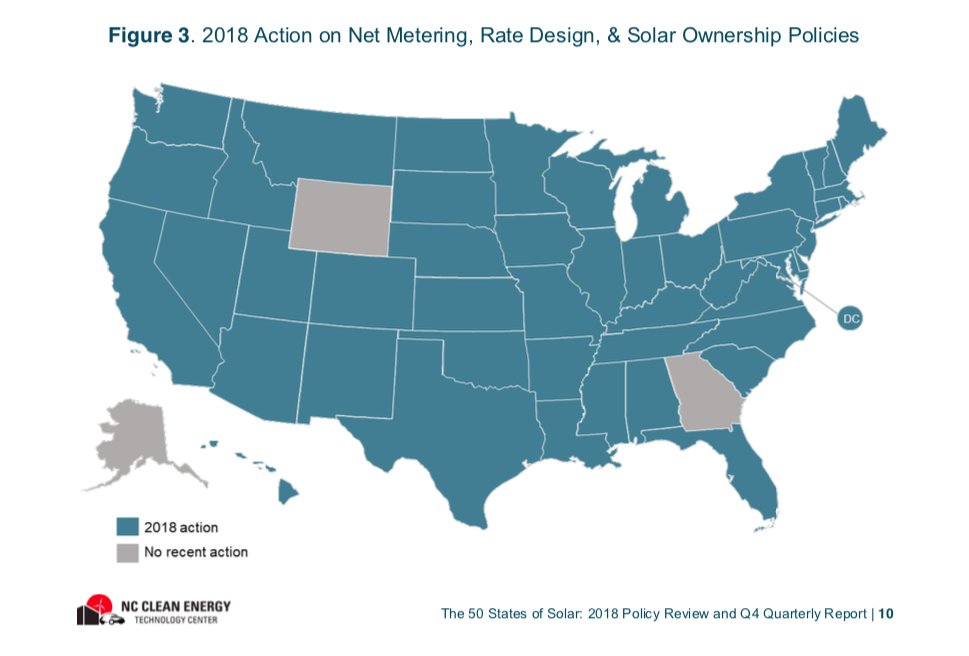

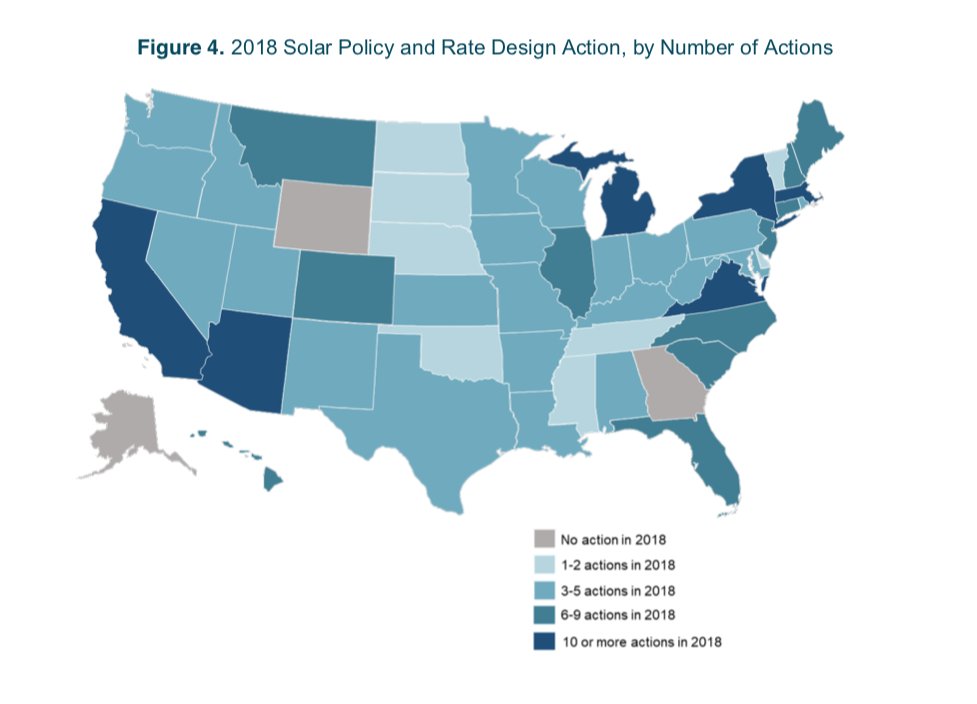

A new report focusing on distributed solar from the North Carolina Clean Energy Technology Center notes that even as solar growth remained relatively flat in 2018, state policy actions continued to increase from past years. NC Clean Energy cataloged 264 actions in 2018, compared to 249 actions in 2017, 212 actions in 2016 and 175 actions in 2015.

The only states that didn’t initiate any policies in the areas NC Clean Energy tracked in 2018 were Alaska, Wyoming and Georgia.

Source: North Carolina Clean Energy Technology Center

NC Clean Energy Technology Center’s report details the nitty-gritty policies that states, utilities and regulators have considered and implemented each year. And while the trends can be wonky, the results show which states are leading the vanguard in distributed solar and also where the market is moving as a whole in designing programs.

Fixed-charge increases stall

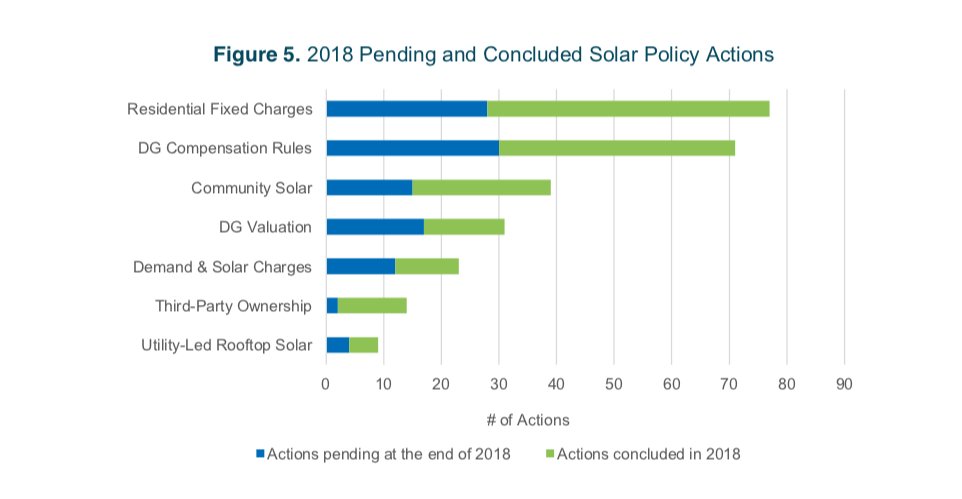

Autumn Proudlove, the report’s lead author and senior manager of policy research at NC Clean Energy Technology Center, said that in the past couple of years actions on residential fixed charges have dominated the center’s tracking.

But, even as actions on residential fixed charges were again the most common in 2018, the number of investor-owned and large utilities seeking residential fixed charge increases of at least 10 percent has also been in decline since 2016.

Source: North Carolina Clean Energy Technology Center

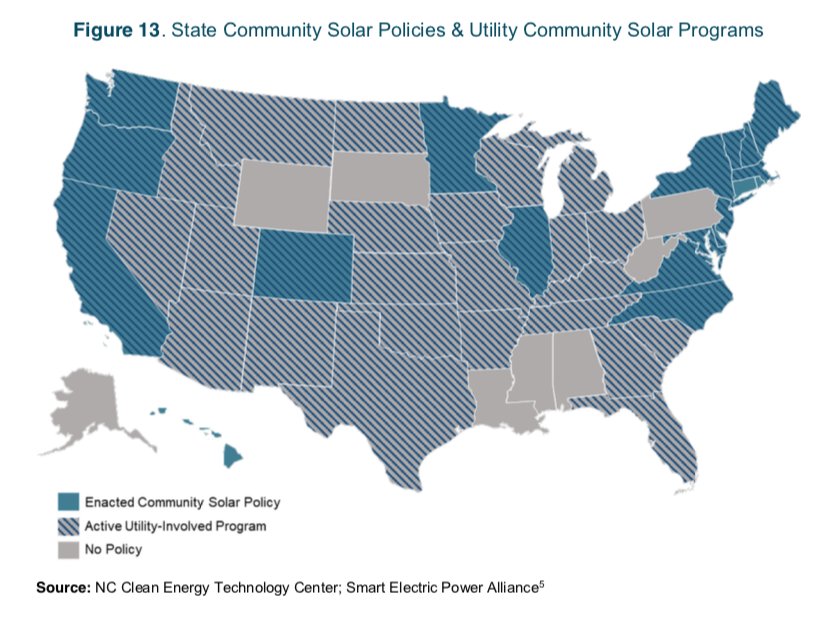

In 2018, two newer trends rose to the top: an increase in the number of states considering or working on community solar and the stakeholders grappling with a tariff structure to follow on net-metering (part of the DG compensation rules category above), called a successor tariff.

According to the report, “[d]istributed generation (DG) compensation is the only category showing a consistent increase in the number of states taking action from 2015 to 2018, with consideration of net metering successor tariffs, in particular, spreading to new states.”

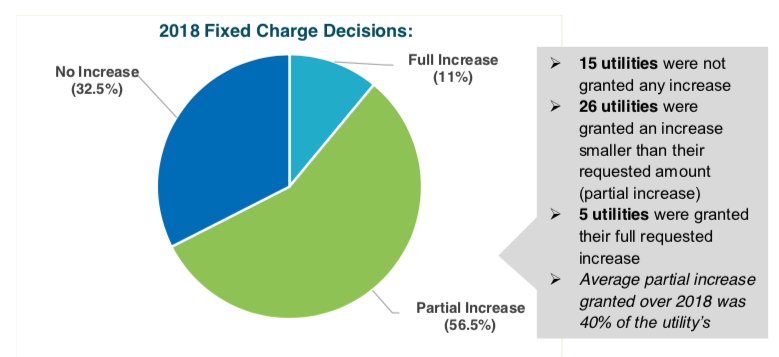

And when it comes to increasing residential fixed charges, which reduces the electricity bill savings rooftop solar customers can realize from their systems, only 11 percent of utilities were offered the full increase they requested in 2018.

Source: North Carolina Clean Energy Technology Center

While the percentage of utilities offered no increase or partial increases for their fixed charge requests has yo-yoed in the past two years, the percentage of utilities getting their full requested increase has steadily declined. In 2017, 13.5 percent of utilities received the full increase requested, and in 2016, 21.2 percent of utilities got the full increase.

NC Clean Technology Center also notes that the median increase requested has dropped from $4.07 in 2016 to $3.87 in 2018.

Net metering changes on the rise

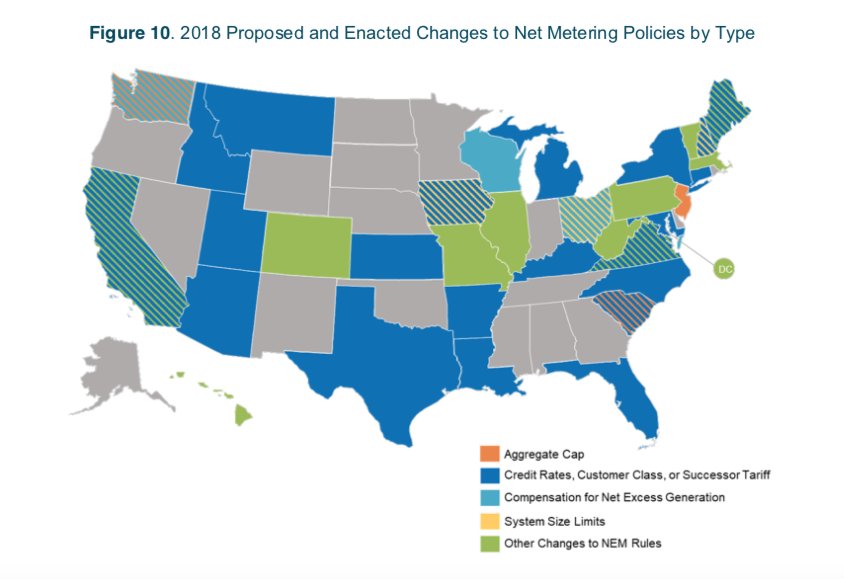

A record number of states contemplated net metering changes last year, 33 states and Washington, D.C., according to the report. Changes to net-metering fall under the DG compensation category tracked by NC Clean Technology Center. The center said that 35 states and D.C. now have mandatory net metering rules. Ten states have other compensation rules or are working toward developing them.

Source: North Carolina Clean Energy Technology Center

Four states that have considered changes to net metering, California, Nevada, New Hampshire and Vermont, have opted to keep the policy in place, although California will consider more changes this year.

Other states are looking into different options, such as the most popular successor thus far: net billing. Using that structure, customers use the energy they produce and are credited at a non-retail rate for solar energy exported to the grid. Under typical net metering policies, which played a critical role in launching the U.S. residential solar market, customers are credited at the full retail electricity rate for solar power they don't use.

Seven states, including Hawaii, New York and Indiana, have approved switching to a net billing structure. What states choose to do with net metering will have significant implications for the solar market, according to Proudlove.

“For net metering successor tariffs, those are significantly changing the economics of the projects for the customers installing rooftop solar,” said Proudlove. “It can really make or break a project for a customer.”

Community solar, the new darling

It’s the same for community solar projects. "In a lot of states, community solar projects really aren’t feasible because of the policy and regulatory landscape," Proudlove said.

Community solar, the new darling of the distributed solar world, is the only category that saw a consistent increase in the actual number of actions from 2015 to 2018 according to the center.

Austin Perea, a senior solar analyst with the Power & Renewables division of energy research and consulting firm Wood Mackenzie, said the rhythm at which community solar has taken off has “been a little wonky.”

WoodMac expects growth in Minnesota, which has led the community solar segment to date, to level off in 2019 and 2020. Other emerging markets, like Illinois, New York and New Jersey — which just approved a program in 2018, a “big-time win,” according to Perea — will pick up in that timeframe. That means growth should remain steady.

“Even though you have the development of these new emerging community solar markets, because of the cyclical nature of how these programs were developed and the timeline on which they’re developed, the overall community solar forecasts do increase gradually, but are fairly flat,” Perea said.

Perea named New Jersey’s new community solar program, along with the roll-out of the Solar Massachusetts Renewable Target and off-peak rate changes in California, as some of the most consequential policy actions of 2018. But analysts added that within the context of the larger market, though 2018 brought an uptick in solar policy considerations and actions, few were as influential on the solar market as pure economics.

“The vast majority of projects we saw being pushed forward in 2018 were being driven by the low cost of renewable energy, not policy-driven mechanisms,” said Colin Smith, a senior solar analyst at WoodMac.

Though state policy actions may not have wrought sweeping market changes, Proudlove at NC Clean Technology Center said the policy details are consequential because they factor into project costs.

“That’s where policy really comes into play, in these smaller market segments,” said Proudlove. “Things like the aggregate cap on net metering, and how that is influencing the market in South Carolina, or the design of a particular demand charge, or the netting period within a successor tariff. All of these finer details have a significant impact on the economics of the projects.”

Top states

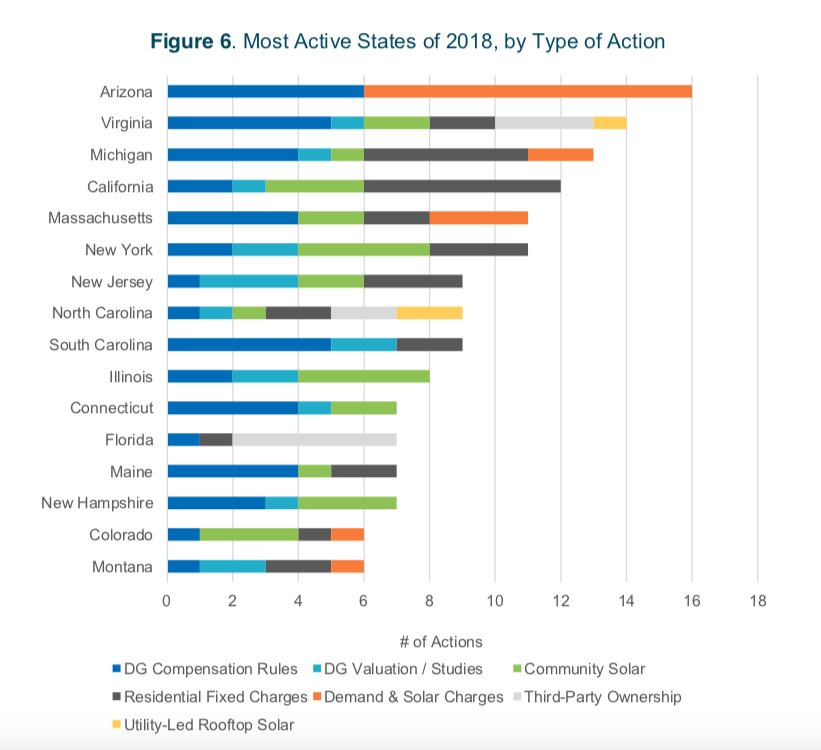

As the chart below shows, action in distributed solar centered on the coasts, with a few outliers in the Midwest and West.

Source: North Carolina Clean Energy Technology Center

Only a handful of states, including California, Michigan and Arizona, worked on more than 10 actions last year.

According to NC Clean Energy Technology Center, Arizona was the most active in 2018 with 16 actions. The country’s largest distributed solar market, California, came in fourth with 12 actions.

Source: North Carolina Clean Energy Technology Center

Many of the usual suspects, such as Massachusetts, North Carolina and New York, also ranked in the top 10 in terms of actions.

WoodMac forecasts that California, Illinois and Florida will account for 60 percent of residential capacity installed through 2023.

California’s solar rooftop mandate, approved in 2018 and going into effect in 2020, means the top market will maintain that foothold. WoodMac’s Perea said the policy insulates the firm’s long-term residential forecasts. It also has the potential to influence other state markets and is pushing residential installers to establish relationships with homebuilders inside and outside the state.

“There’s the actual mandate itself, and then there’s the voluntary approach. The voluntary approach is creeping up,” said Perea. “We know that residential installers are building out new divisions and new teams that are specifically trying to develop these relationships with builders.”

In Illinois, Perea credits the state’s adjustable block program with continuing to grow the residential market. Proudlove also points to the community solar program there as a driver.

In Florida, Perea said more “organic growth” from local and regional installers will continue based on the state’s stable net metering policy, high population and healthy solar resources. Proudlove said the state is home to a lot of consumers the solar industry hasn’t yet reached.

“Florida hasn’t typically had a very large rooftop market, so there’s a lot of customers there still to reach, whereas some of the more mature markets have already been saturated in some areas,” said Proudlove.

In 2019, Proudlove said NC Clean Energy Technology Center expects more discussions on the actions that rose to the fore this year, especially on community solar programs and net metering successor tariffs. Lawmakers in at least seven states are already slated to consider legislation tied to community solar.

NC Technology Center said states and utilities in 2018 also increasingly assessed solar policies within the greater context of grid modernization, “taking a more holistic view to energy policy discussions.” Several states broadening their discussions to distributed energy resources rather than just solar.

“What I see is the push toward better integration of distributed generation systems and the traditional electric grid in order to really move toward a more integrated renewable energy economy,” said WoodMac’s Smith. “To me, that’s the biggest takeaway.”