We’ve been looking hard for evidence of life in the solar-plus-energy storage market, with little to show for it so far. Sure, GTM Research projects that the U.S. market for battery-backed solar will reach more than $1 billion by 2020. But at present, less than 1 percent of U.S. solar PV installations come with energy storage.

There are plenty of reasons for this. Batteries are still cost-prohibitive for most grid-tied or behind-the-meter settings and markets, whether or not they’re paired with solar. Falling battery prices and new regulatory constructs for valuing storage as part of a portfolio of renewable resources could help ease this situation, as we’re starting to see that happen in states like Hawaii and California.

But there’s also the issue of solar and energy storage being two very different technologies, offering very different business propositions. Right now, despite the hype surrounding the seemingly natural idea of using batteries to store, shift, smooth and optimize the otherwise intermittent and unpredictable flow of solar energy, there’s no generally recognized set of technology integrations and business models that combine the two to meet today’s market needs -- at least, not outside the realm of pilot projects, or extreme market conditions like those existing on island grids.

That’s what makes SolarCity's latest solar-storage project so noteworthy. Announced last month, the 13-megawatt solar PV project, backed with 6 megawatt-hours of lithium-ion batteries from partner Tesla Energy, isn't being deployed in Hawaii or California, but in Connecticut. And it’s being done not as a pilot project, but as a standalone commercial project.

To hit cost-competitiveness, SolarCity has combined the value of the megawatt-hours that its solar panels produce with the firm megawatts of capacity resource that well-managed grid batteries can provide. “We’re providing energy at a competitive rate, and capacity at a competitive rate, that makes this more akin to a traditional power plant,” Bob Rudd, SolarCity’s energy storage and microgrid project development director, said in an interview last month.

It also adds another critical financial benefit, one that’s only started to become a reliable resource for ongoing solar-storage projects this year. That’s the recently renewed federal Investment Tax Credit, which covers 30 percent of the cost not just of SolarCity’s solar systems, but its batteries as well -- as long as they charge mostly from the sun, not the grid.

Rudd wouldn’t reveal the project’s price points for either energy or capacity, but he did state that “the economics are immediately relevant and competitive." They’re also replicable across a range of potential customers in multiple markets, and supported by the software and technology platforms SolarCity has been developing since it launched its energy storage business in 2013, he added.

With the official launch last month of its utility-scale and distributed solar-plus-storage business, SolarCity is now pledging to find repeat business for this model across the country. And with its recent announcement of a $150 million round of non-recourse financing with Credit Suisse for commercial solar energy systems, including battery storage systems, it has the money to put that vision into effect.

“This project, for us, is the culmination of five years of R&D that we’ve been doing with energy storage,” he said. That can allow for fast deployment -- “we’ve gone from concept to completion for some of these sites in 18 months,” and its Connecticut battery systems are expected to be up and running in time for its summer peak season.

Finding the right fit for the solar-storage equation

This is far from the first solar-storage project out there, as we mentioned before. Indeed, SolarCity itself is already doing a much larger project on Kauai, combining 17 megawatts of PV with 52 megawatt-hours of batteries for the Hawaiian island’s electric cooperative.

But that kind of oversize storage capacity only pencils out in Kauai’s environment of expensive, diesel fuel-fired electricity, and a truly islanded grid that’s looking for ways to manage the intermittency challenges it’s facing as it seeks to go 100 percent renewable.

SolarCity’s new project for the Connecticut Municipal Electric Energy Cooperative (CMEEC), by contrast, combines a set of energy, capacity and grid market value streams, suitable to a broader range of potential customers. “I would refer to the CMEEC portfolio as a distributed utility-scale portfolio,” Rudd said, and he described each individual unit as “a distribution-connected, mini-utility-scale PV plus storage project.”

The 13 megawatts of solar will come in packages of 2 megawatts to 5 megawatts, spread out across seven sites in Groton, Norwich and Bozrah, three of the six cities that make up CMEEC’s municipal utility membership. CMEEC will buy the energy they generate, under a relatively standard power-purchase agreement, as is done for solar projects around the country.

The two 3-megawatt-hour storage systems, which are using Tesla’s Powerpack batteries, will be paid for under a separate agreement based on capacity service charges, he said. In other words, “The solar is being paid on a dollar per kilowatt-hour for energy delivered, and the battery is being paid separately on a dollar-per-kilowatt basis for the capacity provided.”

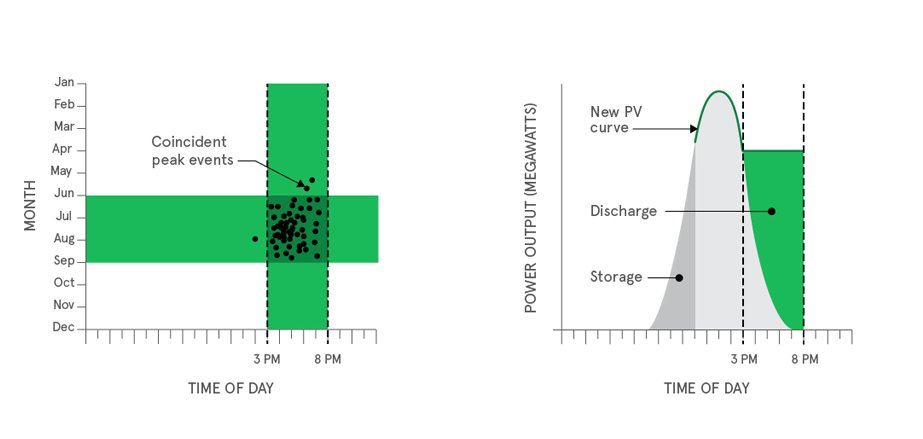

What are capacity services? In the case of CMEEC and other electricity buyers in the territory of grid operator New England ISO, it’s the ability to manage their energy consumption during certain “coincident peak events,” usually summer afternoons when regional power demand reaches its peak. That, in turn, allows them to reduce their share of current and future charges meant to cover investment in generation and grid infrastructure.

Managing capacity costs is one of the primary drivers of demand response and energy management services for big commercial and industrial customers, utilities and other participants in wholesale energy markets. Batteries can provide the same capability, as long as the software running them can predict when peaks are coming, make sure they’re charged up beforehand, and then discharge enough energy for long enough to reduce their capacity contribution sufficiently to make it all worthwhile.

To apply the concept at utility scale, “What we’re providing to CMEEC is a software control platform we’ve developed in-house that we call GridLogic,” he said. First unveiled as part of SolarCity’s “microgrid-as-a-service” launch last year, GridLogic combines real-time dispatch with the ability to predict the hour-ahead or day-ahead charging and discharging schedules required to reliably reduce peak loads.

While SolarCity owns the assets in question, CMEEC will have full access to the GridLogic operating system that runs the batteries, he noted. The municipal co-op is already operating a set of diesel-fired generators as capacity resources, and will be able to fold the operation of its new batteries into its existing network operations center.

This is all a much more complicated proposition than simply installing solar panels and selling the energy they generate, of course. While Rudd declined to disclose financial details of the company's CMEEC agreement, such as how much it’s charging for its solar energy and battery capacity services, he said they are competitive with avoided costs on both fronts.

Ravi Manghani, senior storage analyst with GTM Research, noted that SolarCity’s energy-capacity approach isn’t unique. But it is one of the first that attempts to simplify and separate the value streams from energy and capacity -- a task that’s rarely been necessary in the past, since the two have traditionally been done via separate business arrangements.

In fact, some of the world’s largest standalone battery storage projects are predicated on providing capacity value. In the front-of-the-meter category, AES Energy Storage is developing a 100-megawatt, 400-megawatt-hour battery system for Southern California Edison, as well as a 20-megawatt-hour array for AES utility Indianapolis Power & Light, to name two noteworthy examples from the world’s biggest battery project developer. Behind-the-meter projects from SolarCity, Stem, Green Charge Networks and others are monetizing capacity values from the customer demand charge side of the equation.

The ITC as the key to unlock solar-plus-storage value

Almost none of these battery systems are linked up with solar specifically, however. For the most part, that’s due to the early-stage nature of the energy storage market in general. But industry watchers also describe a disconnect between the solar and storage project development worlds, with solar companies not yet incorporating the more complex, and more flexible, capabilities of batteries into their approach.

There’s also been little economic justification for combining the two technologies in the way that SolarCity’s new project, and a handful of others, have done. At least, that was the case until late last year, when the U.S. Congress reauthorized the ITC for solar PV systems.

But with this multi-year renewal came a multi-year extension of a valuable opportunity for solar-storage projects. That’s because the ITC’s 30 percent tax credit for solar can also be extended to energy storage systems attached to them -- at least, as long as the batteries get at least 75 percent of their energy from the solar panels, not the grid.

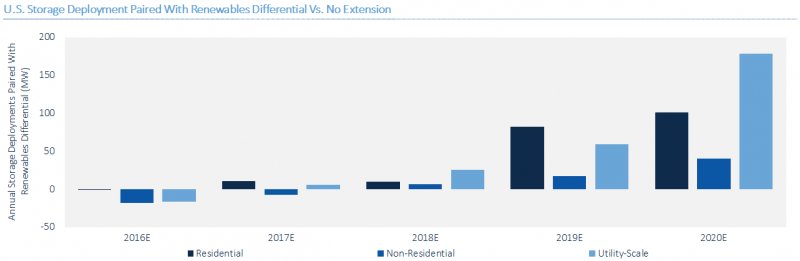

The specific rules for how solar-storage systems can qualify for the ITC are being worked out through an IRS rulemaking launched in October. According to the latest edition of the U.S. Energy Storage Monitor, GTM Research expects an additional half a gigawatt of storage paired with renewables to come on-line between 2016 and 2020 because of the tax credit extension, compared to previous projections. And “if renewables-paired storage does become explicitly eligible, there is an even more significant upside for projected deployment in the coming years,” GTM Research’s Manghani noted.

Seizing the value of the ITC for its Connecticut project does add a few complications for SolarCity. In particular, there’s a critical need to make sure that as much as the energy being stored by the batteries is coming from the solar panels they’re associated with, rather than from the grid. “We did think about this early on,” Rudd said, and the project has been put together to both maximize the credits available for stored solar power, and provide “some flexibility to charge from the grid as needed” he said.

“The way the ITC works, you have to be greater than 75 percent solar-charged to be eligible” as a bare minimum, he said. That’s not ideal, however, because the tax credit percentages awarded to the storage portion of ITC-eligible projects will be discounted, based on the percentage of grid power they end up using.

It’s a pretty simple equation -- the percentage of the ITC that batteries can claim is equal to the percentage of stored energy that comes from the solar portion of the project. If you store 75 percent from solar, you’ll get to claim 75 percent of the 30 percent ITC value of the batteries. If you charge 90 percent from solar, you’ll get 90 percent of the ITC, and charging 95 percent or more from solar entitles you to the full ITC credit.

Of course, it’s possible that the ITC charging rules could conflict with the batteries’ purpose of reducing capacity charges. What if the batteries need to be charged up to meet a coming afternoon peak, but it’s been cloudy for the previous three days?

“It’s an operational and economic balancing act that you want to do,” Rudd said. “That’s sort of built into our system. We’ve set a floor, a minimal amount -- we call it the ITC charging floor. Above that floor, CMEEC has flexibility to charge from the grid,” while analyzing how that could affect the long-term value of maximizing the ITC.

Another wrinkle has to do with CMEEC’s status as a public agency, which makes it ineligible to collect the ITC. But because SolarCity is the owner of the project and is financing it through one of its tax equity funds, it can claim the credit, and then pass on the cost savings, he said. That’s making “the economics immediately relevant and cost-competitive” for other municipal utilities and cooperatives that might be looking for the same kind of deal, he said.

At the same time, SolarCity isn’t excluding investor-owned utilities as potential clients. In a recent interview, Ryan Hanley, SolarCity’s vice president of grid engineering solutions, noted that the company’s broader grid services offering can combine solar and energy storage with different utility grid imperatives, such as replacing distribution grid upgrades by bolstering overloaded circuits.

“We’re also seeing it with really large utilities that are looking for things like voltage support,” he said. “We’ve got utilities like Con Ed and Southern California Edison that have done solicitations,” like SCE’s long-term procurement proceeding, or Con Ed’s Brooklyn-Queens demand management project. GTM’s Manghani noted that other IOUs, such as Southern Company, Xcel Energy and Entergy, are also exploring solar-storage projects.

In the case of its Connecticut project, Rudd noted that “both CMEEC and SolarCity feel there is the potential to extract additional value from the battery in the wholesale market, whether by providing ancillary services or otherwise. As the battery begins operation, we’re going to remain focused exclusively on the peak load reduction. But certainly the intention and expectation is that we’ll begin to, so to speak, stack different services.”