Late last month, the Hawaii Public Utilities Commission approved the first big decision in its legislatively mandated task of creating a performance-based ratemaking framework for the state’s big investor-owned utility, Hawaiian Electric Industries.

The decision and order (PDF) officially ends Phase 1 of the Proceeding to Investigate Performance-Based Regulation and initiates Phase 2. In simple terms, Phase 1 was the part where the PUC, utility Hawaiian Electric, moderator Rocky Mountain Institute and the scores of stakeholders and parties participating in the process hashed out just what performance-based rates, tariffs and other regulatory mechanisms were most critical for the island state’s efforts to reach 100 percent renewable energy by 2045.

Phase 2, set to open in the next month, will be the part that actually creates the dollars-and-cents structures to enforce these imperatives.

Hawaii’s Ratepayer Protection Act (SB 2939), passed in April 2018, sets a 2020 deadline for implementing at least some incentives and penalties that link revenues at Hawaiian Electric’s utilities on the islands of Oahu, Maui and Hawaii to the utility’s success at hitting various customer-focused performance metrics.

This hard deadline sets Hawaii apart among the 19 states and counting that have instituted some effort to shift regulated utilities from traditional cost-of-service ratemaking to a performance-based ratemaking (PBR) approach, according to Fei Wang, Wood Mackenzie Power & Renewables analyst.

"I think that Hawaii, if they do well, they’re going to set the standard. It depends on what metrics they come up with — and what incentives they put in," she said.

Hawaii is also unusual in terms of its approach, with the PUC and the Rocky Mountain Institute holding hundreds of hours of public meetings and discussions to develop the Phase 1 agenda, as opposed to the typical approach of filing documents, accepting written comments, and largely limiting participation to those with the wherewithal and knowledge to follow the process, she noted.

This approach has yielded a working document that represents a well-vetted set of ideas to turn into actual rates, tariffs and other forms of incentives and penalties, Jay Griffin, chairman of the Hawaii PUC, said in an interview last week.

“When this started, there was a lot of concern that the environment here would be very adversarial, very contentious,” he said. “I think it’s been the opposite. This is the commission’s highest priority” since SB 2939 passed last year, “and everyone’s brought their A-game.”

Setting the priorities of a ratemaking revolution

“We remain highly cognizant of the fact that we have the highest energy costs in the nation, but we also have this enormous opportunity to transition from oil to clean energy,” Griffin added.

But at present, the state’s focus on boosting clean energy at utility scale, and empowering customers to install rooftop solar, behind-the-meter batteries, or other distributed energy resources (DERs), isn’t necessarily well aligned with cost-of-service ratemaking structures.

That’s because the traditional structure tends to reward utilities for capital investments and discourage them from supporting efforts that might undermine that secure rate of return. It also doesn’t clearly link a utility's performance to how much money it makes, whether in terms of core safety and reliability, or in terms of how well it serves its customers or processes DER interconnection requests.

In this sense, core reliability measurements like the number of service interruptions and the duration of outages, or typical hold times for customers service calls, can be considered “performance-based” regulations. In each case, they’re addressing a need that isn’t aligned via the cost-of-service ratemaking model and has to be fixed via an alternative mechanism.

Hawaii’s new PBR efforts will go far beyond these industry-standard policies — but in a deliberative manner.

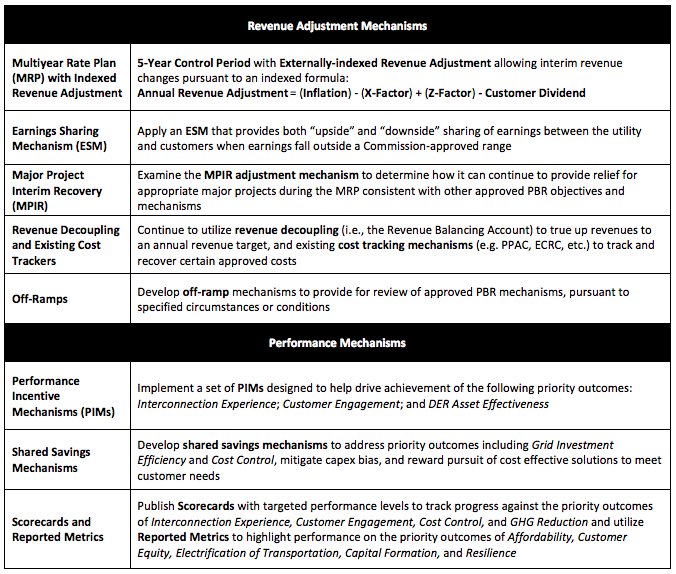

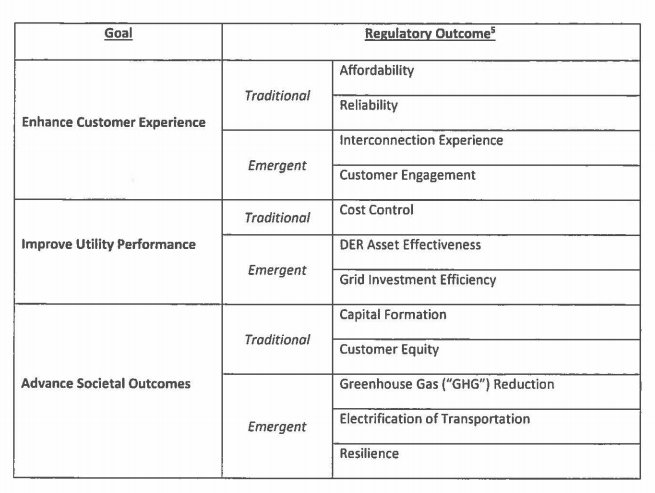

Last month’s decision specifically identifies several important changes to the state’s regulatory framework, including:

- A shift from three-year rate cases to a five-year multiyear rate plan — in an effort to extend the number of years the utility has to prove out the relative value and performance of its investments or initiatives to regulators and the public, along with rules for midstream adjustment.

- The development of an Earnings Sharing Mechanism to calculate upside and downside adjustments to revenues when they fall outside commission-approved “dead-band” ranges. “The quantification of earnings subject to adjustment by the ESM will be comprehensive, including the contributions of target revenues, performance incentive revenues, cost trackers, and other components of overall utility revenues,” the PUC’s decision states.

- Development of a portfolio of performance mechanisms (that is, the meat-and-potatoes work of designating which aspects of the utility business will be subject to adjustment based on how they’re done, compared to some performance target). “Phase 2 will prioritize development of a portfolio approach to performance mechanisms, which will include Performance Incentive Mechanisms, Scorecards and Reported Metrics, and Shared Savings Mechanisms." These three terms roughly correspond to the actual rates or tariffs that will incentivize or penalize utilities, the sets of measurements being made to prepare for future regulations, and the methods to share benefits between the utility and its customers, respectively.

At the same time, the decision doesn’t actually tie any of these categories to specific metrics or incentive or penalty figures.

“The commission intends to issue another order next month which will convene the Phase 2 process,” Dave Parsons, Hawaii PUC’s chief of policy and research, noted in an interview last week. “The intent is to continue the collaborative process that was used in Phase 1 and dive into the details.”

A shift from three-year to five-year rate plans

The most immediate change being proposed by the Hawaii PUC is also the one least explicitly linked to performance-based regulation: the switch from HECO’s three-year multiyear rate plan process to a five-year multiyear rate plan with interim adjustments.

The link between a longer rate plan period and improved performance lies primarily in extending the frame of reference for that performance to be measured, Parsons explained.

Three years is a tight timeline for achieving a return on investment for a big capital project or operational initiative, but just how much longer is ideal is open to debate. In fact, some groups suggested an eight-year timeframe, he noted, while HECO sought to keep the existing three-year framework. The commission’s five-year plan represents a compromise between these sides, he said.

Shifting to a longer ratemaking period could also reduce the administrative costs and burdens associated with rate cases, which can take about nine months to move from initial filing to approval or rejection, WoodMac’s Fei Wang noted.

Of course, there’s also a risk that the regular adjustment built into the five-year plan could increase administrative costs — something that the commission takes seriously as part of its mandate that its PBR efforts reduce, not increase, administrative costs and complexity, Parsons said.

Linking utility revenues and penalties to performance

The Earnings Sharing Mechanism (ESM), the next step in the Phase 2 plan, is where the PUC and stakeholders will work on “designing a ratemaking program that makes investments more efficiently and saves money,” while also establishing some level of certainty that “if utilities can perform within that framework, they can earn money and keep it,” according to PUC Chairman Griffin.

In other words, it’s the framework by which utilities can start to get paid more if they do well, and paid less if they do poorly, Wang explained.

HECO faces high and rising costs for its largely oil-fueled generation capacity, and a rising number of solar-equipped customers chipping away at its revenues, she noted.

While ESMs could represent a threat in the form of new penalties, they could also represent opportunities for creating new revenues by doing things well, she added — particularly things now paid out of HECO’s operations budget, which lacks the guaranteed rate of return of approved capital projects.

Of course, the big question is just how these ESMs will be applied, Wang noted, and on this front, “the performance mechanisms are really important,” she said.

According to the PUC’s decision, these new performance mechanisms are meant to create “new utility earnings opportunities as an incentive to achieve exemplary performance and business innovation.”

Performance Incentive Mechanisms: Where the rubber hits the road

Last month’s decision chose to emphasize the target areas “that stakeholders had strongly expressed interest in” and “where tariffs can really help,” Griffin noted. In the language of the document, these top-priority items are its Performance Incentive Mechanisms (PIMs) — the actual tariffs that will measure performance and pay or penalize accordingly.

Last month’s decision prioritizes the categories Interconnection Experience, Customer Engagement and DER Asset Effectiveness as the areas that should yield “three to six new PIMs” in Phase 2 — in other words, those are the tariffs it wants to see emerge at the end of that process.

The commission will consider both upside and downside elements — that is, incentives and penalties — for interconnection experience PIMs, but will only explore upside elements for the Customer Engagement and DER Asset Effectiveness PIMs. (This may be a reflection of stakeholder pressure to include potential penalties for interconnection delays or costs, a big issue for solar and DER developers.)

As for just what form these PIMs may take, Parsons noted that stakeholders in the proceeding have submitted multiple methods that Hawaii PUC could consider, including methods that have been used in other jurisdictions. “For things like interconnection experience, and not just DER but larger-scale projects too, it’s things that you’d expect — how quickly can projects move forward through the interconnection process, are they meeting the timelines laid out in the tariffs,” and to a lesser extent, interconnection costs.

For a more nebulous category like DER Asset Effectiveness, “we’re trying to get metrics that are touching on how effectively DERs are being utilized,” he said. That could include tracking HECO’s performance with its current demand response, energy storage, energy efficiency and other demand-side programs, as well as the deeper analysis required to consider DERs as non-wires alternatives for traditional grid investments.

Identifying potential PIMs in the Customer Engagement category “is a little more challenging, but there’s a lot of interest in it,” he said.

Some of the proposals to date include customer participation metrics for utility programs such as demand response or community renewables, ranging from how many people sign up to how satisfied they are with the service, he noted. Low-income, elderly and medically vulnerable customers are another key focus, he added.

The remaining categories of focus for the PBR proceeding aren’t set to receive their own PIMs in Phase 2, but that doesn’t mean they’re being dropped. Instead, the PUC will ask stakeholders to come up with new “Scorecards” to track progress for the categories of cost control and greenhouse gas reduction (and to develop additional measurements for interconnection and customer experience), and create new “Reported Metrics” to “measure and track relevant utility performance data” for the remaining categories of affordability, customer equity, electrification of transportation, capital formation and resilience.

Shared Savings Mechanisms

Finally, the PUC decided to pull one item from the long list of “other regulatory mechanisms” it and its stakeholders brought up in Phase 1, and to include it specifically in Phase 2: the development of Shared Savings Mechanisms (SSMs).

As PUC Chairman Griffin put it, “the capital bias is that the utility has a strong incentive to continue to invest in capital because they earn a return on it.”

With an SSM, “we’re trying to offer an incentive to lower cost” by benchmarking the cost of a project or initiative, and then allowing the utility to earn a portion of the difference if it can come in below it — and make up at least part of the guaranteed rate of return it’s giving up by reducing its capex.

The precise ways in which SSMs will become part of the Phase 2 discussion aren’t clear yet, he noted. But as an example of how they can work, he pointed to Hawaii’s recently concluded renewable energy procurement round in January, which set records for size and low prices.

“We established price benchmarks and allowed utilities to earn something when they brought projects in below those benchmarks” or ahead of schedule, he said. Those earnings were split 20-80 between the utility and its ratepayers.