India-based electric car maker Reva announced Monday that it plans a 2009 European launch of a lithium-ion battery-powered version of its long-selling electric car, along with a fast-charging station that can charge it in an hour.

Since 2001, Reva has been making a lead-acid battery-powered car with a range of about 50 miles per charge. Reva has sold about 2,200 of those cars for about $9,000 apiece, according to the New York Times.

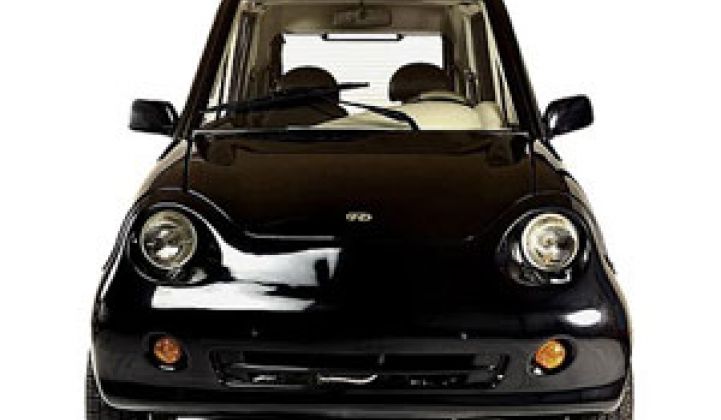

The new lithium-ion battery-powered car, called the L-ion, will have a range of about 75 miles and a top speed of about 50 miles per hour, Reva said in a Monday press release.

Reva also intends to market a fast-charge station that can charge the new car's lithium-ion batteries in about an hour, compared to about six hours without the charging station. Reva's lead-acid battery-powered car takes about eight hours to charge, the company said.

Reva plans to have the cars and charging stations available for pre-order in February and start delivering them in May. The cars will be available through distributors in Norway, the United Kingdom, France, Cyprus, Greece, Spain, Belgium and Ireland, and Reva will seek to expand its network throughout Europe in the coming year, the company said.

The company will also sell upgrade kits to convert lead-acid battery-powered Reva cars to lithium-ion batteries, the company said. Pricing for the L-ion and charging station – available for lease or purchase – won't be announced until later this month, the company said.

But if the L-ion's price is anywhere close to the $9,000 for its lead-acid battery-powered predecessor, it could find itself in strong competition amongst carmakers seeking to supply urban dwellers with low-cost electric-powered transportation for shorter drives.

Bangalore-based Reva – founded in 1994 as a joint venture between Maini Group of India and AEV LLC of California and funded in 2006 with $20 million from investors led by Draper Fisher Jurvetson and the Global Environment Fund – is one of a number of makers of so-called "commuter cars" that range from cheap to high-priced (see U.K. Mini Car Designer Looks to Asian Market).

Commuter cars – basically energy efficient town cars that may never even see a freeway – are a relatively new category, but automakers say they fit well with driving habits. Most U.S. drivers only go about 40 miles a day. Europeans can drive even less. Reva notes that 97 percent of cars go 50 miles or less a day.

Moreover, consumers have overwhelmingly said they want electric cars, and it's far easier to make an electric commuter car than a full-service electric car given the state of battery technology. The rise of the Smart Car and Mini Cooper also demonstrate that small is big for cars these days. Japan, Finland and other countries provide tax incentives to buy energy efficient cars.

Nonetheless, the price of batteries and other issues continues to trip many up.

India's Tata Motors said in early 2008 that it would bring its gasoline-powered, $2,500 Tata Nano to market by this year, and also planned future electric versions of what is meant to be the world's cheapest car. But setbacks – including the cancellation of construction of a plant to build the car in the face of local opposition – may affect the company's timeline.

In the meantime, Norway's Think in November started (after several delays) selling its City electric car, with a range of 112 miles and top speeds of 62.5 miles per hour, for a base price of 200,000 Norwegian Kroner ($28,690). But with battery leasing costs, the price of owning the car over seven years comes to more than $40,000 (see Think's Electric Car Is Here, But Bring Your Wallet).

Think has since reported that it might have to shut down production if it can't get millions of dollars of loan guarantees from the Norwegian government. So far, it has only come out with a few cars.

Other startups eyeing the higher-end electric car market include Venture Vehicles, which is making the three-wheeled Venture One with a price target of $20,000 to $25,000, and Commuter Cars, which makes the Tango, a snazzy electric two-seater with a hefty $108,000 price tag at present.

Meanwhile, auto-making giants are also eyeing the market for inexpensive, all-electric vehicles. Mitsubishi plans to bring the electric-powered MIEV to market in 2010 for a price of about $24,000. Nissan plans to bring electric cars to market by 2010, starting with smaller cars aimed at city drivers (see Is Nissan Building a Car That Charges Itself?).

Then, of course, there are the high-end, sporty electric vehicles being made by startups like Fisker Automotive and Tesla Motors, though neither company's cars could be classified as inexpensive.

Makers of hybrid gasoline-electric cars are also planning to bring versions that can be plugged in to extend range and reduce fuel use. Toyota plans a plug-in version of its market-leading Prius hybrid by 2010, and General Motors wants its plug-in hybrid Chevy Volt to be on sale by the end of the decade as well.

Of course, all the plans of auto giants and startups alike will be tested by the ongoing economic downturn, which has led to plummeting auto sales worldwide and, in the United States, the federal bailout of GM and Chrysler (see Showing Off Green Cars Amid Economic Gloom).