As further validation of the growing U.S. market, as well as the reality of the dominance of China-manufactured PV panels (see the recent Suntech/Sempra announcement), Yingli just announced a 20-megawatt supply agreement with San Diego-based Borrego Solar Systems, double the size of last year's deal. These modules are designated for commercial solar projects across the U.S.

A few years ago, Yingli Green Energy (NYSE: YGE) was not exactly a household name.

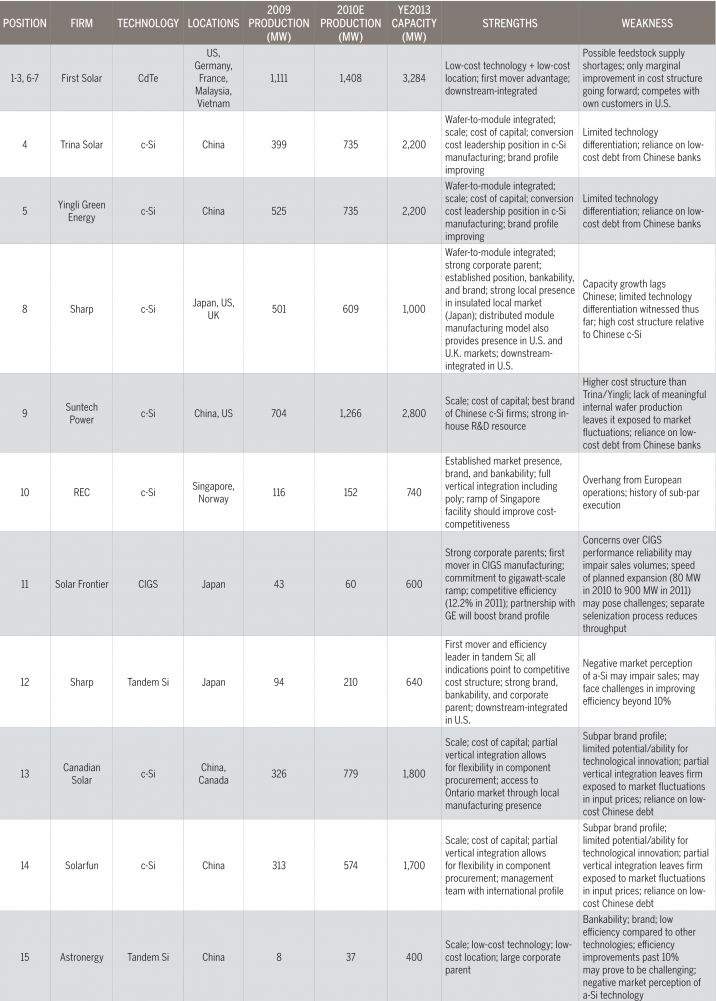

But today, Yingli, although perhaps not a household name in your household, has become one of the lower-cost and more bankable solar module suppliers in the world. (See chart below; more details here.)

The firm is vertically integrated from wafer to module, has a 2010 shipment guidance of 1 gigawatt, and had a successful brand marketing effort at the World Cup. Shyam Mehta, Senior Solar Analyst at Greentech Media Research, forecasts their 2013 manufacturing capacity at 2.2 gigawatts. Mehta lists their competitive weaknesses as "limited technology differentiation" and a "reliance on low-cost debt from Chinese banks." (Although I'm not sure if the latter is actually a weakness.)

Borrego Solar purchased 10 megawatts of Yingli Solar modules in 2010, some of which were used in several high-profile projects, including the 2.8-megawatt San Diego Community College District, the 500-kilowatt City of Ridgecrest project, and the 1.8-megawatt San Diego County Water Authority installation. These three projects created approximately 400 green jobs in the U.S.

Borrego has completed more than 1,000 PV installations totaling more than 35 megawatts.

I spoke with Mike Hall, the CEO of Borrego Solar, late last year. Borrego has been around since 1980, when the firm built an off-grid solar home in Borrego Springs, California. Since then, they re-incorporated to focus on residential grid-tie and expanded to northern California in 2002. Borrego now addresses the middle market, such as schools and government installations, and recently sold off their residential business to GroSolar. The firm works on both coasts with projects in the 100-kilowatt to 5-megawatt range.

Borrego is a 70-employee, full-service provider that designs, builds as the general contractor, structures the PPA and works with banks. When I spoke with Hall, he said that he considered Borrego a 20-megawatt-per-year player with expectations of doubling that figure in 2011. In Hall's words,"c-Si will be 95 percent of what we do this year, with Yingli, Sanyo, Sharp and Solar World as suppliers."

Hall commented on California's new Reverse Auction Mechanism (RAM) for addressing solar projects in the 1-megawatt to 20-megawatt range. He viewed the California Solar Initiative as having a one-megawatt and over gap and saw the RAM as an opportunity to fill that gap. He said, "The chance is they'll get the details wrong, but at least it lets the market set a price," adding, "It's not tax credits, so you don't need exotic investors."

I also spoke with Mathew Sachs, Yingi's Director of Business Development, and he saw this deal as "reaffirming Yingli's commitment to the distributed solar generation business."

Top 15 Solar Module Producers

A Yingli Solar / Borrego Project From Last Year